The data isn’t contradicting my narrative about construction being started in Nov/Dec ahead of the tax credits expiring at year end, which explains the higher starts in Nov/Dec followed by the sharp in January. The expiring credits likely altered the timing of non residential construction as well.

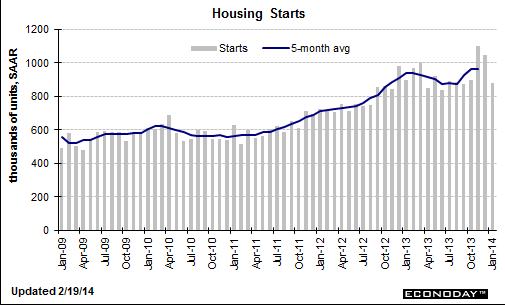

U.S. Housing Starts Fell 16% in January (WSJ) U.S. housing starts fell 16% last month to a seasonally adjusted annual rate of 880,000. That was down from an upwardly revised December rate of 1.05 million new homes built, marking the largest month-over-month decline since February 2011. Starts on single-family homes sank 15.9% in January to an annual pace of 573,000. Building permits, a sign of future construction, fell 5.4% to a seasonally adjusted annual rate of 937,000 last month from December’s upwardly revised rate of 991,000. The pace of housing starts last month actually rose in the chilly Northeast by 61.9%. But it fell 67.7% in the Midwest to the lowest pace on record. Starts also fell 12.5% in the South and 17.4% in the West, which has experienced relatively warm weather. Building permits were still up 2.4% in January from a year earlier, though housing starts last month were down 2% from a year ago.