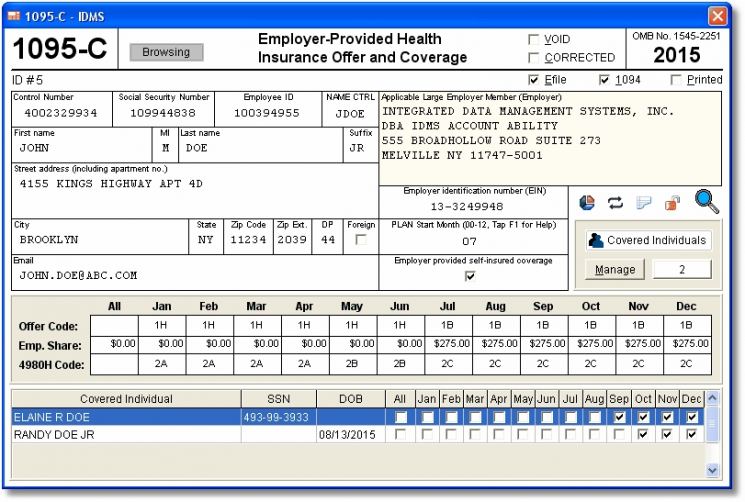

MELVILLE, N.Y. - Nov. 3, 2015 - PRLog -- Integrated Data Management Systems (IDMS) has added Internal Revenue Code (IRC) Section 6055, 6056 compliance to its 1099 and W-2 Compliance Made Easy software, Account Ability. This optional add-on increases the processing power of Account Ability by merging Affordable Care Act (ACA) Forms 1094-B, 1095-B, 1094-C and 1095-C with its existing library of information returns (1098, 1099, 3921, 3922, 5498, W-2G) and annual wage reports (W-2, W-2C).

Who files Form 1095-B? Every entity that provides minimum essential coverage to an individual during a calendar year must file an information return reporting the coverage. Filers will use transmittal Form 1094-B to submit Forms 1095-B. However, employers (including government employers) subject to the employer shared responsibility provisions sponsoring self-insured group health plans generally will report information about the coverage in Part III of Form 1095-C instead of on Form 1095-B. These filers may use Form 1095-B instead of Form 1095-C to report coverage of individuals who aren't full-time employees for any month during the year. In general, employers with 50 or more full-time employees (including full-time equivalent employees) during the prior calendar year are subject to the employer shared responsibility provisions. Small employers that aren't subject to the employer shared responsibility provisions sponsoring self-insured group health plans will use Forms 1094-B and 1095-B to report information about covered individuals.

Who files Form 1095-C? Applicable Large Employers, generally employers with 50 or more full-time employees (including full-time equivalent employees) in the previous year, must file one or more Forms 1094-C (including a Form 1094-C designated as the Authoritative Transmittal), and must file a Form 1095-C for each employee who was a full-time employee of the employer for any month of the calendar year. Generally, the employer is required to furnish a copy of the Form 1095-C to the employee.

Electronic Reporting Requirement. Although filers with 250 or more returns to report are required to file electronically, this requirement applies separately to each type of form. For example, if you must file 1500 Forms 1095-B and 200 Forms 1095-C, you must file Forms 1095-B electronically, but you are not required to file Forms 1095-C electronically. Account Ability's ACA add-on facilitates the entire process.

Account Ability is a robust network ready software package which, together with its entire database, resides on your computer or local area network, not that of some online or cloud based service. Therefore, users can enter as many returns as desired without ever incurring extra charges, as is common with most online processing systems. The base package includes electronic reporting, plain paper filing and taxpayer identification number matching for the entire family of information returns (1098, 1099, 3921, 3922, 5498, W-2G). Account Ability complies with IRS Publication 1220, SSA EFW2/EFW2C reporting specifications and IRC sections 6039, 6050W. The ACA add-on for 2015 extends this processing power by adding IRC 6055 and 6056 compliance to this extensive library.

Contact

Jeff Goldstein

Sales and Support

***@idmsinc.com

Photos: (Click photo to enlarge)

Read Full Story - Account Ability's ACA 1095-B, 1095-C Compliance Software Has Been Released | More news from this source

Press release distribution by PRLog