As I've been noting for some time now, making money in the energy sector is no longer pegged to higher crude oil prices.

In today's environment, picking winning oil stocks is more about where a company drills, how it manages its assets and operations, and the broader flow of supply and demand.

In this case, it's all about selecting the right target - companies that are built to weather the inevitable dips in the price of crude.

And there are plenty of them out there...

Making Sense of the New Balance in Crude Oil PricesOf course, geopolitical events are still going to be the ultimate wild card.

For instance, the impending entry of Turkey this morning into the broadening crisis in Iraq and Syria will create some jitters and instability certain to influence oil prices.

But, at least in the short term, this is quickly becoming a very different oil market.

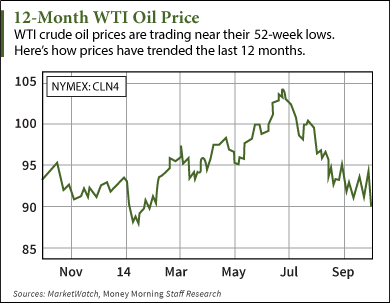

Yesterday marked the first time in almost a year and a half that crude oil prices in New York fell below $90 a barrel. Meanwhile, the Brent price in London mirrored the decline, closing below $93.

The spread between the two is also narrowing. That will have some interesting effects on how traders arbitrage paper barrels (futures contracts) and wet barrels (actual consignments of oil for shipment).

As I've discussed many times before, the emergence of massive unconventional oil reserves in North America and the rest of the world (more than 80% of extractable unconventional reserves are outside of North America) are changing the energy landscape.

However, one thing that is not going to happen is a collapse in oil prices.

Already WTI and Brent are clawing their way back from the recent lows. Much of the move higher has been driven by a Saudi decision to cut back on production. What's more, there is the winter demand cycle that's kicking in for heating fuel and diesel.

The key from this point forward is balance. We are going to be trading in a narrow range for a bit, where the differentials in price will primarily be caused by local markets balancing the available supply with the projected demand.

I expect the near-term trading range to be between $85 and $95 a barrel. That will still provide ample space for some nice profits in the right companies.

But it's going to require a bit more circumspection. Now is not the time to buy a company's stock and hold it until your grandchildren retire.

Instead, here is the approach energy investors will need to take...

The Key Is Finding the Right Kind of SizzleThe security and reliability of certain small producers in the United States and western Canada provide a ready-made list of good investment targets.

As I've observed before, these producers have the advantage of known reserves, stable markets, lower operating costs, fully developed infrastructure, and significant experience in basins and regions they know well. These types of companies make for a nice offset to the uncertainty found abroad.

In addition, as pricing remains range-bound, other elements in the upstream-to-downstream process will benefit, including select pipeline and midstream service providers, along with partnerships and related structures that control critical assets.

First among the "critical asset" category are the limited partnerships established by larger U.S. refineries that own and run transport, gathering, terminal, and storage facilities for the huge volume of crude being shipped to the main processing locations.

This category of refinery asset spin-offs and restructuring reflect a newer phenomenon, especially when it comes to the crude oil transport between Canada and the United States.

As the lower forty-eight moves toward essential energy independence, Canada will be providing more crude oil on the import side. And the difference here is staggering.

From having to import almost 70% of its daily needs just a few short years ago, it is believed that American crude oil imports will drop to only about 30% within the next decade (or even sooner by some estimates).

That sets the stage for continued increases in transit by rail for Canadian crude headed south and a growing use of internal transport by rail tanker cars inside the United States, especially with major refinery networks serving as collective end users.

There are also some interesting opportunities developing internationally (i.e., outside North America).

The focus here is going to be on where the company is located, rather than where it is drilling. For example, operators whose stock is traded on the London Stock Exchange - especially the LSE's AIM (Alternative Investment Market) - with field projects in the Caspian basin, East Africa, and other global locations are going to see a nice pop.

Normally, these opportunities are beyond the reach of the average American retail investor. But not for long. In fact, I will have some exciting news on this front coming shortly. So stay tuned.

But once again, putting geopolitical uncertainties aside, the crude oil balance will dictate specific targets in this kind of investment environment.

Don't Sleep on the Opportunities in Natural GasIt's another story entirely on the natural gas side. Despite the expanding global reserves of shale, tight gas, and coal bed methane, gas prices are moving up. Once again, more than 80% of extractable reserves worldwide are found outside of North America.

In fact, while the attention remains fixed on the shale revolution underway in the United States, latest figures indicate there is more volume available in China, Argentina, and Algeria than in the United States.

With natural gas, the NYMEX price is now above $4 per 1,000 cubic feet (or million BTUs) as we move into a winter heating cycle that should push prices closer to $4.50.

That means there is a range of profitable moves about to hit. Natural gas normally doesn't have the sizzle that crude oil has among investors. Of course, making money tends to change that real fast.

What makes the gas picture different are appreciable increases emerging on the demand side. From the rise of U.S. liquefied natural gas (LNG) exports to both Europe and Asia beginning in 2015 to the transition well underway from coal to gas in the generation of electricity, the ability to produce more unconventional gas is being met by a rise in the demand curve.

So despite a dip in crude oil prices, there are still plenty of places to make money in energy.

More from Dr. Kent Moors: When it comes to what actually moves oil prices, the television pundits usually overlook some key considerations. Here are the three major price influences most "analysts" ignore...

Tags: Crude Oil Prices, energy investing, how to invest in oil, how to profit, how to profit from oil, oil price, Oil Prices, oil prices today, oil stocks, price of oilThe post The Best Way to Profit from Crude Oil Prices Right Now appeared first on Money Morning - Only the News You Can Profit From.