Bad.

And prices down again.

As previously discussed, with mtg purchase apps down and cash buyers down it’s hard to see how sales can rise…

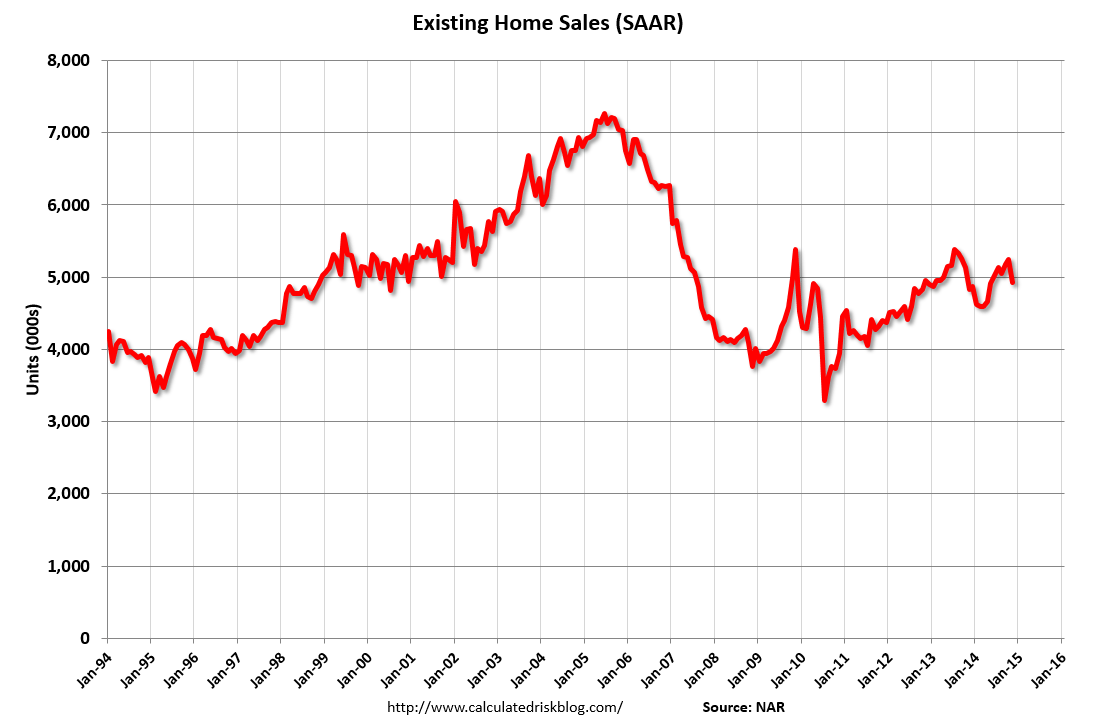

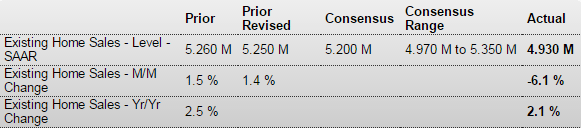

Existing Home Sales

Highlights

Existing home sales had been showing some life but not in November, sinking a very steep 6.1 percent to a 4.93 million annual rate which is below the low end of the Econoday consensus (4.97 million to 5.35 million). November, a month when the nation’s weather proved mostly mild and which should have given a boost to sales, ends 5 straight months of plus 5.0 million rates.

November’s weakness is broad based with all 4 regions showing single digit monthly declines. But the good news is that the weakness in sales is not inflating supply which, due to a draw down of homes on the market to 2.09 million from 2.24 million, held steady relative to sales, at 5.1 months.

Lower prices don’t seem to be giving a boost to sales. The median fell for a 5th straight month, down 1.1 percent in November to $205,300. Year-on-year the median price, where growth had been in the double digits through most of last year, is up 5.5 percent, holding in the mid-single digit area where it’s been since March.

By Bill McBride

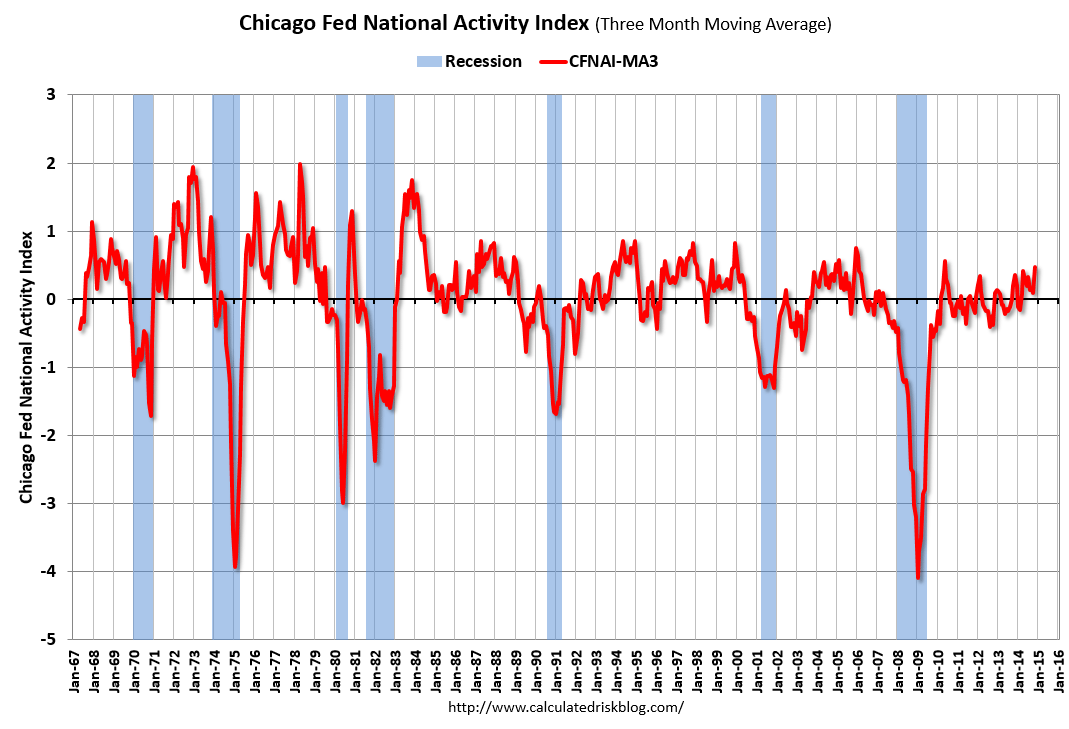

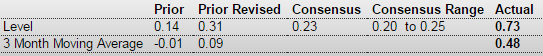

A bit of a blip up in manufacturing, the rest not good:

Chicago Fed National Activity Index

Highlights

The big 1.1 percent jump in the manufacturing component of the industrial production fed a very strong plus 0.73 percent reading for November’s national activity index vs a revised plus 0.31 in October. Other components in November, however, were flat with the positive contribution from employment edging lower while the positive contribution from sales/orders/inventories all but disappeared. The drag from consumption & housing remained moderate. The outsized manufacturing gain also boosted the 3-month average which rose to plus 0.48 in November from October’s revised plus 0.09 for its strongest reading since May 2010.