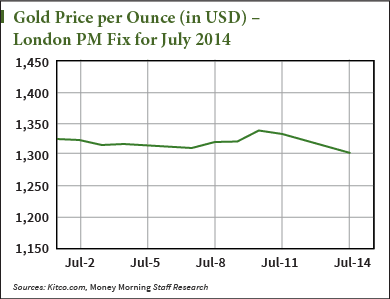

Gold prices today (Monday) fell sharply by 2.3% for the biggest one-day drop of 2014.

U.S. gold futures for August delivery were down $30.70 at $1,306.70 an ounce – their biggest one-day drop since December. Spot gold fell $33.50 at $1,305.50 an ounce. The sell-off happened quickly following the Comex futures market open in early U.S. trading according to Kitco, suggesting a big sell order hit the futures market at that time.

Our new gold price chart reflects today's sell-off.

Here's why gold prices took a beating today…

Gold Prices Took a Beating Today for One Major ReasonMoney Morning Chief Investment Strategist Keith Fitz-Gerald appeared on FOX Business' "Varney & Co." this afternoon to discuss what's behind gold's biggest one-day drop.

He pointed at a profit-taking spree as the main cause.

"A lot of people are taking gold profits and putting it back into stocks," Fitz-Gerald said.

You see, prior to today, gold prices had rallied with a 9.5% gain in 2014 through mid-July. Last Wednesday, August Comex gold was on track for the biggest gain in nearly three weeks. And on Tuesday, SPDR Gold Trust (NYSE Arca: GLD) – the world's largest gold exchange-traded fund (ETF) – reported its second consecutive session of inflows, according to Reuters. It was the first time since mid-April GLD's holdings reached above 800 tonnes.

What's more, U.S. markets were on track for gains across the board on Monday, with the Dow Jones up 113 points (0.67%) as of 3:30 p.m. EDT. Fueling gains were strong merger activity and favorable Citigroup (NYSE: C) earnings.

"The earnings report out of Citigroup helped to lift the market," Banyan Partners LLC chief market strategist Robert Pavlik said to Bloomberg. "The market has more room to run. It's going to be interesting to watch the amount of strength that it carries day to day."

Watch the video to see Fitz-Gerald's breakdown of today's toppling gold prices:

The Dow Jones today hit another record high in early trading. Here’s why the DJIA keeps climbing and why “stocks just want to go up.”

Other factors weighing on the yellow metal today included uncertainty over U.S. Federal Reserve Chairwoman Janet Yellen's comments to Congress on deck for tomorrow, and a decline in some of the geopolitical tensions that were swirling last week.

With gold prices taking a downward turn, is it a bad time to invest in gold?

Time to Buy Gold?Money Morning Chief Investment Strategist Keith Fitz-Gerald said in May that the case for owning gold has never been stronger, in the right proportion.

"Many investors are asking themselves if now is the time to buy gold. I think that's the wrong question," Fitz-Gerald said. "What they should be asking themselves is if they can afford not to buy gold."

Fitz-Gerald highlighted the fact that central banks are trillions of dollars in the hole, so they are buying gold as a means of supporting their currencies. According to the World Gold Council (WGC), in 2013 net purchases totaled 369 tonnes. That represents 12 consecutive quarters in which the central bankers have reported net inflows.

And recent gold news corroborates Fitz-Gerald's bottom line…

You see, Fitz-Gerald also stressed that consumers in India and China – who jointly represent three out of every five people alive today – generally believe that gold is going to increase in price over time. Yet few actually own it, according to the WGC and U.S. Global Investors.

"As the economic development in these two countries continues at a rapid pace, overall demand will increase, even if it falls off in developed countries like the United States and in the European Union," Fitz-Gerald said. "Already the statistics are proving this point. Consumer demand in China rose 32% in 2013 to a record 1,066 tonnes, while in India, demand rose 13% to 975 tonnes."

Money Morning recently delivered for our Members a two-part "cheat sheet" that outlines the right amount of gold for your portfolio. You can get that gold investing guide – for free – here.

Related Articles:

- Kitco: Gold Down Sharply on Heavy Profit Taking, Weak Long Liquidation, Sell Stops Hit

- Bloomberg: U.S. Stocks Rise on Earnings Optimism as Citigroup Jumps

The post What's Behind Gold Prices' Biggest Daily Drop of 2014 appeared first on Money Morning - Only the News You Can Profit From.