As the Alibaba IPO date grows closer, details continue to emerge concerning what will be one of the largest IPOs ever. And even though we keep learning more about the deal, we still don't have all the Alibaba IPO facts we want...

One of the biggest questions we still have concerns the Alibaba IPO date - although a new report last week hinted at a potential timeframe...

And that's only one of the burning questions we still have about the Alibaba IPO. Here's everything about this massive public offering that we're keeping an eye out for answers to.

The Five Big Alibaba IPO Facts Left to Deliver

The Exact Alibaba IPO Date: Late last week, The Wall Street Journal reported that Alibaba will be waiting until after Labor Day (Sept. 1) to hit the market. Previously, reports had suggested that Alibaba could make its public debut on Aug.8, which was later pushed back to mid-August. But according to The Journal, Alibaba prefers to wait until September, which it views as a busier month for initial public offerings.

No official date has been announced, and investors should not expect to know the definite date for several more weeks. Typically, companies announce their final IPO date late in the IPO process, so the recent delay is not surprising.

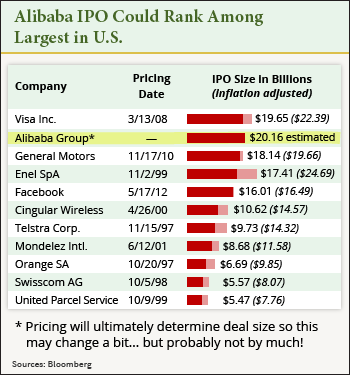

The Record-Breaking IPO Price: Analysts have been estimating the size of the Alibaba IPO, and numerous projections place the deal over $20 billion. That would surpass the $19.65 billion of Visa Inc. (NYSE: V) for the largest IPO in U.S. history. Even the most conservative estimates have Alibaba raising at least $16 billion, which would outraise the 2012 Facebook Inc. (Nasdaq: FB) record for largest Internet IPO.

When Alibaba filed its prospectus, the company said it plans to raise at least $1 billion, but that figure was just a placeholder. The company should release more pricing information as the IPO date draws closer.

Money Morning Members - keep reading for three more key points about Alibaba we're waiting for. Non-Members, sign up now for instant access to the rest of this Alibaba IPO update (and you'll get all our investing analysis, for free)...

Alibaba's Share Price: While many believe that Alibaba will end up raising $20 billion, investors are still waiting for any information on how Alibaba might price its shares. Companies will usually announce a price range for its shares in the week leading up to its IPO date.

The share price a company picks is very important to the stock's initial success. If a company overprices its stock, early investors may sell, thinking the share price will decrease. For instance, when Facebook priced its shares at $38, the company watched its stock decrease 50% in the first four months.

For that reason, Alibaba has reportedly decided to discount its shares as much as 22% at the time of its IPO. According to Bloomberg, that could be done in an effort to stir early buying following the stock's public debut.

"Alibaba is raising so much money, for the market to support that, it's logical that it provides some discount to investors at the time of the IPO," Li Yujie, analyst at RHB Research Institute Sdn Bhd in Hong Kong, told Bloomberg. "It has a lot of potential, but investors want to see a few quarters of results and also see how the company will strategically place itself."

Still, no price range has been announced.

Alibaba IPO Valuation Total: Last week, a Bloomberg survey of five analysts estimated that Alibaba would be worth $154 billion when it goes public, but other estimates have gone higher.

In early July, Piper Jaffray analyst Gene Munster projected that the Chinese e-commerce giant was worth $221 billion, including cash. Before that, the financial research company Sanford C. Bernstein released the highest estimate, claiming Alibaba was worth $230 billion.

While we won't know Alibaba's exact valuation figure until the IPO date, look for even more staggering estimates to be released before then.

Alibaba's "Mystery" Shareholders: Alibaba has disclosed the identity of 70% of its shareholders, but who owns the other 30% stake is still a mystery. According to The New York Times, many of those unknown shareholders are high-level Chinese political officials.

The Times wrote that Alibaba bought back $7.6 billion worth of shares from Yahoo! Inc. (Nasdaq: YHOO) in 2012, and raised the money by selling shares to China's sovereign wealth fund and three other prominent Chinese investment firms. The three firms were Boyu Capital, Citic Capital Holdings, and CDB Capital, but Alibaba did not detail the political connections of the firms.

PROFIT ALERT: You Can Make Money from Alibaba Today...The best news about this looming IPO is that it has created a major profit opportunity that most investors haven't yet noticed... It's happening now, months before Alibaba hits the market...

In fact, this could be your one and only chance to make the kind of gains normally reserved for the high-net-worth investors and bankers. And there are three ways to play. You can learn more about this Alibaba profit opportunity here.

Related Articles:

- The New York Times:

Alibaba's IPO Could Be a Bonanza for the Scions of Chinese Leaders - The Wall Street Journal:

Alibaba Plans IPO for After Labor Day - Bloomberg:

Alibaba Seen Offering IPO Discount to Avoid Listing Flop

The post The Five Big Alibaba IPO Facts Investors Still Don't Know appeared first on Money Morning - Only the News You Can Profit From.