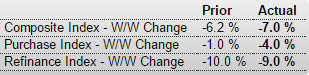

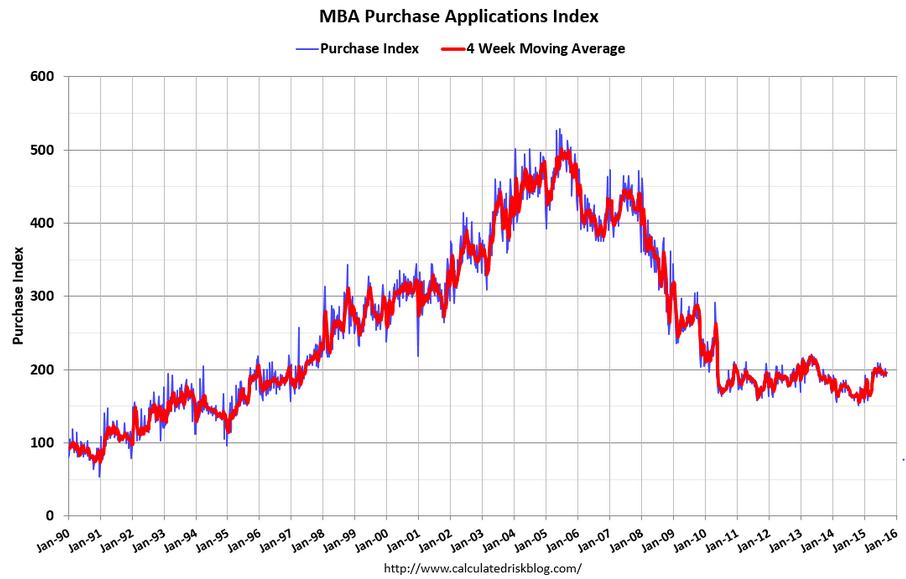

Looking like it’s turned south:

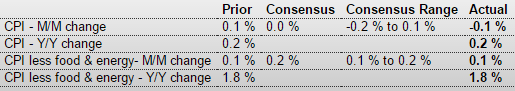

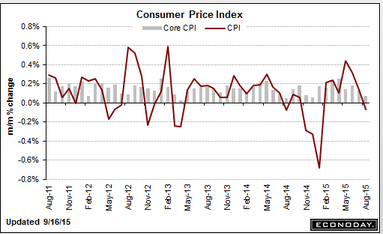

Fed continues to fail to sustain enough aggregate demand to meet it’s 2% inflation target:

Consumer Price Index

Highlights

Consumer prices came in soft in August and will not be turning up the heat on the doves at the FOMC. Pressured by gasoline, the CPI fell 0.1 percent in August with the year-on-year rate up only 0.2 percent. The core, which excludes energy and food, rose only 0.1 percent with the year-on-year rate steady at plus 1.8 percent and still under the Fed’s 2 percent goal.

And details are soft. Energy prices fell 2.0 percent in the month including a 4.1 percent decline for gasoline. Airfares were down sharply for a second month, 3.1 percent lower. Owners equivalent rent, which had been hot, rose only 0.2 percent in the month.

Showing some pressure is apparel, up 0.3 percent for a second straight month in what hints at back-to-school price traction. Otherwise, components are flat to steady such as food at plus 0.2 percent or medical care at no change.

The 1.8 percent year-on-year core rate does catch the eye but with commodity prices soft and foreign economies weak, the outlook for price acceleration remains elusive.

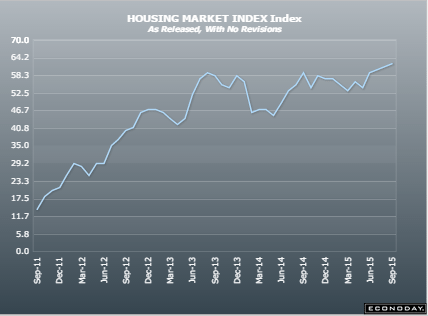

Up a bit! The new home builders are still optimistic:

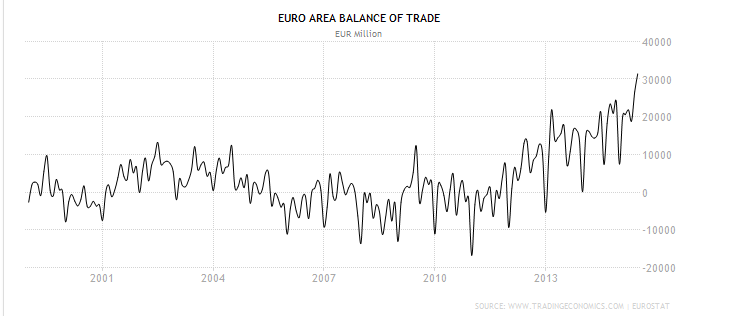

New record high- very euro friendly…

(Bloomberg) — The Business Roundtable CEO Economic Outlook Index fell to 74.1 in a quarterly survey, down from 81.3. The survey was completed between Aug. 5-26. The CEOs projected U.S. economic growth of 2.4 percent this year, down 0.1 percentage point from the previous forecast. The share of CEOs expecting a decrease in their companies’ U.S. capital spending in the next six months rose to 20 percent in the latest survey from 13 percent in the previous one. Thirty-two percent said their firms’ U.S. employment will decline, compared with 26 percent in the prior survey.

The post Mtg Purchase Apps, CPI, Home Builder’s Index, Euro Area Balance of Trade, CEO Outlook appeared first on The Center of the Universe.