The Shanghai Composite fell 6.12% today (again).

The Shanghai Composite fell 6.12% today (again).

If this is the first place you're hearing about it, that's very sad and very scary because it should be the screaming headlines as China is our largest trading parner and the second-largest economy on Earth and those of us who invest in the Global Marketplace (and yes, that includes America!) should care very much what happens in China.

Since the last time China fell 6% in a day (which is a neat trick since they halt stocks that fall 10% so most of the stocks were halted to get that average), which was only 3 weeks ago, China has taken extraordinary measures to prop up the market yet they are already failing and once again we are rapidly approaching another test of the 200-day moving average, below which there is no real support for another 20% drop and even that will be tenuous at best as the Shanghai is still 100% higher than it was last summer – for no particularly good reason.

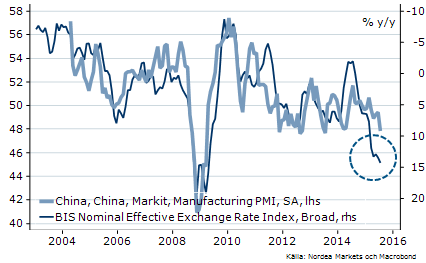

In fact, looking at China's PMI Report, it's amazing that the markets are holding up so well as we spiral back to low levels of production not seen since 2008/9. It's not just China, of course. Globally, the average PMI reading in July was 51, just one point into expansion

In fact, looking at China's PMI Report, it's amazing that the markets are holding up so well as we spiral back to low levels of production not seen since 2008/9. It's not just China, of course. Globally, the average PMI reading in July was 51, just one point into expansion

IN PROGRESS