The amount of money big banks have spent on settlements, alone, in just the last four years will blow your mind - and these totals are about to get higher.(Read the full article here)

We all remember the recent housing market crash, and the associated bailout of some of America's biggest banks. Some of us consider the allocation of American taxpayer funds unjust, and believe the bail outs to be a ludicrous abuse of the big banks' power.

What Are Big Banks Using Bailout Money For?What many Americans don't know is that Big Banks have been using residual bailout funds for defense from lawsuits.

The bailouts big banks received in 2008 will forever affect the way they do business & in turn will limit the trust they receive from American citizens - their customer base.

Recently, The non-profit Better Markets filed a lawsuit against the U.S. Justice Department to block the government's $13-billion settlement with JPMorgan Chase (NYSE: JPM) over faulty mortgage products the bank sold before the financial crisis. Better Markets argues that the record settlement provides JPMorgan with "blanket civil immunity" for its illicit activity without a day in court. Its CEO Dennis Kelleher said, "taxpayers are being forced to accept a secretive backroom deal that may well have been another sweetheart deal" for JPMorgan Chase five years after its bailout.(Read the full article here)

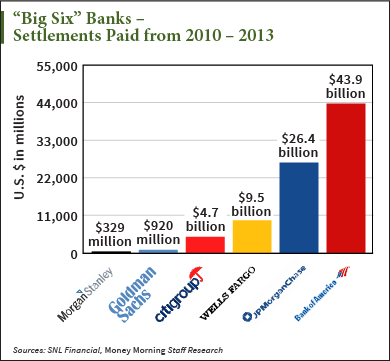

Together the six biggest banks paid $85.75 billion in credit and mortgage-related settlement costs from fiscal 2010 through the end of third-quarter 2013. Here's how those payments breakdown by bank*:

As distrust of big banks increases amongst the American population, we have to ask ourselves: Will Americans be willing to post bail for these big banks again?

Related Articles

Big Bank Earnings Is One of the Most Significant Events of 2014 – And It Could Bring You a Fortune

The big banks are all reporting their fourth-quarter earnings this week. Make no mistake: Although it's only January, this will be one of the most significant events of the year...

CHART: The Ridiculous Amount of Money Big Banks Spend in Settlement Costs

The amount of money big banks have spent on settlements in just the last four years will blow your mind - and these totals are about to get higher.

Read more stories about Big Banks.

Related Chart

JPMorgan Chase NYSE: JPM Feb 11 06:26 PM loading chart... Price: 57.11 | Ch: 0.37 (0.6%) JPMorgan (NYSE: JPM) Stock Price Up Today After Earnings

The JPMorgan Chase & Co. (NYSE: JPM) stock price is up 0.35% today (Tuesday) to $57.64 despite Q4 profit slipping 7% to $5.3 billion, or $1.30 per share. That compares to $5.7 billion, or $1.39 per share, the previous quarter.

Analysts had projected earnings per share (EPS) of $1.35 for JPMorgan.

Somehow, CEO Jamie Dimon pulled another rabbit out of his hat...

The post Why the 2008 Big Bank Bailout Has Changed the way Americans do Business appeared first on Money Morning - Only the News You Can Profit From.