ROFL! Greek Prime Minister Tsipras claims that the creditors have rejected his deal while they are claiming he has walked back on proposals that were put forward on Monday. That's the latest news as the meeting in Brussels fell apart into lunch (but will resume later). Apparently, the Commission stressed Athens still had to show willingness to carry out " prior actions, " spending cuts that had already been agreed to before they'd be getting close to a deal and Greece is now complaining (though I'd say realizing) that EU President Junker is an unfair arbiter in talks with Germany and the IMF . Greek stocks are plunging again, led lower by the banks as Greece is on day to day life support and this is all it takes to get us back in panic mode and S&P just released a warning that isn't helping to calm things down : In our baseline scenario, we continue to think that Greece will remain a eurozone member. But the limited progress in talks to date between Greece and its creditors suggests that a Greek exit is possible. We consider that Greece's exit--coupled with the loss of emergency European Central Bank (ECB) financing--would bankrupt Greece's financial system. This could in turn send negative ripples across Southeastern Europe's Greek-owned banks. Amazingly (and dangerously) this is diplomacy by Twitter as Tsiparis tweeted out a message this morning saying that the IMF's rejection of the Greek proposal indicated that they were insincere about wanting a deal or slaves to " special interests " in Greece (ie., the Top 1% that don't want to be burdened by Greece's proposed bailout measures ( see yesterday's post to understand why we shorted overnight in aniticipation of this happening ). This is only day one of the two day " emergency summit " that is supposed to fix Greece so it ain't over 'till it's over, as the great Yogi would say. Of course fat ladies are singing in opera houses all over Europe as this nonsense has been going on for 4 months (plus 6 years) so the chance of suddenly smooting everything out by lunch wasn't very likely anyway. …

ROFL!

ROFL!

Greek Prime Minister Tsipras claims that the creditors have rejected his deal while they are claiming he has walked back on proposals that were put forward on Monday. That's the latest news as the meeting in Brussels fell apart into lunch (but will resume later). Apparently, the Commission stressed Athens still had to show willingness to carry out "prior actions," spending cuts that had already been agreed to before they'd be getting close to a deal and Greece is now complaining (though I'd say realizing) that EU President Junker is an unfair arbiter in talks with Germany and the IMF.

Greek stocks are plunging again, led lower by the banks as Greece is on day to day life support and this is all it takes to get us back in panic mode and S&P just released a warning that isn't helping to calm things down:

Greek stocks are plunging again, led lower by the banks as Greece is on day to day life support and this is all it takes to get us back in panic mode and S&P just released a warning that isn't helping to calm things down:

In our baseline scenario, we continue to think that Greece will remain a eurozone member. But the limited progress in talks to date between Greece and its creditors suggests that a Greek exit is possible. We consider that Greece's exit--coupled with the loss of emergency European Central Bank (ECB) financing--would bankrupt Greece's financial system. This could in turn send negative ripples across Southeastern Europe's Greek-owned banks.

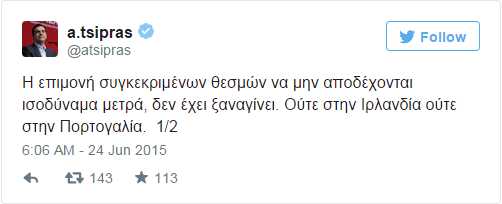

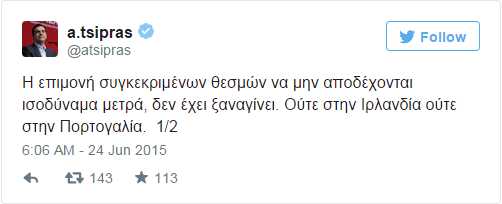

Amazingly (and dangerously) this is diplomacy by Twitter as Tsiparis tweeted out a message this morning saying that the IMF's rejection of the Greek proposal indicated that they were insincere about wanting a deal or slaves to "special interests" in Greece (ie., the Top 1% that don't want to be burdened by Greece's proposed bailout measures (see yesterday's post to understand why we shorted overnight in aniticipation of this happening).

Amazingly (and dangerously) this is diplomacy by Twitter as Tsiparis tweeted out a message this morning saying that the IMF's rejection of the Greek proposal indicated that they were insincere about wanting a deal or slaves to "special interests" in Greece (ie., the Top 1% that don't want to be burdened by Greece's proposed bailout measures (see yesterday's post to understand why we shorted overnight in aniticipation of this happening).

This is only day one of the two day "emergency summit" that is supposed to fix Greece so it ain't over 'till it's over, as the great Yogi would say. Of course fat ladies are singing in opera houses all over Europe as this nonsense has been going on for 4 months (plus 6 years) so the chance of suddenly smooting everything out by lunch wasn't very likely anyway.

…

ROFL!

ROFL!  Greek stocks are plunging again, led lower by the banks as Greece is on day to day life support and this is all it takes to get us back in panic mode and S&P just released a warning that isn't helping to calm things down:

Greek stocks are plunging again, led lower by the banks as Greece is on day to day life support and this is all it takes to get us back in panic mode and S&P just released a warning that isn't helping to calm things down:  Amazingly (and dangerously) this is diplomacy by Twitter as Tsiparis tweeted out a message this morning saying that the IMF's rejection of the Greek proposal indicated that they were insincere about wanting a deal or slaves to "special interests" in Greece (ie., the Top 1% that don't want to be burdened by Greece's proposed bailout measures (see yesterday's post to understand why we shorted overnight in aniticipation of this happening).

Amazingly (and dangerously) this is diplomacy by Twitter as Tsiparis tweeted out a message this morning saying that the IMF's rejection of the Greek proposal indicated that they were insincere about wanting a deal or slaves to "special interests" in Greece (ie., the Top 1% that don't want to be burdened by Greece's proposed bailout measures (see yesterday's post to understand why we shorted overnight in aniticipation of this happening).