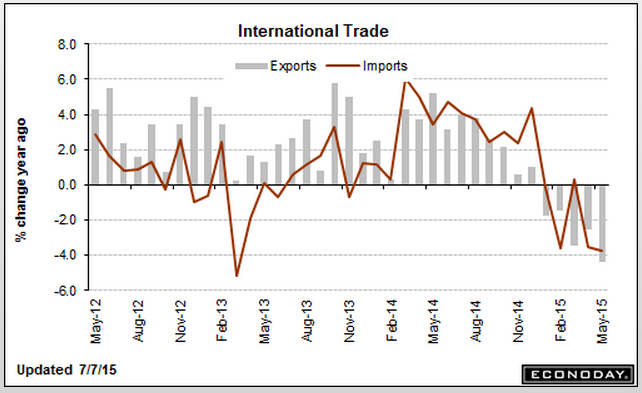

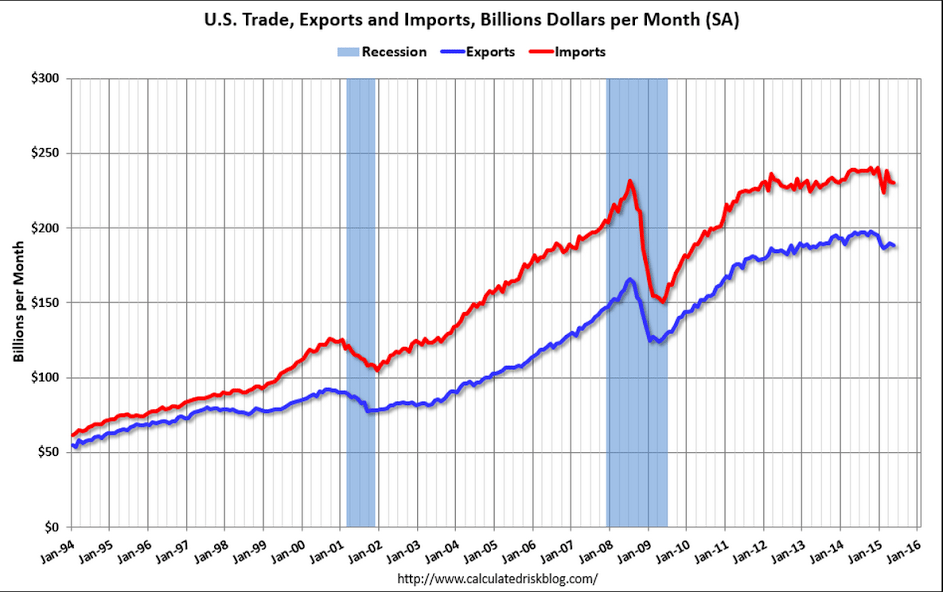

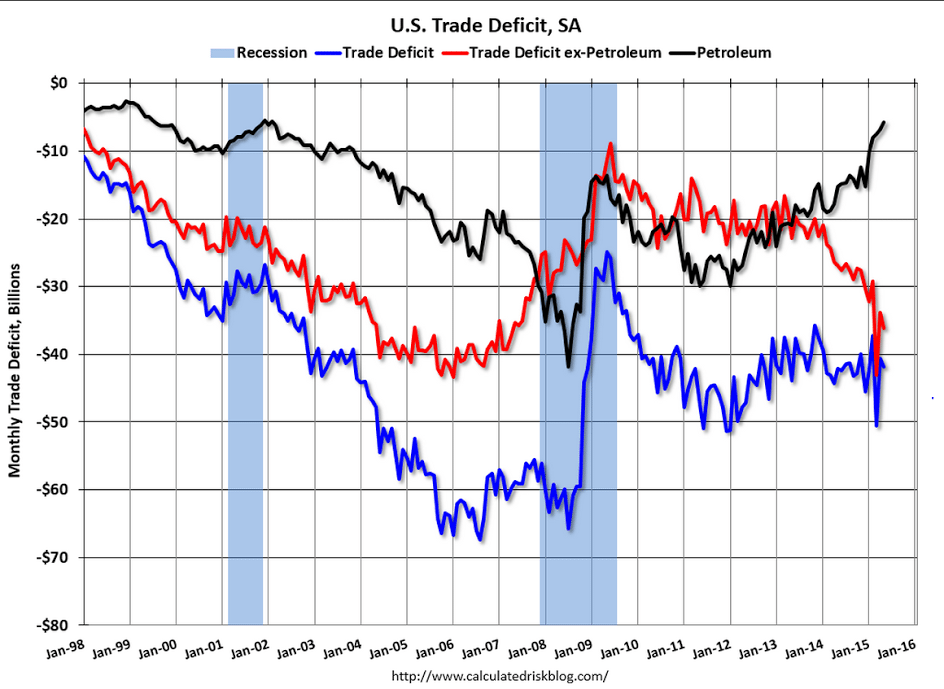

Trade deficit a bit higher but looks to me like more to come, including revisions. The petroleum gap is set to widen as US production begins to decline and is replaced by imports. And to my prior point, auto imports were up. And further note that global reductions in trade are associated with recessions:

International Trade![]()

Highlights

The nation’s trade gap came in near expectations in May at $41.9 billion, wider than April’s revised gap of $40.7 billion. The goods gap rose by a net $1.2 billion to $61.5 billion, offset in part by a fractionally wider services surplus of $19.6 billion. The petroleum gap narrowed $1.0 billion to $5.8 billion which, reflecting rising domestic oil output together with rising exports of refined products, is the lowest since February 2002.

Exports, which have been pressured by strength in the dollar, fell $1.5 billion to $188.6 billion in May reflecting a $2.4 billion downswing for capital goods and, within this reading, a $1.2 billion downswing in aircraft exports. Exports of nonmonetary gold fell $0.5 billion in the month.

Imports were also down, $0.3 billion lower to $230.5 billion including a $0.8 billion decline in capital goods. Imports of industrial supplies fell $0.6 billion within which imports of crude oil fell $0.4 billion. The decline in crude imports comes despite a more than $4 rise in prices to $50.76 per barrel. Imports of autos rose $0.9 billion in the month.

By country, the gap with China rose $4.0 billion to $30.5 billion with the EU gap down $0.8 billion to $12.5 billion. The gap with Japan narrowed $1.8 billion to $5.2 billion while the gap with Mexico widened slightly to $4.6 billion in the month. And for the first time since 1990, the nation posted a monthly surplus with Canada, at $0.6 billion.

The decline in goods exports is a major concern for the manufacturing sector which is struggling right now with weak foreign demand. The May gap is in line with trend and is not likely to affect GDP estimates.

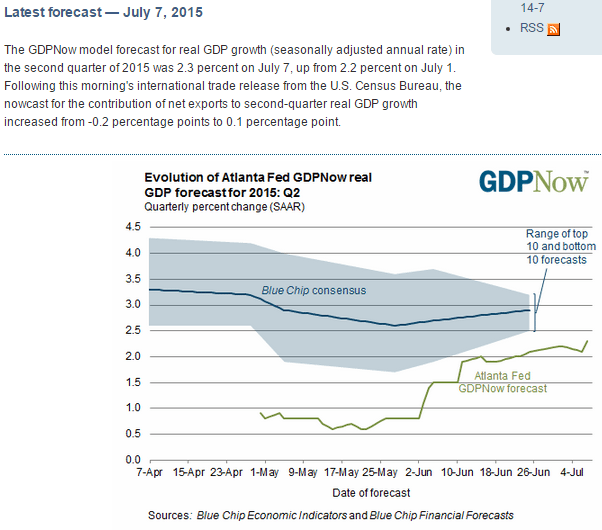

An uptick to 2.3% based on today’s trade report for May. The first Q2 GDP estimate will be out later this month, and will include an estimate for June trade which won’t come out until the first revision for Q2 GDP comes out:

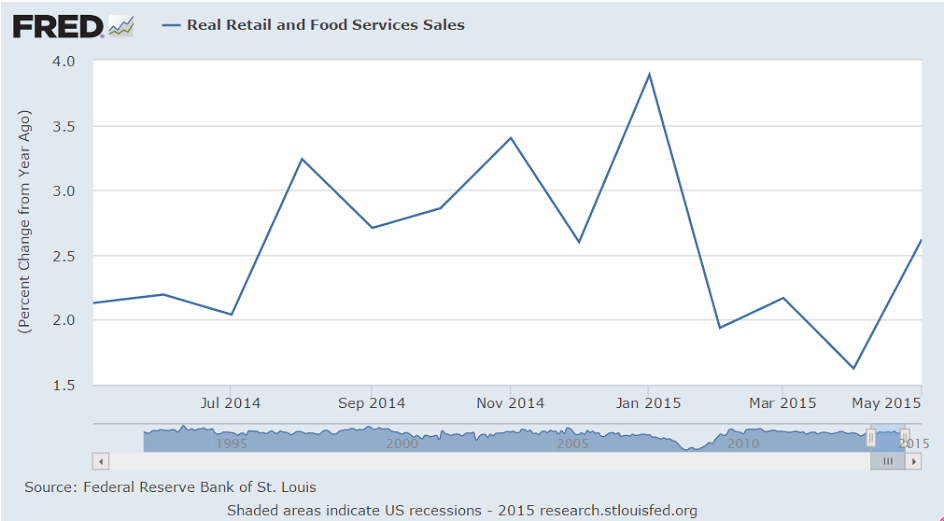

This minor indicator remains depressed, as do other retail sales indicators:

Redbook![]()

Highlights

Hot weather triggered demand for seasonal goods in the July 4 week, helping to boost Redbook’s same-store year-on-year sales index by 3 tenths to plus 2.0 percent. But the reading is still soft and does not point to strength for the government’s core retail sales reading (ex-auto ex-gas). May was a very strong month for retail sales which, however, appear to have edged lower since.

The post Trade, Atlanta Fed, Redbook sales appeared first on The Center of the Universe.