State Street Corporation (NYSE:STT) today announced the results of its GX Private Equity Index (PEI), a benchmark for comparative analysis of private equity performance, which includes a comprehensive data set dating back to 1980. In the second quarter of 2016, the index saw an overall return of 2.7 percent, with Buyout, Private Debt and Venture Capital each posting positive returns.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20161121005843/en/

GX PEI

“The last eight quarters have been difficult for all private equity funds. Rolling one-year returns have been in decline since the second quarter of 2014, down from a nearly 30 percent return to single digits, mainly due to continued slow growth, economic and political uncertainty, and a lackluster IPO market,” said Will Kinlaw, senior managing director and global head of State Street Associates®, a division of State Street Global ExchangeSM. “Nonetheless, we do see recent gains in buyout funds, which can in large part be tied to the strong performance we’ve been seeing in energy-focused funds.”

The PEI is based on directly sourced limited partnership data and represents more than $2.4 trillion in private equity investments, with more than 2,600 unique private equity partnerships, as of June 30, 2016.

Second Quarter Highlights Include:

- Improving quarter over quarter for the last four quarters, Buyout gained 3.41% in Q2 (up from 1.25% in Q1) while Private Debt funds gained 2.61% (up from 0.75 in Q1) during the second quarter of 2016. Venture Capital posted a 0.28% return in Q2 (up from -1.49% in Q1).

- Among all three main strategies, Venture Capital posted a 0.84% return for one year, as of Q2 2016; while Buyout and Private Debt recorded 4.98% and 1.77% returns respectively, for the same period.

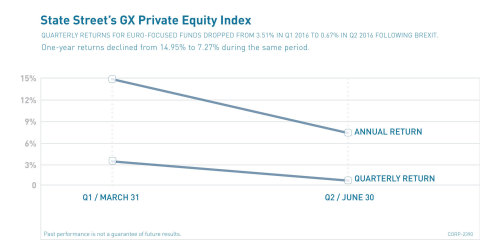

- Recent volatility of the Euro foreign exchange rate has brought some headwinds to European focused funds. The quarterly return dropped from 3.51% in Q1 to 0.67% in Q2 2016. One year returns also declined from 14.95% at the end of March 2016 to 7.27% as of June 30, 2016.

“In the second quarter we saw movement to European-based funds among a significant amount of investors looking to capitalize on the Brexit, as the declining Euro and British Pound created opportunities for investors looking to make new commitments to the region,” said Anthony Catino, managing director, Alternative Investment Solutions for State Street. “It will be interesting to see how these Euro funds perform throughout the remainder of 2016.”

For additional insights, or to learn more about the GX Private Equity Index please visit http://www.ssgx.com/peindex.

About State Street

State Street Corporation (NYSE: STT) is

one of the world's leading providers of financial services to

institutional investors, including investment servicing, investment

management and investment research and trading. With $29 trillion in

assets under custody and administration and $2 trillion* in assets under

management as of September 30, 2016, State Street operates in more than

100 geographic markets worldwide, including the US, Canada, Europe, the

Middle East and Asia. For more information, visit State Street’s website

at www.statestreet.com

* Assets under management were $2.4 trillion as of September 30, 2016. AUM reflects approx. $40 billion (as of September 30, 2016) with respect to which State Street Global Markets, LLC (SSGM) serves as marketing agent; SSGM and State Street Global Advisors are affiliated.

Important Risk Information

Investing involves risk including the risk of loss of principal.

Past performance is no guarantee of future results.

Performance of an index is not illustrative of any particular investment. It is not possible to invest directly in an index.

This press release is provided for informational purposes only and should not be considered investment advice. Any such views are subject to change at any time based upon market or other conditions and State Street disclaims any responsibility to update such views. Neither State Street nor its affiliates can be held responsible for any direct or incidental loss incurred by applying any of the information offered. Please consult your tax or financial advisor for additional information concerning your specific situation.

State Street Corporation One Lincoln Street, Boston, MA 02111-2900.

© 2016 State Street Corporation - All Rights Reserved

CORP-2390

Exp. Date: 11/30/17

View source version on businesswire.com: http://www.businesswire.com/news/home/20161121005843/en/

Contacts:

Julie Kane, 1-617-664-3001

jekane@statestreet.com

@StateStreet