When trading stock options, one of the drawbacks of writing covered calls is the heavy upfront capital costs required to actually own the underlying stock before you can write/ short the call. After all, that’s the covered part of the covered call strategy, which applies to any stock in any stock sector.

Selling a naked call doesn’t require owning the stock, but it has risks that could cost you much more money in losses. These can be much riskier than selling a naked put since a stock can only go to zero on the downside. If a short squeeze sends shares rocketing higher than your strike price, you're on the hook for having to buy it on the open market to have to be assigned away at the lower strike price.

For example, if you write a naked call on XYZ at $55 and XYZ squeezes to $59, you will have to buy the stock at $59 to have it assigned, taken from your account since the call was exercised by the call buyer, at $55, resulted in a $4 loss.

Collecting rent for owning stocks

We likened writing covered calls to collecting rent on the stocks you own. Here’s a way to collect the same rent without actually owning the stock. It’s like being a landlord and collecting rent without actually owning the property.

Putting the pieces together

There's a strategy that lets you enjoy covered call income without tying up the capital actually to own the underlying stock. If you have already read our option articles on covered calls, debit spreads, the option Greeks and long-term equity appreciation securities (LEAPS) options, then you have the foundation to put the pieces together a long call diagonal debit spread (LCDDS), which literally lets you collect rent on stocks you don’t own.

Long call diagonal debit spread (LCDDS)

The LCDDS strategy sounds complicated, but it's a rather simple two-leg options strategy once you understand the mechanics. In a nutshell, you will be buying an in-the-money (ITM) LEAP call option while selling/shorting an out-of-the-money (OTM) short-term call option on the same underlying stock that you are bullish on. This bullish part is important, so make sure you use wider time frame charts to do your technical analysis.

By selling the near-term OTM call, you collect a premium, which the ITM LEAP call option takes the substitute role of the underlying stock in case you get assigned. The LEAP call option usually costs 70% less than buying the stock. Once again, the LCDDS strategy can be summed up in one sentence:

Buy an ITM or DTM LEAP call option and sell a short-term OTM call option on the same stock.

Putting on the trade

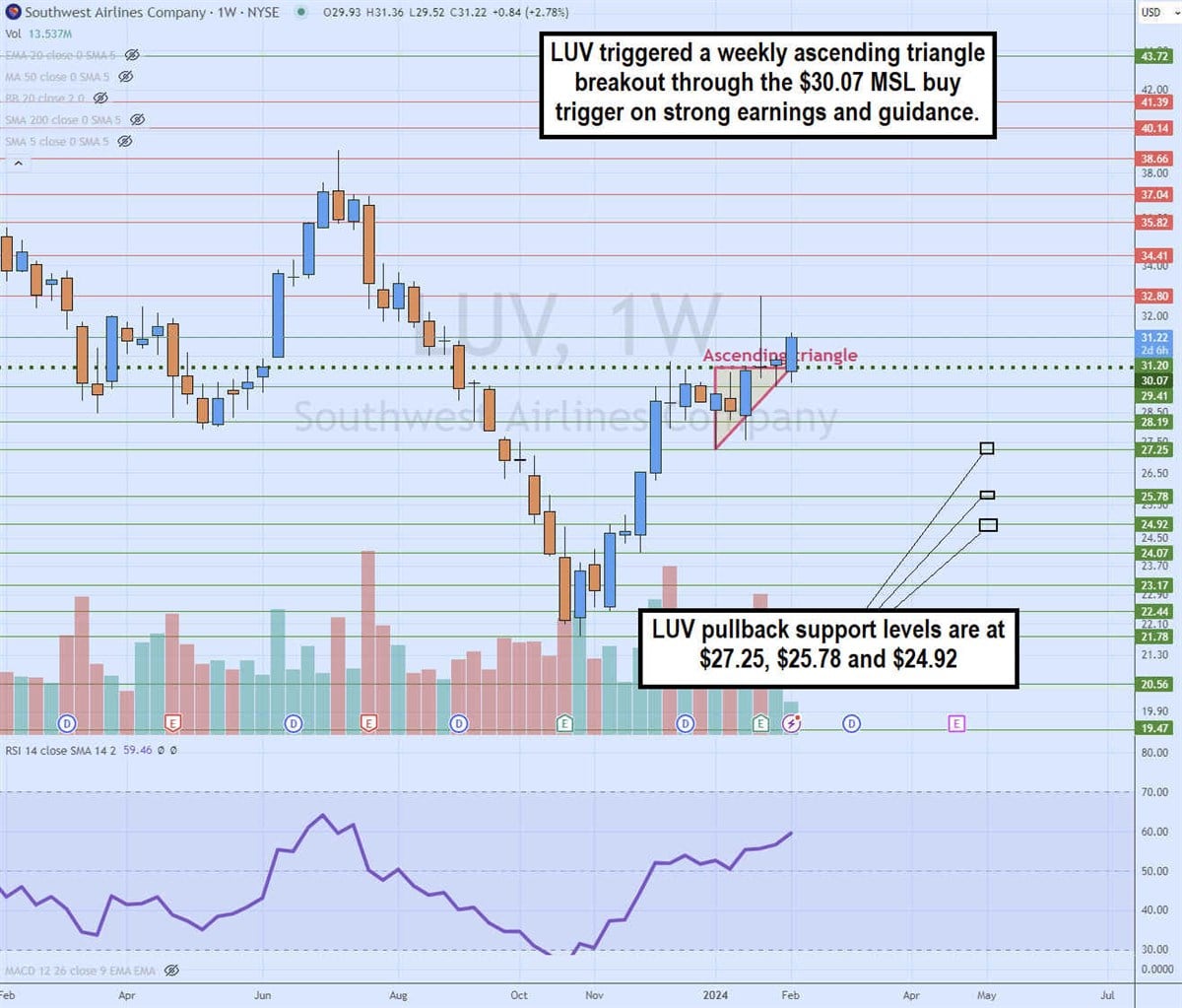

Let’s take a real-life example with Southwest Airlines Co. (NYSE: LUV). The company reported a solid Q4 2023 earnings report, more than tripling its EPS at 37 cents versus 12 cents consensus analyst estimates. Revenues rose 10.5% YoY, hitting a record of $6.82 billion, beating the analyst estimates of $6.75 billion.

The weekly candlestick chart indicated an ascending triangle breakout through the $30.07 market structure low (MSL) trigger. The weekly relative strength index (RSI) is steadily climbing through to the 60-band. There's triangle support at $27.25 and further pullback support levels at $25.78 and $24.92. LUV is trading around $31.18 on February 7, 2024.

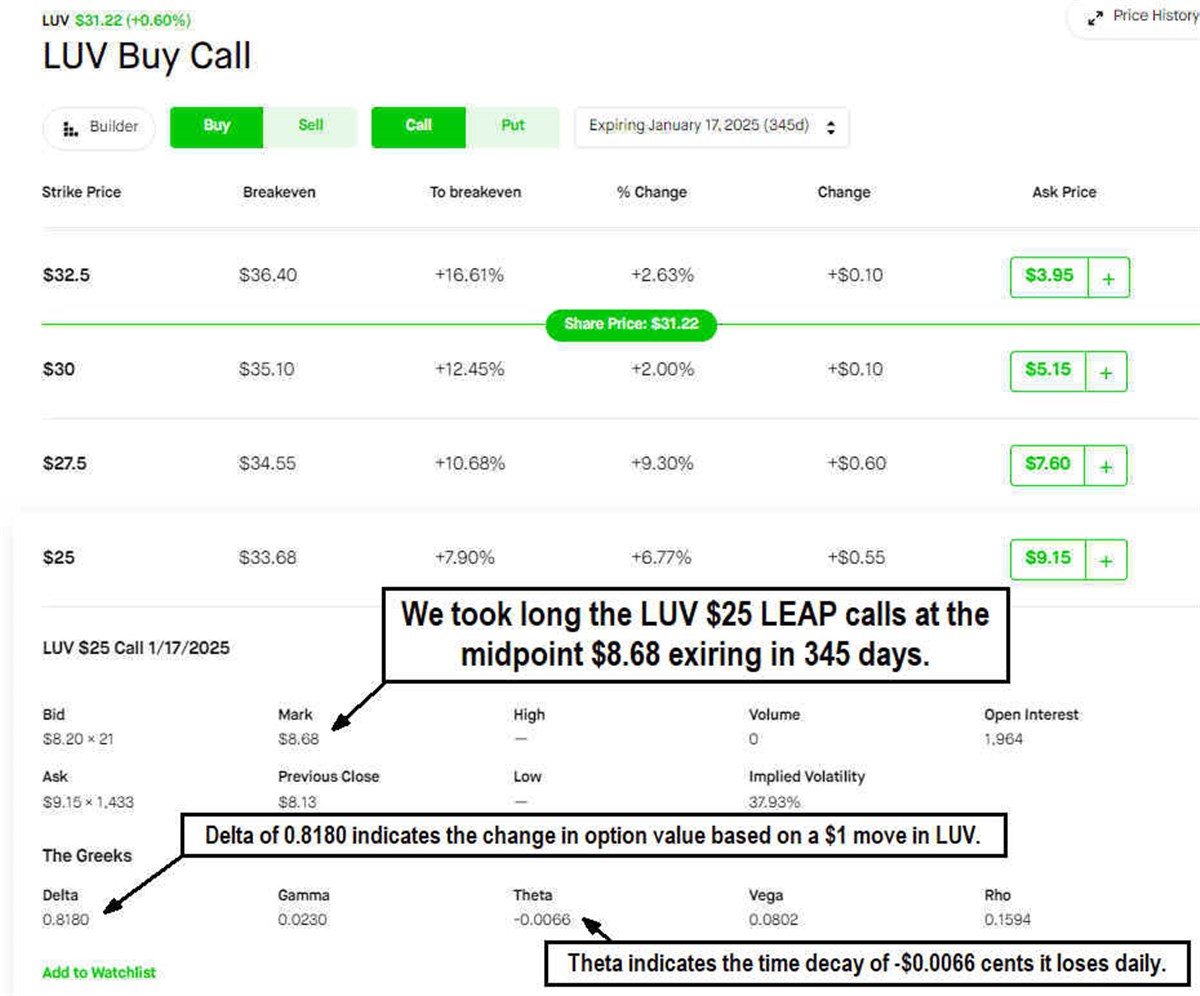

Based on this data, let's execute the first leg of the trade, taking long a LUV $25 LEAP call for $8.68, expiring on January 17, 2025, which is 345 days from now. Since options contracts represent 100 shares a piece, 1 contract will cost $868, which is much cheaper than buying 100 shares of LUV stock for $3,118. Note the options Greeks. The Delta of 0.8180 reflects how much the option price changes per $1.00 of price movement in LUV. The Theta of $0.0066 reflects how much money the option loses on a daily basis.

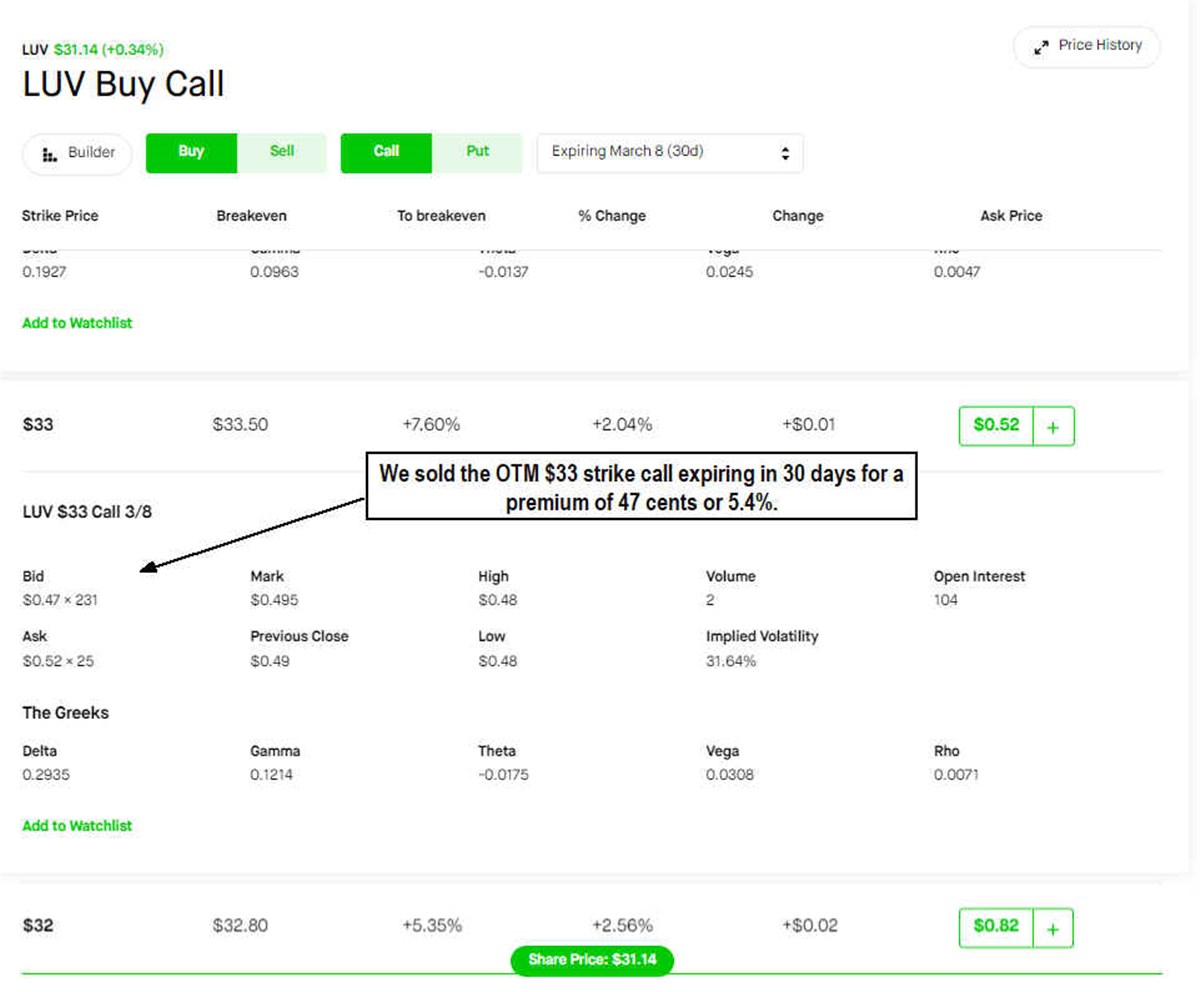

To collect our rent premium, let’s sell/short a LUV $33 call option for 47 cents, expiring on March 8, 2024, which is 30 days from now. This is the premium we get to keep regardless of where LUV closes at a month from now. The $47 is a 5.4% monthly gain on the $868 investment (the price of the LEAP call option). If we purchased 100 shares of LUV, it would only amount to a 1.5% gain on the $3,118 invested in the stock. That is the second leg, and it completes the execution of the LCDDS position. However, it is important to manage the trade.

Calculate the price of future options using the Greeks.

Here’s a quick way to use the options Greeks to estimate the value of an options contract upon expiration. If LUV closes at $34.18 on the March 8, 2024, expiration, we derived a value for the LUV $25 LEAP January 17, 2025, of $11.05.

We will use the Delta, Theta, and Gamma values of the LEAP option in the screenshot. We use the options Greeks to calculate the premiums of a $3.00 net price gain expiring in 28 days. The Delta premium is 0.8180 x $3.00 price gain for a $2.45 premium. The Theta is -0.0066 x 28 days for -18 cents. The Gamma of 0.0230 x 0.5 is 10 cents. Total options price gain is $2.45 Delta + 10 cents Gamma minus 18 cents Theta = $2.37 net gain + $8.68 initial cost of the LEAP call = $11.05 estimated value of the $25 LEAP call option.

The outcomes are upon expiration.

Let's review the outcome under different scenarios based on LUV's stock price on expiration on March 8, 2024.

If LUV closes under the $33 strike price of the short call, then we keep the $47 premium for a 5.4% monthly profit. We can sell/short a LUV call again or roll it over to the $33 April call to collect more premium.

Compare this outcome to the 1.5% monthly gain if we executed a traditional covered call strategy of buying the stock for $3,118 and writing the March $33 covered call for 47 cents.

If LUV closes ITM at $34.18, then the $25 LEAP call option would be worth approximately $11.05. We covered how we calculate the future value of options using the Greeks just above.

The short $33 call position would have a loss of $1.18. If we calculate the $11.05 value of the LEAP call and add the 47-cent premium for a total of $11.52, then we can calculate the costs of $8.68 for the LEAP call and the loss of $1.18 on the short call position for a total of $9.86. We subtract the $11.47 premiums minus the $9.86 costs for a final net gain of $1.66 profit or $166, which is a 19.1% monthly gain.

Compare this to the 7.3% monthly gain for a traditional covered call strategy that would result in a $182 gain on being assigned at the $33 strike price from our $31.18 entry price and the $47 premium for a total of $229 profit.

More gains for less cost

The LCDDS strategy in this example provides a 5.4% monthly premium and 19.1% monthly gain if LUV closes above $33, at $34.18 upon the March expiration. This is compared to the 1.5% monthly premium and $7.3% monthly gain with the traditional covered call strategy, which costs 70% more capital to execute. We will cover more multi-legged options strategies in upcoming articles.