The countdown continues . Here's a nice rundown of the Greek endgame, which is moving towards it's final stages as the ECB refused to consider a "plan B," even as a meeting of the block's 19 finance ministers fell apart over the weekend. Greece doesn't just need money to service their Bonds and IMF loans, which are what the US press has been fixating on (because we are one of the parties that is owed that money). Greece also needs moneys to pay their own country's pension obligations and, of course Government salaries so perhaps you can understand the "FU" attitude the Government is beginning to have towards the ECB as the ministers insist on more and more cutbacks. Greece has about two weeks to convince the EU to release another $7Bn to them under SOME kind of terms that will enable them to pay $3.7Bn in bonds $800M due to the IMF on the 12th otherwise that default will quickly cascade things out of control. Over the next month, that $7Bn will be used up on other debt obligations all ahead of a $4Bn payment they already owe to the ECB on July 20th. Per Goldman Sachs : We believe negotiations could drag on likely through May and possibly into June. A ‘hard’ deadline could be July 20, when Greece faces a payment of €3.6 bn to the ECB, for which, we think, the country will not have sufficient cash. Peripheral spread volatility is likely to increase as time goes by, as investors will associate a higher probability of default to a higher probability of Grexit, although this association will depend on what conditions have led to the credit event. …

The countdown continues.

The countdown continues.

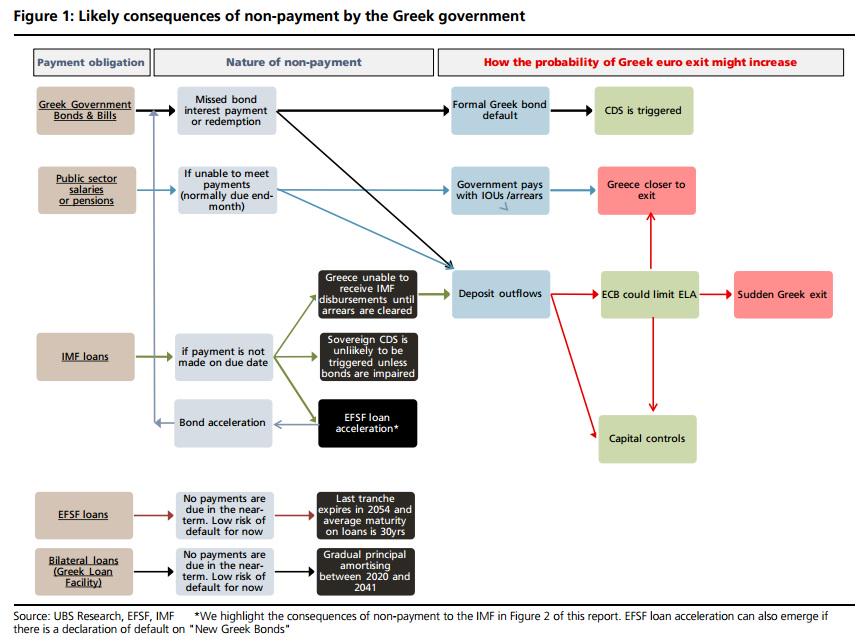

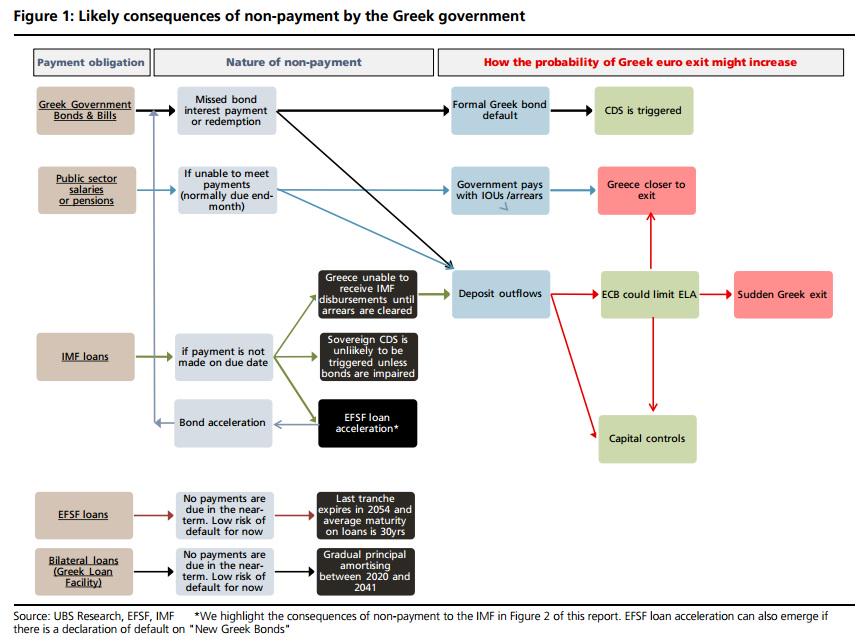

Here's a nice rundown of the Greek endgame, which is moving towards it's final stages as the ECB refused to consider a "plan B," even as a meeting of the block's 19 finance ministers fell apart over the weekend.

Greece doesn't just need money to service their Bonds and IMF loans, which are what the US press has been fixating on (because we are one of the parties that is owed that money). Greece also needs moneys to pay their own country's pension obligations and, of course Government salaries so perhaps you can understand the "FU" attitude the Government is beginning to have towards the ECB as the ministers insist on more and more cutbacks.

Greece has about two weeks to convince the EU to release another $7Bn to them under SOME kind of terms that will enable them to pay $3.7Bn in bonds $800M due to the IMF on the 12th otherwise that default will quickly cascade things out of control. Over the next month, that $7Bn will be used up on other debt obligations all ahead of a $4Bn payment they already owe to the ECB on July 20th. Per Goldman Sachs:

Greece has about two weeks to convince the EU to release another $7Bn to them under SOME kind of terms that will enable them to pay $3.7Bn in bonds $800M due to the IMF on the 12th otherwise that default will quickly cascade things out of control. Over the next month, that $7Bn will be used up on other debt obligations all ahead of a $4Bn payment they already owe to the ECB on July 20th. Per Goldman Sachs:

We believe negotiations could drag on likely through May and possibly into June. A ‘hard’ deadline could be July 20, when Greece faces a payment of €3.6 bn to the ECB, for which, we think, the country will not have sufficient cash. Peripheral spread volatility is likely to increase as time goes by, as investors will associate a higher probability of default to a higher probability of Grexit, although this association will depend on what conditions have led to the credit event.

…

Greece has about two weeks to convince the EU to release another $7Bn to them under SOME kind of terms that will enable them to pay $3.7Bn in bonds $800M due to the IMF on the 12th otherwise that default will quickly cascade things out of control. Over the next month, that $7Bn will be used up on other debt obligations all ahead of a $4Bn payment they already owe to the ECB on July 20th. Per Goldman Sachs:

Greece has about two weeks to convince the EU to release another $7Bn to them under SOME kind of terms that will enable them to pay $3.7Bn in bonds $800M due to the IMF on the 12th otherwise that default will quickly cascade things out of control. Over the next month, that $7Bn will be used up on other debt obligations all ahead of a $4Bn payment they already owe to the ECB on July 20th. Per Goldman Sachs: