Adding a few reliable and high-yield dividend stocks to your portfolio can significantly enhance its income-generating potential. Beyond providing a steady stream of income, these stocks also offer the opportunity for gradual capital appreciation, making them attractive to both income-focused and long-term investors.

One such compelling dividend stock is Energy Transfer (ET). The company currently offers a high dividend yield of 8.04%, backed by a consistent track record of dividend growth and a “Strong Buy” consensus from Wall Street analysts. Energy Transfer’s strong fundamentals and strategic positioning have helped it deliver reliable earnings and robust distributable cash flow (DCF), supporting sustainable dividend payouts.

What makes the company even more compelling is its potential to benefit from emerging artificial intelligence (AI)-driven demand across the energy and infrastructure sectors. As AI technologies continue to expand, the need for energy to power data centers and digital operations is rising sharply, creating a favorable environment for companies like Energy Transfer. Together, these factors suggest a solid foundation for both income stability and potential growth, making Energy Transfer a noteworthy candidate for investors seeking high and reliable yield and solid total returns.

Energy Transfer to Pay and Grow Its Dividend

Energy Transfer operates a diversified energy infrastructure business, moving and marketing natural gas (NGZ25) across the country through its extensive intrastate pipeline network. Its vast reach connects key production regions with power generators, industrial users, utilities, and other pipelines, driving the utilization of its assets and supporting its cash flow.

The company’s integrated and diversified business model helps balance risks and improve efficiency, ensuring steady operations even during periods of commodity price volatility. The key to its stability is its reliance on long-term, fee-based contracts. These agreements secure consistent cash flows, allowing the company to support both ongoing growth investments and shareholder returns.

Reflecting its confidence in cash flow durability, Energy Transfer recently raised its quarterly dividend to $0.3325 per share from $0.3275, or $1.33 annually, which translates to a forward yield of approximately 8%. Energy Transfer has steadily increased its distributable cash flow (DCF), supported by strategic capital projects and disciplined financial management, setting the stage for continued dividend growth.

Much of this growth is likely to be driven by its extensive growth project backlog, which is projected to generate mid-teen returns. These projects are well-contracted under long-term agreements and are likely to come online in the coming years, driving its cash flow and dividend payouts.

The company is also capitalizing on structural tailwinds in the U.S. natural gas market, driven by rising demand from data centers. With its extensive and strategically located network, the company is well-positioned to meet the growing energy needs of this sector. Recently, Energy Transfer announced a deal to supply natural gas to a major hyperscaler in Texas, reflecting its increasing role in supporting the energy infrastructure behind the digital economy.

The momentum doesn’t stop there. The company has also inked multiple gas supply agreements with Oracle (ORCL) to power three U.S. data centers, and secured a 10-year exclusivity arrangement with Fermi America. These partnerships highlight Energy Transfer’s growing commitment to serving energy-intensive technology companies that require dependable, large-scale natural gas supplies to support their expanding operations.

Looking further ahead, Energy Transfer has signed a new 20-year agreement with Entergy Louisiana to provide firm transportation services beginning in 2028. This long-term deal strengthens the company’s contracted backlog and adds visibility to future cash flows.

Over the past year alone, Energy Transfer has contracted for more than 6 billion cubic feet per day of pipeline capacity with demand-pull customers, including data centers, industrial end-users, and utilities. These agreements, which carry a weighted average contract life exceeding 18 years, are expected to generate more than $25 billion in revenue from transportation fees.

In essence, Energy Transfer’s diversified infrastructure, focus on long-term, fee-based agreements, extensive project backlog, and AI-driven opportunities position it well to deliver durable cash flow growth and maintain its commitment to rewarding investors through steady dividend increases.

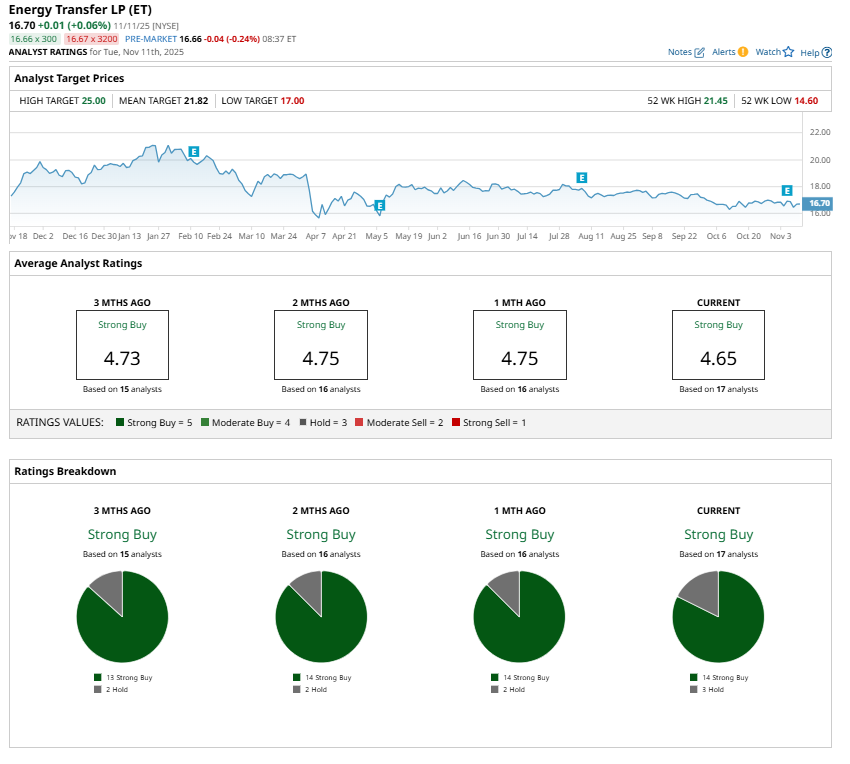

Analysts are bullish on Energy Transfer, with a “Strong Buy” consensus rating on the stock.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Ray Dalio Warns the Next Big Debt Crisis Won’t Come From Banks. It’ll Come From Governments.

- This ‘Strong Buy’ Dividend Stock Yields 8%. Should You Add It to Your Portfolio?

- Who Is Phil Clifton? Michael Burry Names Successor as Famed Investor Deregisters Hedge Fund.

- Michael Burry Slams NVDA, PLTR, META, ORCL. Here’s What the Charts Say About His Tech-Focused ‘Big Short.’