Wheeeee, what a ride!

Wheeeee, what a ride!

As you know, we called a floor at $44.50 even as we told you the market would falter on Friday morning and those /CL (Oil) Futures made almost $2,000 per contract on Friday's pop but that's nothing compared to the $3,000 per contract move oil busted on the shorts this morning.

That puts oil up 13.5% in less than 24 trading hours – how's that for a bottom call? As noted in our January Top Trade Review, we pressed our long USO and UCO bets just last week in our Live Member Chat Room and made them our ONLY bets in our $25,000 Portfolio, which will very much reap the rewards this morning. We also have big bets on oil in both our Short-Term and Long-Term Porfolios, some of which we discussed in last week's Live Webinar (replay available here).

We also called a nice bottom in Natural Gas, using the UNG ETF to go long and that one hasn't gotten away – yet. As I often have to remind people: I can only tell you what is going to happen and how to profit from it, the rest is up to you!

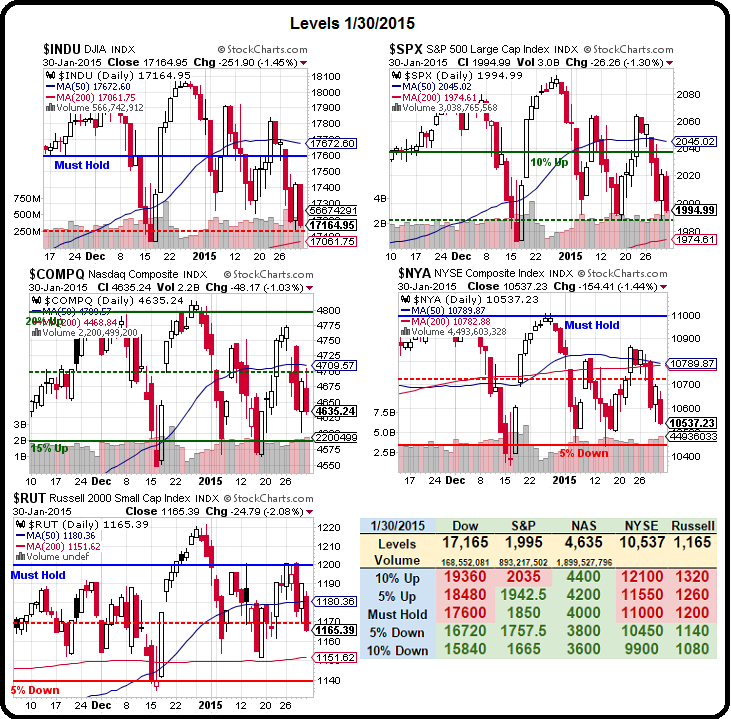

Meanwhile, turning our attention back to the indexes, things are NOT GOOD. Last Monday we talked about Greece being an issue again and Tuesday's post was titled "Testy Tuesday – MSFT, CAT and PG Paint a Poor Picture", where we told you we were shorting Russell Futures (/TF) at 1,190 (up $3,000 per contract this morning) and Dow Futures (/YM) at 17,600 (up $2,000 per contract this morning).

Meanwhile, turning our attention back to the indexes, things are NOT GOOD. Last Monday we talked about Greece being an issue again and Tuesday's post was titled "Testy Tuesday – MSFT, CAT and PG Paint a Poor Picture", where we told you we were shorting Russell Futures (/TF) at 1,190 (up $3,000 per contract this morning) and Dow Futures (/YM) at 17,600 (up $2,000 per contract this morning).

Wednesday we took a break from the Doom and gloom to celebrate AAPL earnings (our Stock of the Year) but Thursday's title said it all: "Faltering Thursday – Weak Bounce Lines Failing After Fed" while we hammered the point home on Friday (in case you missed it) with "Failing Friday – Rejected at our Strong Bounce Lines – Again!." Those lines, of course, are the same ones we've been using all year: …