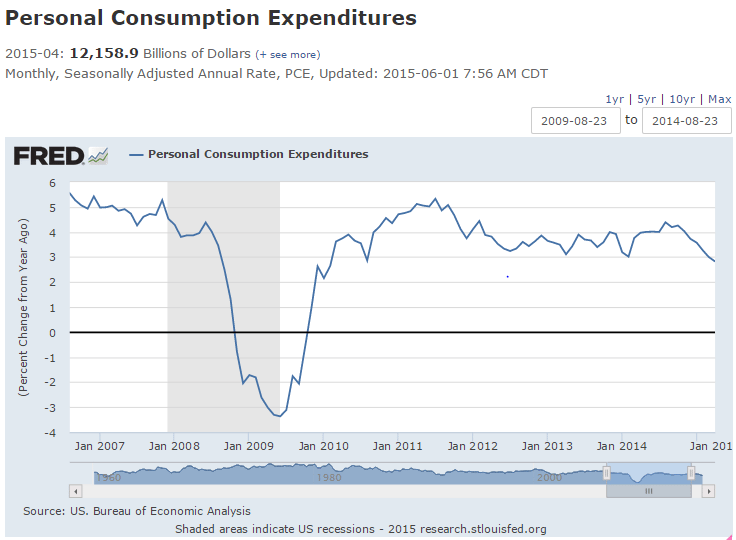

The sharp reduction in oil capex that was driving the economy has predictably shown up first in the oil states like Texas, Oklahoma, North Dakota, etc. Just as these states led on the way up, they are leading on the way down as well, with that weakness working its way to the other regions as the US continues to suffer from a general lack of aggregate demand. Though to a lesser degree, this is similar to the sub prime episode, where that housing expansion led the recovery, driving down the Federal deficit via the automatic fiscal stabilizers (tax revenues and transfer payments) as private sector deficit spending increased and did the heaving lifting. Then when that private sector deficit spending came to an end, sales and jobs collapsed, as the recession unfolded. Same for the .com era expansion and the S and L driven expansion prior to that, etc. Once the deficit spending falls short of the demand leakages the cycle ends.

Yes, debt levels are low enough for a consumer debt led rebound, but the private sector tends to be pro cyclical, and we see this happen only on the way up, pro cyclically, and not counter cyclically to rescue a slowdown already in progress.

Also, seems much like they did a few years ago, the Fed has engineered a spike in mortgage rates just as housing was beginning to show some signs of life, though admittedly not much. Traditionally housing has been the source of private sector deficit spending- borrowing to buy houses- but seems this time it isn’t going to happen. Nor are a few car loans going to move the needle, and in any case overall consumer spending growth seems to be fading.

Beige Book

Highlights

The second to last risk for a June rate hike has passed as the Beige Book, prepared by the Fed for its June 16-17 policy meeting, downgrades the strength of the economy slightly. Four of the Fed’s 12 districts are reporting slowing growth from the prior Beige Book, especially Dallas which is being hit hard by the energy sector.

Nevertheless, total employment is up slightly as are wages, but only slightly. Retail sales are also up as are residential and commercial construction. Manufacturing is described as steady with the exception, again, of Dallas and also Kansas City. The service sector is described as growing.

The pace of the nation’s economy is somewhere between moderate and modest with no signs of over heating. The only chance left now for a rate hike at the June meeting is Friday’s employment report which would not only have to show huge gains for May but also major upward revisions for April. The economy is not getting the big second-quarter boost that the hawks expected.

The post Fed’s Beige Book appeared first on The Center of the Universe.