Land & Buildings Investment Management, LLC (together with its affiliates, "Land and Buildings") announced today that it has issued an open letter to shareholders of Taubman Centers, Inc. (NYSE: TCO) (“Taubman,” “Taubman Centers” or the "Company”) and has filed definitive proxy materials with the Securities and Exchange Commission in connection with its campaign to elect two highly-qualified directors – Charles Elson and Jonathan Litt – to the Taubman Board at the Company’s 2017 Annual Meeting of Shareholders.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170419005741/en/

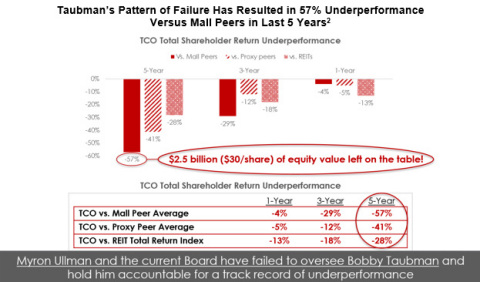

Sources: Land and Buildings' analysis, Bloomberg (Graphic: Business Wire)

The full text of the letter follows:

April 19, 2017

Dear Fellow Taubman Shareholders:

It is Time for Change at Taubman.

Vote the GOLD Proxy Card Today!

Land & Buildings Investment Management, LLC (together with its affiliates, "Land and Buildings") is an investment firm that specializes in publicly traded real estate and real estate related securities. We have been involved with Taubman Centers, Inc. (“Taubman,” “Taubman Centers” or the "Company”) since its Initial Public Offering (“IPO””) in 1992 and have followed the company through its disappointing journey riddled with failures in capital allocation, operations and corporate governance. We are seeking your support to elect two independent, highly-qualified individuals – Charles Elson and Jonathan Litt – to the Board of Directors of Taubman Centers (the “Board”) at the Company’s upcoming Annual Meeting of Shareholders (the “Annual Meeting”). We believe that these candidates have the right experience and expertise to help correct the course of Taubman and drive strong shareholder value creation.

We, the shareholders of Taubman, deserve change. We are seeking to replace two incumbent directors, CEO, President and Chairman Robert S. “Bobby” Taubman and Lead Director Myron E. Ullman, III, who we believe have failed to represent the best interests of shareholders.

In the paragraphs that follow, we lay out our case for why change is desperately needed at Taubman – illustrating the pattern of failures that has characterized the Company for years, and explaining what we would do to fix it.

The Board, Under the Helm of CEO and Chairman Bobby Taubman, Has Demonstrated a Pattern of Failures, Resulting in Material Stock Underperformance

Common shareholders have suffered under the leadership of Chairman and CEO Bobby Taubman and the rest of the Board through a troubling series of failures. It is time for accountability at Taubman.

Why Are We Here? A Pattern of Failure1 | ||||||||

| Capital Allocation | Operations | Governance | ||||||

Undisciplined approach resulting | Run like an unaccountable | The “Worst of the Worst” | ||||||

|

|

| ||||||

THE RESULT: 57% stock underperformance1versus mall peers over last 5 years | ||||||||

Taubman Centers’ Board has created a situation whereby TCO

will likely never approach its intrinsic | ||||||||

Sources: Land and Buildings’ analysis, Green Street Advisors, Company reports and filings, Bloomberg | ||||||||

Failure #1: Bad Capital Allocation

The Board, led by Chairman Bobby Taubman, has overseen repeated horrible capital allocation decisions during the past five years, resulting in significant cost overruns, delays and woefully inadequate returns on new investments. Impairments totaling $1 billion are likely necessary on four ill-advised developments in the past five years alone. Despite these costly mistakes, the Company also embarked on an expensive foray into Asia that has apparently failed to serve as anything but a distraction to management and Taubman expects to start yet another new development in Asia by the end of this year or next.

Taubman’s horrible 5-year capital allocation record is littered with value-destroying developments that, in our view, illustrate an alarming lack of proper Board oversight. This is evidenced by:

- Significant construction cost overruns

- Delayed openings on over half of new developments

- Exclusive high-end focus that is out of touch with the changing retail landscape

Management’s Ill-fated Developments Over Past 5 Years Likely to

Cost Shareholders $1 Billion3 | ||||||||

| Estimated Loss | % Loss | |||||||

| Taubman Prestige Outlets | ($70M) | -54% | ||||||

| The Mall of San Juan | ($260M) | -50% | ||||||

| International Market Place | ($160M) | -34% | ||||||

| Beverly Center | ($500M) | -100% | ||||||

| Total: ~$1 billion of losses | ||||||||

L&B estimates TCO destroyed ~$1 billion of value over the last 5 years in just 4 projects | ||||||||

Sources: Land and Buildings’ analysis; Company filings, including Form 10-Ks and earnings supplementals filed on Form 8-Ks; Company website materials, including Taubman’s December 2016 Investor Presentation |

Failure #2: Poor Operations

Despite owning the most productive publicly traded U.S. mall portfolio, the Company’s premier malls have generated inferior operating results that are glaring given our on the ground due diligence and deep industry experience. Not only is the Company leaving money on the table in terms of missed revenue opportunities, but the lavish corporate culture is driving bloated costs throughout the organization. Taubman’s broken culture and poor leadership have, in our view, caused massive operational underperformance, as evidenced by the chart below. We estimate that approximately $65 million, or approximately 20% upside, to earnings per share, and $1.7 billion of value creation, or $20 per share, could be achieved by entirely closing EBITDA margin gap relative to Mall Peers.

Taubman Operating Underperformance Has Been Significant and

Persistent4 | |||||||||||||||||||

2012 | 2013 | 2014 | 2015 | 2016 | 5 Year | ||||||||||||||

| TCO | 57.0% | 58.1% | 57.3% | 59.2% | 59.6% | 58.2% | |||||||||||||

| Mall Peer Avg. | 64.9% | 65.2% | 65.9% | 67.2% | 66.5% | 66.0% | |||||||||||||

| TCO Poor EBITDA Margins | -7.8% | -7.1% | -8.6% | -8.0% | -6.9% | -7.7% | |||||||||||||

Sources: Company and Mall Peers publicly available information, including earnings releases and earnings supplementals filed on Form 8-K for each of the figures referenced during the respective year referenced; Land and Buildings’ analysis |

Under Bobby Taubman’s leadership, we believe the Company has focused on ego-gratifying developments over the past five years rather than focusing on low-hanging fruit and establishing a culture of excellence in order to produce best in class operating results.

Failure #3: Horrible Corporate Governance

Taubman Family Has Sought to Maintain Control, Not Maximize Value

The Board cemented the Taubman Family’s6 control over the Company in 1998 by approving the issuance of the “Killer B” preferred stock to the Taubman Family garnering them near absolute control for a mere $38,400 given the super-majority voting requirement for nearly all material voting matters. A mere mortal would have had to pay approximately $350 million at that time to acquire 30% of Taubman common shares.

We believe the addition of new, truly independent and experienced directors to the Board is necessary given the current Board’s failure to oversee management and hold them accountable for the Company’s 57% stock underperformance versus Mall Peers over the last five years under the leadership of Bobby Taubman.

Poor Governance Practices Not in the Best Interests of Shareholders

The Taubman Family’s influence over the Company and the Board has, in our view, contributed to the Company’s poor corporate governance practices, including:

- Classified board

- Over-tenured Board at 15 years on average (excluding Cia Marakovits)

- Combined Chairman/CEO

- Ability of the Taubman Family to block an acquisition

- Dual class voting

- Limited investment among independent directors reflecting a lack of “skin in the game”

- Onerous anti-takeover provisions

- 90 year-old director with 25-year Board tenure

We find it hard to believe that the following actions (or lack thereof) were taken by the Board with the best interests of shareholders in mind:

- Allowed Taubman Family to pledge one-third of their OP Units at that time

- Did not implement majority-supported shareholder proposals to de-stagger the Board two years in a row

- Unilaterally rejected acquisition offer at substantial premium8

- Approved Taubman Family purchase of Series B stock for $38,400 giving the Family a 30% vote

- Judge finding that Board likely breached its fiduciary duty9

- Appointed Lead Director without director ever being elected by shareholders to the Board

- Ignored likely Charter violations of Taubman Family breaching ownership limit

- Ignored likely Charter violations by shrinking Board size10

- Limited independent Board stock ownership with minimal buying in past eight years

- Cosmetic and reactive changes since our involvement to preserve status quo

- Excessive activist defense spending

- Perfunctory 26 minute phone interview with our Nominee Mr. Elson by Myron Ullman

The Board is Not Taking the Necessary Steps to Position Taubman Centers on a Path to Value Creation

Changes by the Company since our initial engagement have, in our view, been solely cosmetic and were crafted in such a manner to give the appearance that the Board is acting reasonably, while really seeking to protect the troubling status quo:

- In a shocking display of nepotism, Myron Ullman was appointed to a newly created role of Lead Director without having yet been elected as a director by shareholders, a role which appears to lack any meaningful powers that could change the status quo. Mr. Ullman was appointed to the Board in April 2016 (after previously serving on the Board from 2003 to 2004) to fill Lisa Payne’s seat after her resignation from the Board, two months after Ms. Payne was added to the J.C. Penney Board where Ullman was previously a director and CEO.

- 90-year old Jerome Chazen was stripped of the Chair title on Audit Committee.

- Reduction of shares pledged by Taubman Family.

- Cia Buckley Marakovits was added to the Board only after the Company likely violated its Charter by shrinking the size of its Board following a then Board member’s resignation.10

The Board’s reactive approach to adopting changes as a result of shareholder pressure further underscores the need for independent, shareholder representation in the boardroom. When the pressure is off, what will keep the Board from returning to its past practices of complacent oversight and weak governance?

The Path Forward: A New and Independent Vision11

The path to unlock substantial long-term value in Taubman Centers is clear to us, with the potential of 60% upside to net asset value.

By voting for our two independent and highly-qualified director nominees, Charles Elson and Jonathan Litt, you have the power to help facilitate change by electing directors committed to instilling accountability and representing the best interests of shareholders. We believe our nominees have the right experience and expertise to help correct the course of Taubman and drive strong shareholder value creation. Importantly, our nominees will bring the fresh perspective and objectivity that we believe is currently lacking on the Board that has served as an obstacle to shareholder value creation.

The Path Forward: A New and Independent Vision | ||||||||

| ~60% upside to NAV | ||||||||

Disciplined | Enhanced Operations | Modernizing Corporate | ||||||

|

|

| ||||||

| Source: Land and Buildings’ analysis of the Company, Mall Peers and the REIT industry generally |

Taubman Centers Needs Fresh Leadership and Culture: | ||||||||

| Current Board | Refreshed Board | |||||||

| FFO | $3.75/share | $4.50/share | ||||||

| NAV | Destruction | Enhancement | ||||||

| G&A | Bloated & growing | In-line with peers | ||||||

| Impairments |

Up to $1bn across four |

Value creation through | ||||||

| Disclosure |

Opaque - hiding property |

Transparent - property | ||||||

| Investor Communication |

Falsehoods & | Realities in marketplace | ||||||

| Board |

Disenfranchise common |

Maximize value for all | ||||||

| Shareholders |

Dedicated REIT investors |

Dedicated REIT investors | ||||||

| Share Price | $66 | $106+ | ||||||

Sources: Land and Buildings’ views and analysis, Company and peer filings (see charts above) |

Land and Buildings’ Highly-Qualified Nominees: It is Time For Shareholder Voices to be Heard

As detailed above, we believe the Board lacks the stewardship necessary to create long-term shareholder value. Today, significant value is being trapped in Taubman and we believe our Board nominees can help unlock that value for the benefit of all Taubman shareholders.

Despite our sincere efforts to engage constructively with the Company, including through Mr. Ullman in his newly created role as Lead Director, we are deeply disappointed by the Board’s apparent failure to adequately address the issues we have identified and now believe a greater sense of urgency for creating shareholder value is required at the Board level to best position the Company and its owners for long-term success.

It is time for shareholders’ voices to be heard and to elect two new highly-qualified and independent directors who will work alongside their fellow Board members to improve accountability and seek ways to maximize value for all Taubman shareholders and not just the Taubman Family. Land and Buildings believes each of Messrs. Elson and Litt has the right experience and expertise to help correct the course of Taubman.

It is Time for Shareholders’ Voices to be Heard: Elect Charles Elson and Jonathan Litt

Charles Elson

- Edgar S. Woolard, Jr., Chair in Corporate Governance and the Director of the John L. Weinberg Center for Corporate Governance at the University of Delaware

- Current Director of HealthSouth Corporation, a healthcare services provider and Bob Evans Farms Inc., a restaurant and food products company

- Former Director at AutoZone Inc., a specialty retailer of automotive replacement parts

Jonathan Litt

- Founder and Chief Investment Officer of Land and Buildings

- Former Director at Mack-Cali Realty Corporation, an owner and operator of office and apartments assets throughout New Jersey and the northeast

- Former Managing Director and Senior Global Real Estate Analyst at Citigroup

It is time for the shareholders’ voices to be heard and send a clear message to elect two new independent directors to the Board to hold management and the rest of the Board accountable

VOTE FOR CHANGE AT TAUBMAN BY VOTING FOR OUR NOMINEES ON THE GOLD PROXY CARD TODAY

We urge you to vote the enclosed GOLD proxy card TODAY by telephone, over the Internet, or by signing, dating and returning your GOLD proxy card in the postage-paid envelope provided.

Sincerely,

Jonathan Litt

Founder & CIO

Land and Buildings Investment Management, LLC

| ________________________________________________ |

1 References to mall peers in this letter is the peer group defined by Land and Buildings as Taubman’s high quality mall peers GGP, Inc. (NYSE:GGP), The Macerich Company (NYSE:MAC) and Simon Property Group Inc. (NYSE:SPG), which are the only U.S. publicly traded regional mall companies (in addition to Taubman) that primarily own class A, high sales productivity, enclosed regional malls (collectively, “Mall Peers”). Mall Peers selected by Land and Buildings from the Company’s Executive Compensation Peer Group for 2016 as disclosed in Taubman’s proxy statement for the Annual Meeting. Initial development yields disclosed by Taubman in earnings supplementals filed on Form 8-Ks. Governance score based on the universe of REITs covered by Green Street Advisors.

2 Reflects total returns for the trailing 1-, 3- and 5-year periods through October 14, 2016 (few days prior to Land and Buildings public involvement in Taubman) as obtained from Bloomberg share price data for Taubman, Mall Peers and the Company’s Proxy Peers (from Taubman’s Executive Compensation Peer Group for 2016). Market capitalization and per share underperformance based on estimated figures at the beginning of the trailing 5-year period compared to if Taubman would have generated returns consistent with Mall Peers.

3 Estimated loss represents Land and Buildings’ estimates of the difference between the Company’s share of the disclosed cost for each project and estimated market value of each asset based on estimated yields and cap rates. Percent loss represents Land and Buildings’ estimates of the percentage difference between the Company’s share of development cost and estimated market value. Developments include redevelopment of existing assets as well as new ground-up developments.

4 Figures reflect pro rata ownership of assets; Land and Buildings’ estimates used where the Company does not disclose each metric. For each company, Land and Buildings identified what it believes to be the most comparable figures to arrive at such company’s share of income statement figures, including consolidated figures as well as estimated percentages of unconsolidated figures, to match each respective company’s ownership percentage of its assets. Land & Buildings’ analysis is subject to the following limitations: (i) each company does not disclose operating results using the same line items, (ii) company disclosure of unconsolidated assets varies by company and (iii) not all companies provide pro rata EBITDA, in which case Land and Buildings has estimated such figures. Please refer to Appendix A of Land and Buildings’ definitive proxy statement filed with the SEC on April 18, 2017, which further describes Land and Buildings’ EBITDA calculations and estimates. Fully closing the average EBITDA margin gap to Mall Peers over the past five years could result in $20 per share of value creation based on the cap rate Land and Buildings applied in its valuation analysis. Closing the EBITDA margin gap by 400 basis point could result in $10 per share of value creation. Land and Buildings, based on its more than 25 years of real estate experience and extensive knowledge of real estate valuations, applied estimated private market valuation cap rates to Taubman’s reported operating results utilizing a net asset value framework to arrive at estimated net asset value and potential value creation from margin expansion.

5 Approximately $1 billion of losses based on Land and Buildings’ estimates for four projects over the past 5 years. Approximately $1.7 billion of value creation opportunity missed based on applying the rate Land and Buildings applied in its valuation analysis to the amount of incremental income that the Company would generate if it were to generate EBITDA margins consistent with Mall Peers over the past five years.

6 Consisting of Mr. Bobby Taubman, Chief Operating Officer and director William "Billy" Taubman, Gayle Taubman Kalisman and the A. Alfred Taubman Restated Revocable Trust (collectively, the “Taubman Family”).

7 Quotes are intended to reflect Land and Buildings’ views on Bobby Taubman and the Board and are not actual quotes or statements from Bobby Taubman. Voting on the election of directors at the Annual Meeting is, in our view, the only way to defeat the “Killer B” vote as Taubman’s plurality voting standard provides that the director candidates’ receiving the most number of votes for his or her election will be elected as directors of the Company.

8 According to Simon Property Group’s press release, dated November 13, 2002.

9 Simon Property Group, Inc. v. Taubman Centers, Inc., 261 F. Supp. 2d 919, 939 (E.D. Mich. 2003)

10 Taubman Form 8-K filed on September 30, 2016 announcing the resignation of then director William Parfet from the Board and that the size of the Board was reduced from 9 to 8 directors rather than leaving the size of the Board at 9 with one vacancy.

11 The valuations referenced herein are estimates and, therefore, there can be no assurance that such estimates are reflective of actual realizable value. We believe our nominees will work rigorously to help put the Company on the right path towards shareholder value creation, however, if elected at the Annual Meeting our nominees will constitute a minority of the Board and there can be no guarantee that they will be able to implement the actions that they believe are necessary to maximize shareholder value, including those outlined in the charts herein.

12 Current Board FFO (funds from operations) based on midpoint of 2017 Company FFO guidance. Refreshed Board FFO based on Taubman generating FFO in excess of the Company’s 2017 FFO guidance midpoint to achieve EBITDA margins that are consistent with its Mall Peers over the past five years, or $65 million of incremental EBITDA. Current Board share price based on closing price as of April 13, 2017. Refreshed Board share price based on the Company’s share price trading consist with Land and Buildings’ estimate of net asset value, which is based on estimated private market value of the Company’s real estate. Land and Buildings’ analysis of the Company, including capital allocation decisions, operating results and corporate governance, detailed various deficiencies, in our view, that are highlighted in the table.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170419005741/en/

Contacts:

Sloane & Company

Dan Zacchei, 212-486-9500

Dzacchei@sloanepr.com

or

Joe

Germani, 212-486-9500

JGermani@sloanepr.com

or

Investors:

D.F.

King & Co., Inc.

Edward McCarthy, 212-493-6952

emccarthy@dfking.com