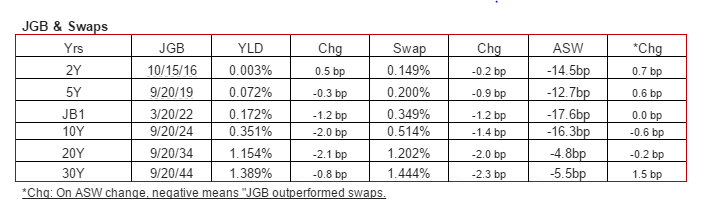

‘The market’ sure doesn’t seem to think rates in Japan are going up after decades of 0 rates:

This survey just turned radically:

New York state manufacturing index lowest in two years: NY Fed Dec 15 (Reuters) — Manufacturing activity in New York state contracted for the first time in nearly two years, a New York Federal Reserve survey showed on Monday.

The New York Fed’s Empire State general business conditions index fell to -3.58 in December from November’s 10.16 reading, falling to negative territory for the first time since January 2013.

Empire State Mfg Survey![]()

Highlights

Sudden contraction is the theme in this month’s Empire State manufacturing report where the general conditions index fell to minus 3.58 for the first negative reading since January last year. This compares with plus 10.16 in November and a soft plus 6.17 in October. This report had been showing very strong momentum from May to September when the index averaged 21.22.

New orders, at minus 1.97 vs November’s plus 9.14, are in the negative column for the second time in the last three months while unfilled orders, at a very steep negative reading of minus 23.96, are the weakest since December last year. Shipments are at minus 0.22 for the first negative reading since July last year.

A plus in the report is steady and respectable growth in hiring, at 8.33 vs November’s 8.51. But unless all the other negative readings reverse back to the positive side, hiring isn’t likely to remain solid. Price data are little changed showing moderate gains for costs of raw materials and modest price traction for finished goods.

Anecdotal reports on the manufacturing sector have been running much hotter than government data, and today’s report hints at a reality check for other anecdotal reports including Thursday’s closely watched report from the Philly Fed whose November report last month showed spectacular strength. Later this morning at 9:15 a.m. ET, the industrial production report will offer the first hard data on the November manufacturing sector.