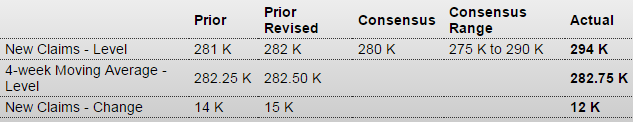

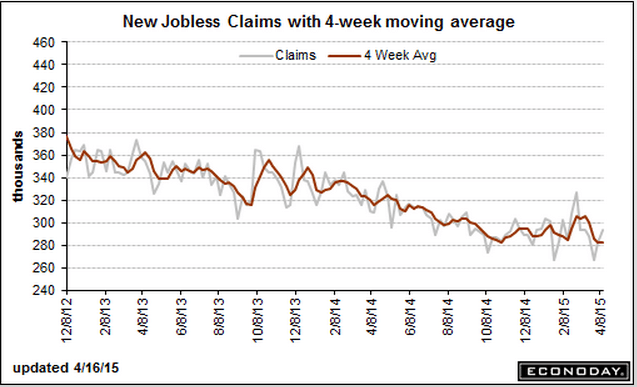

Moving up some but still relatively low, but as previously discussed,

this is about people losing jobs, not new hires:

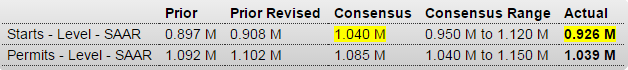

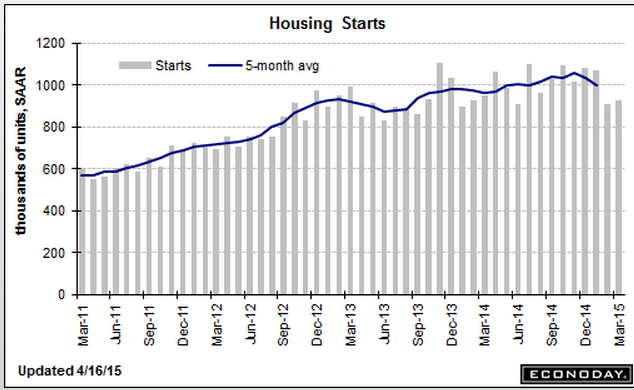

And yet another lower than expected release:

Just anecdotal evidence of what happens as the euro is pushed down by CB portfolio selling to ‘equate supply and demand’ etc.

Italy : Merchandise Trade![]()

Highlights

The seasonally adjusted merchandise trade balance was in a sizeable E4.6 billion surplus in February, up from an unrevised E3.9 billion excess in January.

The headline gain was attributable to a tidy bounce in exports which, up 2.5 percent on the month, essentially reversed their January decline. Capital goods saw a 7.6 percent rise while consumer goods were up 0.2 percent and energy 2.7 percent. Intermediates fell 0.5 percent. Overall exports were 3.7 percent higher than in February 2014, a marked acceleration versus their minus 4.2 percent January rate.

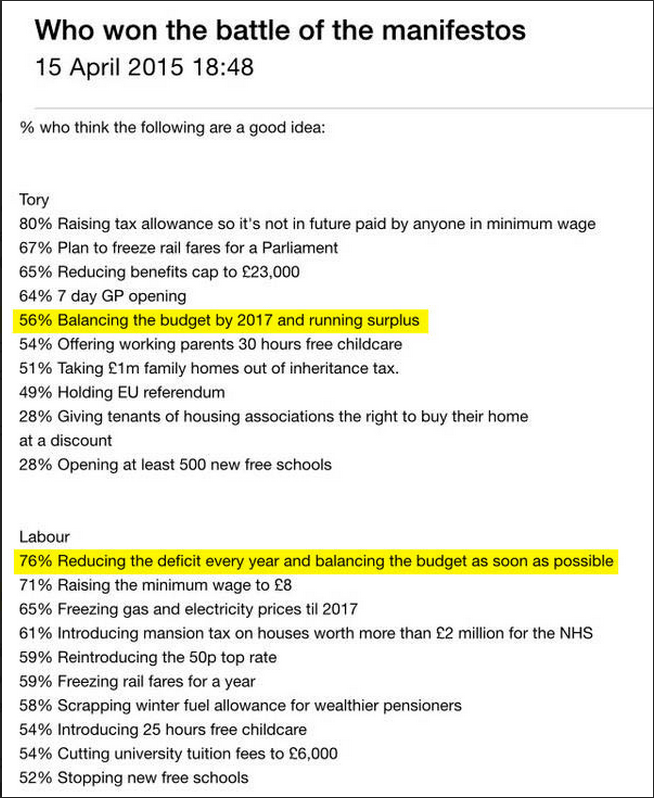

Low odds of the UK going for fiscal expansion:

Not to forget every Fed member recognizes their role in ‘managing expectations’ as they all believe that the economic performance has a large psychological component. That is, if people were led to believe things were getting worse that would cause a downturn.

By Jefferey Sparshott

April 15 (WSJ) — The U.S. economy continued to expand across most of the country in February and March, though a strong dollar, falling oil prices and harsh winter weather slowed activity in some sectors, according to the Federal Reserve’s latest survey of regional economic conditions. The Fed found modest or moderate growth in eight of its 12 districts. Elsewhere, the pace of economic activity was described as steady, slight or continuing to expand. Minutes of the March meeting showed “several” officials thought June would be the right time, though others said it would be better to wait.

Possible narrative?:

China told Draghi that if the ECB not to go to negative rates and QE or they would retaliate by selling their euro reserves. So Draghi did exactly that to induce a ‘devaluation’ to support EU net exports. The ploy worked, for as long as it lasts. When the CB reserve liquidation fades, the euro will appreciate until the current account surplus turns to a deficit, reversing prior gains in output and employment, and dashing any hoped of growth and employment:

By Brian Blackstone and Todd Buell

April 15 (WSJ) — ECB President Mario Draghi said there is “clear evidence the monetary policy measures we put in place have been effective.” Mr. Draghi said, “The euro area economy has gained further momentum since the end of 2014. We expect the economic recovery to broaden and strengthen substantially.”

The post Housing starts, Italy Merchandise Trade, UK opinion chart, ECB euro policy musings appeared first on The Center of the Universe.