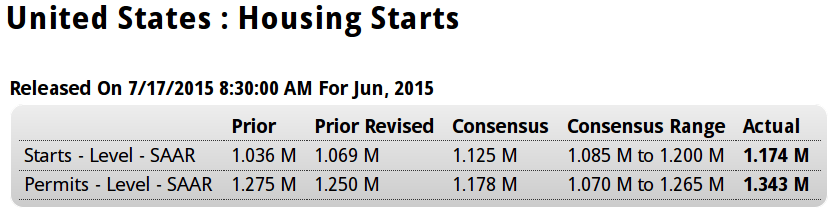

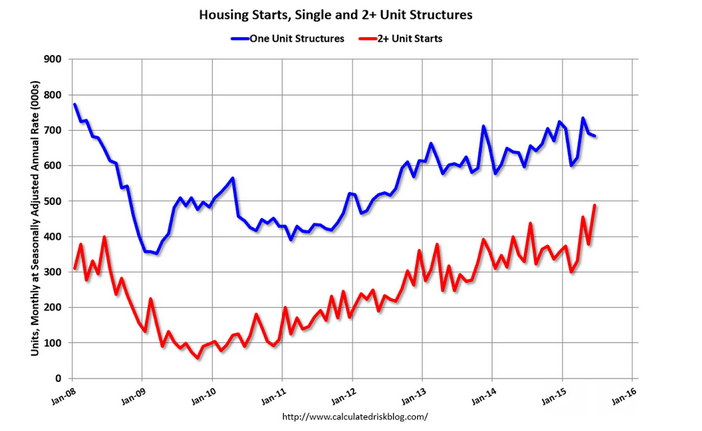

The increase is entirely a multi family story, and multi family dwellings are cheaper/smaller than single family:

Highlights

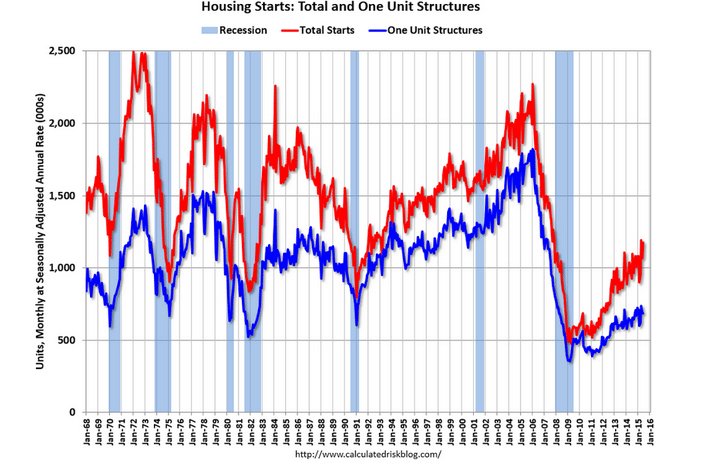

Strong demand for apartment units drove housing starts & permits data far beyond expectations, overshadowing less strength for the key single-family home category. Starts came in near the top of expectations, up 9.8 percent in June at a 1.174 million annual rate, but reflect a 29.4 percent surge in the multi-family component. The single-family component actually fell 0.9 percent. The same pattern appears for permits which jumped 7.4 percent overall to a much higher-than-expected 1.343 million rate but here too multi-family units rose 15.3 percent with single-family up far less but at a still very strong 0.9 percent.

Regional data, where the separation between single-family homes and multi-family units is not broken out, show special strength for the South which is by far the largest region for housing. Starts in the South rose 13.5 percent in June with permits up 10.4 percent. Permits in the West are also strong, up 9.5 percent, though starts in the region fell 6.0 percent. Also of note is an outsized 35.5 percent surge in Northeast starts.

The unusual rise for multi-family units reflects high levels of rent, evident in today’s CPI report. The single-family component is less strong though the 0.9 percent rise in permits does point to strong second-half activity for the new home sector. This report is very solid but just not as spectacular as the headlines suggest.

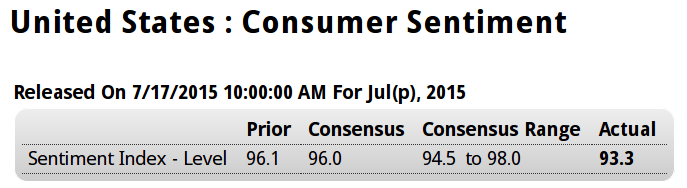

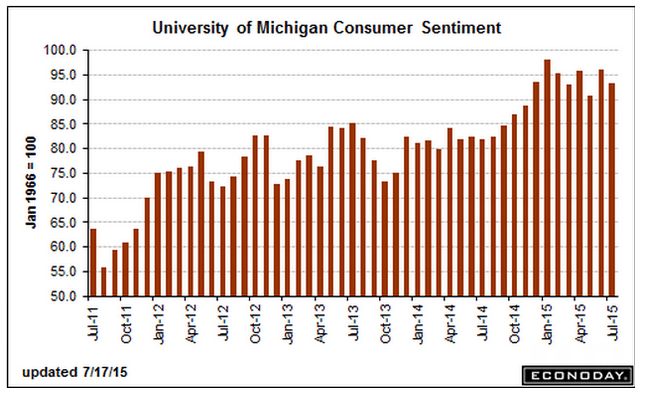

Negative surprise here:

Highlights

Consumer sentiment is softening this month, to 93.3 in the mid-month July reading which is below Econoday’s low estimate for 94.5. The current conditions component is down nearly 3 points to 106.0 in an early reading for July that points to another month of weakness for consumer activity. The expectations component fell a bit less to 85.2 which is still very respectable for this reading and points to confidence in the jobs outlook.

Inflation data, as Federal Reserve policy makers have been predicting, are inching higher with 1-year expectations at 2.8 percent and 5-year expectations at 2.7 percent, both up 1 tenth in the month.

Consumer sentiment has been running very strong most of this year and often well ahead of consumer spending readings which have been flat. But today’s report suggests that the best for confidence may already have passed.

The post Housing Starts, Consumer Sentiment appeared first on The Center of the Universe.