Just one thing . Stick to that and everything else don't mean s**t, as old Curly would say. What that one thing is, we have to figure out! This week, our one thing is not Greece but the Nasdaq, which needs to hold that 5,050 line if we are to believe that other things, like Greece, can be ignored as our own markets move on to new highs. We're still watching 2,120 on the S&P, of course and 1,300 on the Russell would be nice to make but it's the Nasdaq, where all the hot stocks are, that should be leading us higher in a real rally that's not going to get dragged down by the Fed, or Greece, or China, or Russia, or our Negative GDP or anything that investors used to worry about in the times before things were different – like they are supposed to be now. You know I DETEST low-volume rallies and here we are in another one and I've certainly given up hope that the S&P will lead us into the promised land. That means the torch has been passed to tech (and we have SQQQ as a hedge in our Short-Term Portfolio) and that means we should take a look at the only tech company that matters, Netflix (NFLX). No, I'm just messing with you! We shorted the crap out of them yesterday on that ridiculous pop over $700 and we already made a ton of money on the Icahan-inspired pullback. Obviously I'm talking about Apple (AAPL), which is almost 20% of the Nasdaq in weighting and, if you add in all the Apple suppliers, probably about 25% of the Nasdaq's moves depend on what AAPL does on any particular day. Overall, the Nasdaq won't make new highs if AAPL doesn't make new highs. Does AAPL deserve to be at new highs? Well, as a disclosure, it was our Stock of the Year selection for 2015 and 2014 and 2013 before that so it's safe to say we like AAPL and we are not debating the merits of the company but we did cash out of the trade as AAPL tested $130 with the bull call spread at …

Just one thing.

Just one thing.

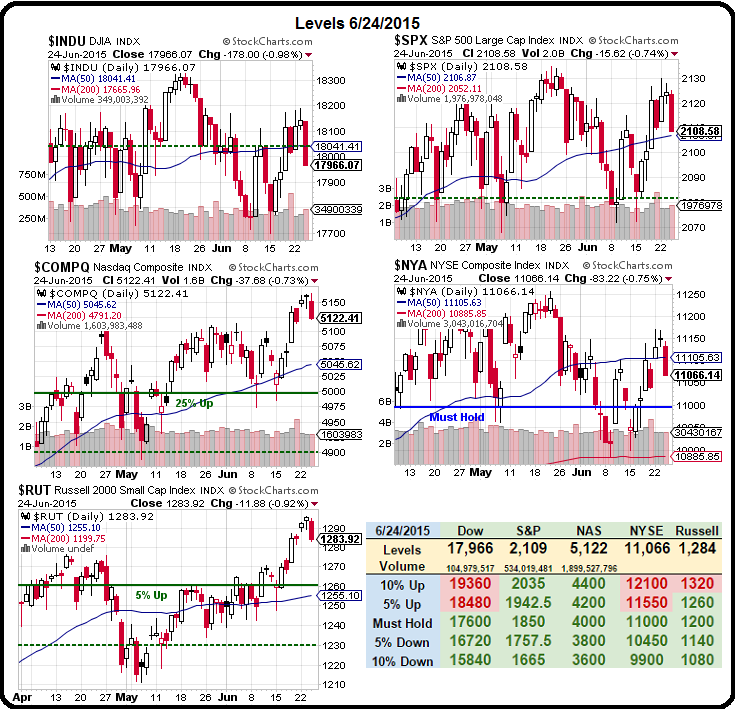

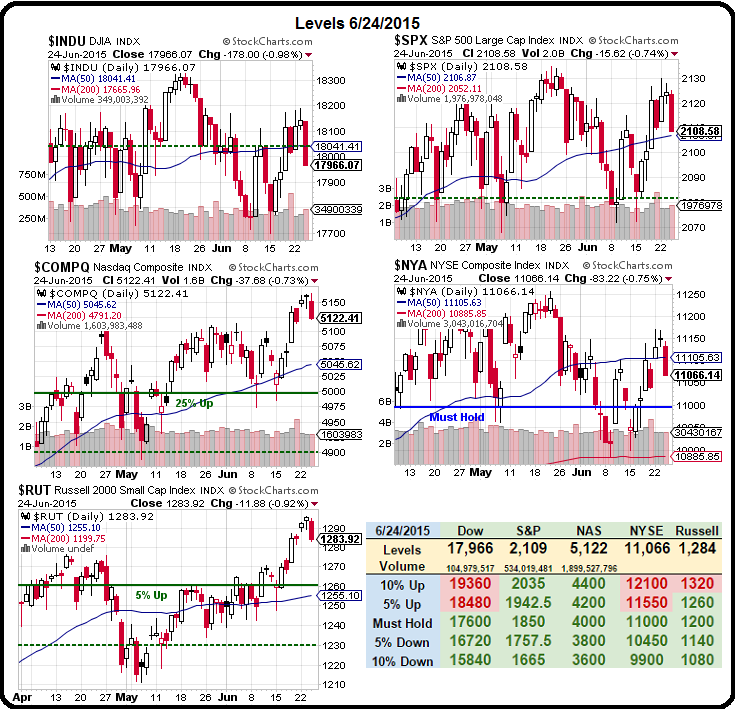

Stick to that and everything else don't mean s**t, as old Curly would say. What that one thing is, we have to figure out! This week, our one thing is not Greece but the Nasdaq, which needs to hold that 5,050 line if we are to believe that other things, like Greece, can be ignored as our own markets move on to new highs.

We're still watching 2,120 on the S&P, of course and 1,300 on the Russell would be nice to make but it's the Nasdaq, where all the hot stocks are, that should be leading us higher in a real rally that's not going to get dragged down by the Fed, or Greece, or China, or Russia, or our Negative GDP or anything that investors used to worry about in the times before things were different – like they are supposed to be now.

You know I DETEST low-volume rallies and here we are in another one and I've certainly given up hope that the S&P will lead us into the promised land. That means the torch has been passed to tech (and we have SQQQ as a hedge in our Short-Term Portfolio) and that means we should take a look at the only tech company that matters, Netflix (NFLX).

You know I DETEST low-volume rallies and here we are in another one and I've certainly given up hope that the S&P will lead us into the promised land. That means the torch has been passed to tech (and we have SQQQ as a hedge in our Short-Term Portfolio) and that means we should take a look at the only tech company that matters, Netflix (NFLX).

No, I'm just messing with you! We shorted the crap out of them yesterday on that ridiculous pop over $700 and we already made a ton of money on the Icahan-inspired pullback. Obviously I'm talking about Apple (AAPL), which is almost 20% of the Nasdaq in weighting and, if you add in all the Apple suppliers, probably about 25% of the Nasdaq's moves depend on what AAPL does on any particular day. Overall, the Nasdaq won't make new highs if AAPL doesn't make new highs.

Does AAPL deserve to be at new highs? Well, as a disclosure, it was our Stock of the Year selection for 2015 and 2014 and 2013 before that so it's safe to say we like AAPL and we are not debating the merits of the company but we did cash out of the trade as AAPL tested $130 with the bull call spread at…

Does AAPL deserve to be at new highs? Well, as a disclosure, it was our Stock of the Year selection for 2015 and 2014 and 2013 before that so it's safe to say we like AAPL and we are not debating the merits of the company but we did cash out of the trade as AAPL tested $130 with the bull call spread at…

You know I DETEST low-volume rallies and here we are in another one and I've certainly given up hope that the S&P will lead us into the promised land. That means the torch has been passed to tech (and we have SQQQ as a hedge in our Short-Term Portfolio) and that means we should take a look at the only tech company that matters, Netflix (NFLX).

You know I DETEST low-volume rallies and here we are in another one and I've certainly given up hope that the S&P will lead us into the promised land. That means the torch has been passed to tech (and we have SQQQ as a hedge in our Short-Term Portfolio) and that means we should take a look at the only tech company that matters, Netflix (NFLX).  Does AAPL deserve to be at new highs? Well, as a disclosure, it was our Stock of the Year selection for 2015 and 2014 and 2013 before that so it's safe to say we like AAPL and we are not debating the merits of the company but we did cash out of the trade as AAPL tested $130 with the bull call spread at…

Does AAPL deserve to be at new highs? Well, as a disclosure, it was our Stock of the Year selection for 2015 and 2014 and 2013 before that so it's safe to say we like AAPL and we are not debating the merits of the company but we did cash out of the trade as AAPL tested $130 with the bull call spread at…