VANCOUVER, BC / ACCESS Newswire / February 6, 2025 / Kingfisher Metals Corp. (TSXV:KFR)(FSE:970)(OTCQB:KGFMF) ("Kingfisher" or the "Company") is pleased to announce that it has entered into a definitive agreement dated February 5, 2025 (the "Agreement"), to acquire the Hickman project (the "Hickman Project") from Golden Ridge Resources Ltd. ("Golden Ridge") (the "Transaction").

Overview

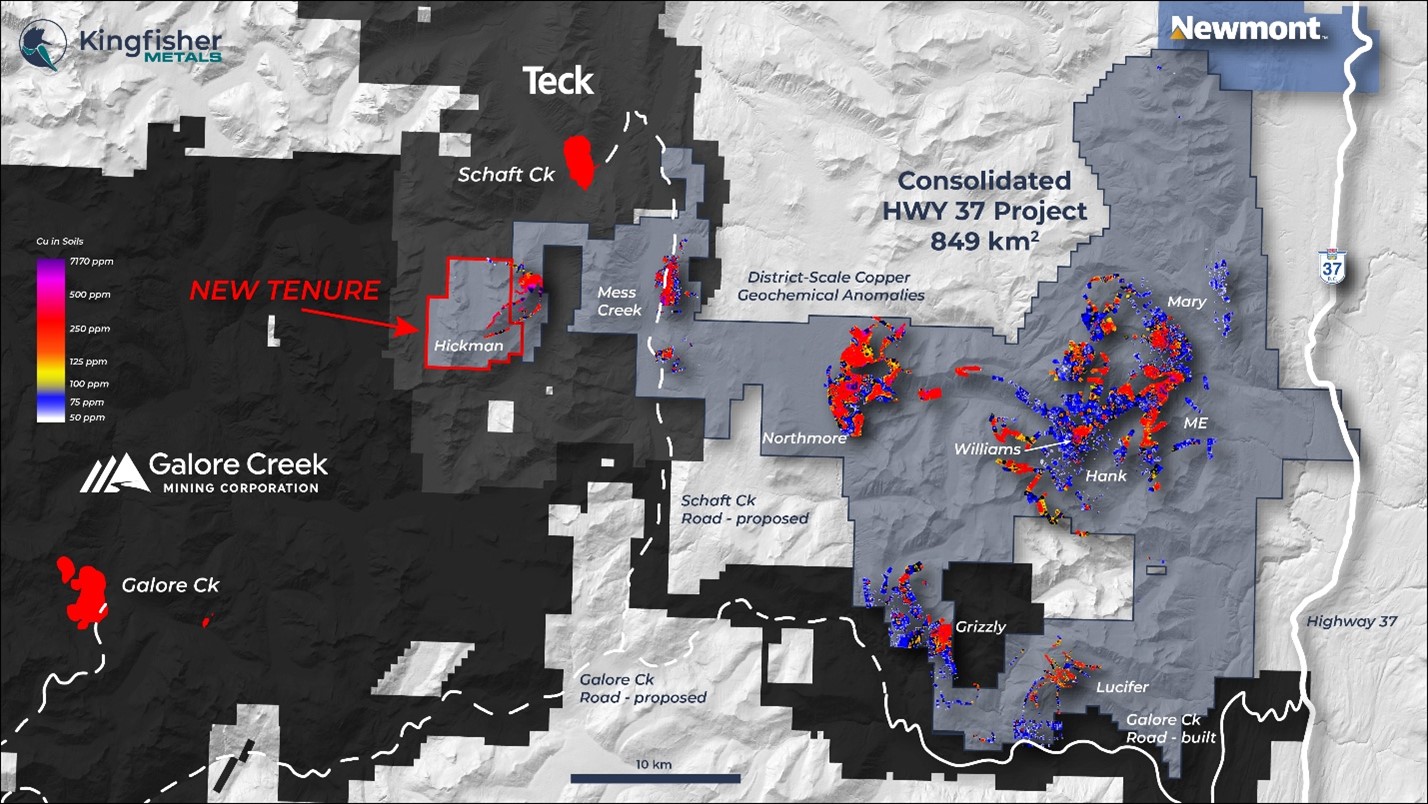

The Hickman Project is comprised of two claims totalling 3,008 hectares and is located immediately west and contiguous with Kingfisher's HWY 37 Project in Northwest British Columbia within the Golden Triangle.

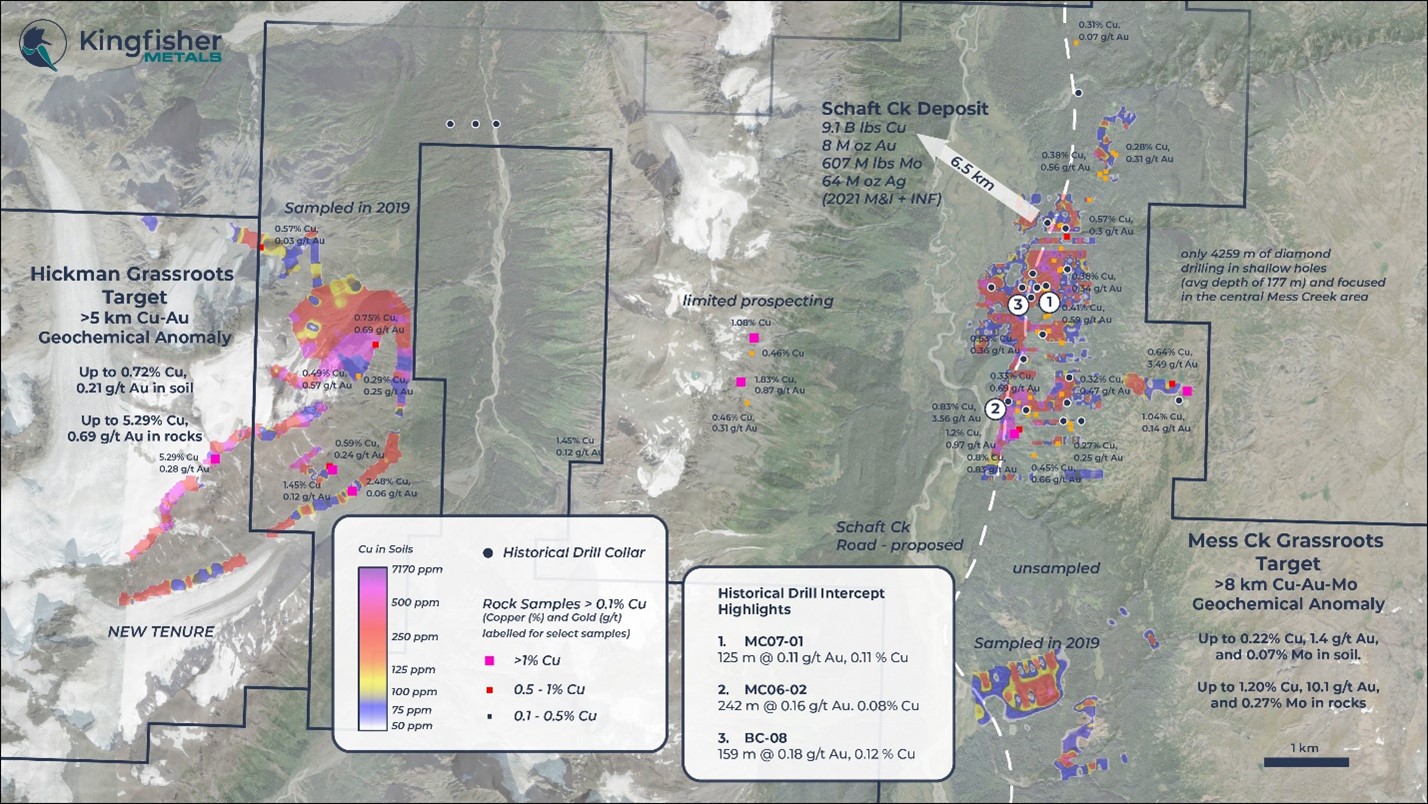

The Hickman Project is highly prospective for Cu-Au porphyry systems and hosts an undrilled copper-gold geochemical anomaly at the Hickman Target that includes recent (2019) rock sampling results of up to 5.3% Cu and 0.28 g/t Au. This accretive acquisition secures the full extent of the open-ended Hickman Target that spans 5 km and is located 6 km away from the Schaft Creek deposit. The Transaction will bring the consolidated HWY 37 Project to 849 km2.

Transaction Details

Under the terms of the Agreement, the Company will issue common shares to Golden Ridge with an aggregate value of C$50,000 priced at C$0.195 per share, and the Company will grant a 2% net smelter return royalty (the "NSR") to Golden Ridge. The Company will have the right to buy back 1% of the NSR for C$5,000,000 at any time. The NSR covers the entirety of the Hickman Project except for the portion of the mineral claims that fall within a 1 km radius of the HWY 37 Project. The excluded portion of the mineral claims are covered under the net smelter return royalty agreement that pertains to the Company's Ball Creek West (BAM) project. The Transaction remains subject to the approval of the TSX Venture Exchange.

Qualified Person

Dustin Perry, P.Geo., Kingfisher's CEO, is the Company's Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects, and has prepared the technical information presented in this release.

About Kingfisher Metals Corp.

Kingfisher Metals Corp. (https://kingfishermetals.com/) is a Canadian based exploration company focused on copper-gold exploration in the Golden Triangle, British Columbia. The Company has quickly consolidated one of the largest land positions in the region at the contiguous 819 km2 HWY 37 Project. Kingfisher also owns (100%) two district-scale orogenic gold projects in British Columbia that total 641 km2. The Company currently has 56,198,734 shares outstanding.

For further information, please contact:

Dustin Perry, P.Geo.

CEO and Director

Phone: +1 778 606 2507

E-Mail: info@kingfishermetals.com

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property. This news release contains statements that constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: Kingfisher Metals Corp.

View the original press release on ACCESS Newswire