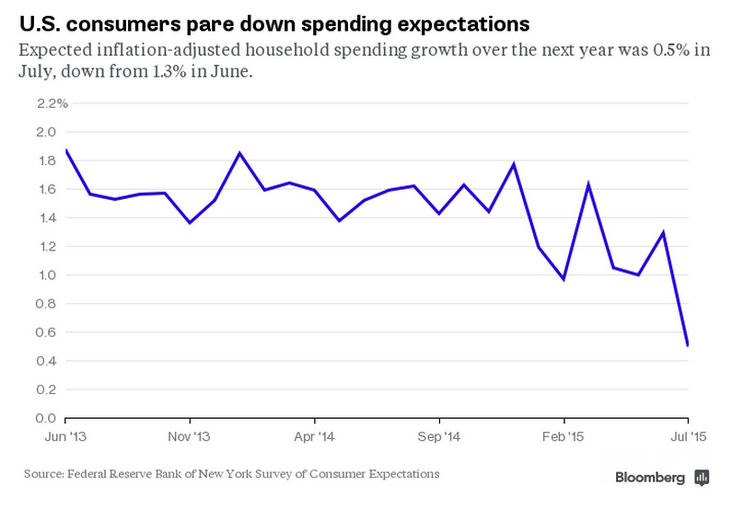

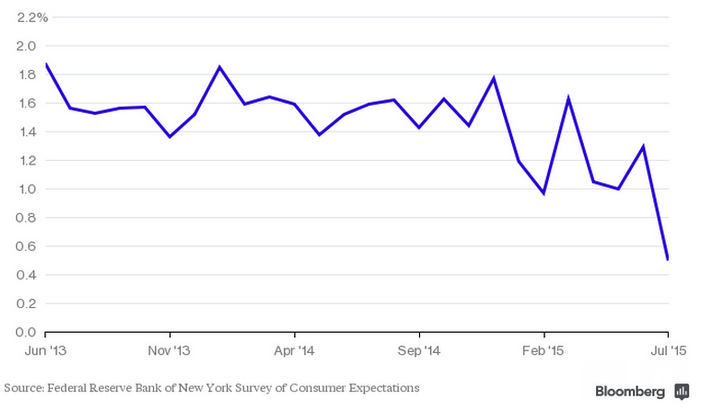

This Fed indicator, whatever it means, just went down some:

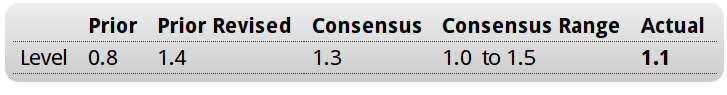

Labor Market Conditions Index

Highlights

If the Fed relied exclusively on its labor market conditions index, no one would be in much hurry for the rate hike. The index for July came in slightly below expectations at 1.1 vs a revised 1.4 in June. The index, based on a broad set of 19 components, has been hovering near zero all year, well off its 5.4 average of last year. Unemployment may be down but hiring has been soft and the 2015 trend for this index is the weakest of the recovery.

Remember when this was taken as an indication of falling demand for housing?

Another indication of a weaker global economy, and a good reason for China to allocate more reserves to Euro:

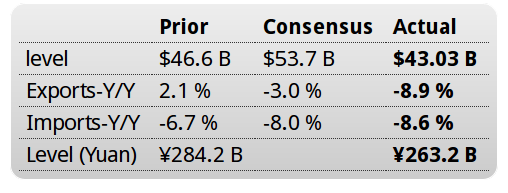

China : Merchandise Trade Balance

Highlights

China’s trade figures shocked analysts. July’s unadjusted merchandise trade surplus was $43.0 billion, down from $45.7 billion in June. Exports plunged 8.3 percent against expectations of a 3.0 percent drop. Imports sank 8.1 percent against expectations of a 8 percent drop. The year to date trade balance was $305.2 billion compared with $212.9 billion in the same period a year ago. For the seven months through July, exports were down 0.8 percent on the year while imports dropped 14.6 percent. On a seasonally adjusted basis, exports slid 3.4 percent on the month after increasing 1.5 percent in June while imports declined 3.8 percent after jumping 6.9 percent in June. On the year, seasonally adjusted exports dropped 7.9 percent while imports were 8.4 percent lower.

China’s top government body, the State Council, said last month that it would give high priority to the nation’s trade sector, providing tax breaks and cutting red tape while reducing import duties. The government has also accelerated a range of infrastructure projects to boost demand at home. Meanwhile, the central bank has cut interest rates four times since November in an effort to help struggling domestic companies.

Adding to the problems for exporters is the relatively strong Chinese currency, which has held steady against a buoyant dollar. That has carried the yuan more than 10% higher against the Euro, providing a drag on exports to some key European markets.

The post Fed Labor Indicator, NY Fed Consumer Expectations, Lumber Prices, China Trade appeared first on The Center of the Universe.