Just a quick look at our 5 virtual portfolios as they stand as of Jan 23rd (mid-day) : Short-Term Portfolio: Our Short-term Portfolio spent no cash with put sales and credit spreads and currently has about a $2,035 net credit, of which $1,420 is profit (69.7% on cash). This portfolio is balanced bearish as we anticipated a market sell-off and now we're in the middle of one! Long-Term Portfolio: Our Long-Term Portfolio is, of course, much more conservative and we collected $13,710 more than we spent and, so far, our gain on cash is $3,845, a 28% return on those positions. We have only deployed about 20% of our margin BECAUSE we anticipated a sell-off and we PATIENTLY waited for a correction so we could do some bargain-hunting. Now we will wait for the music to stop before we jump in for some bottom-fishing but, for the first time since October, we're actually excited about getting some buying opportunities! Those are our two " Webcast Portfolios ." Every Tuesday at 1pm we do a broadcast with the Darwin Investing Network in their Fundamental Profit Room and, of course, we have dozens of other trade ideas each week we discuss in our Daily Member Chat at www.philstockworld.com , where we teach you to BE THE HOUSE – Not the Gambler ! At PSW, we keep these 3 additional portfolios but, not having the pressure of HAVING to make weekly picks for the Webcast, we have generally elected to stay in Cash as we waited for the inevitable correction now in progress. NOW comes the fun part as we get to deploy some of that sideline cash but PATIENCE is still the first major lesson of 2014! $25,000 Portfolio: Just the one trade (we closed one unsuccessful put play on NFLX) so far. Still a very nice $320 gain on a net $1,575 spread is 20% in 2 weeks – we can live with those sort of returns! Butterfly Portfolio: This is…

Just a quick look at our 5 virtual portfolios as they stand as of Jan 23rd (mid-day):

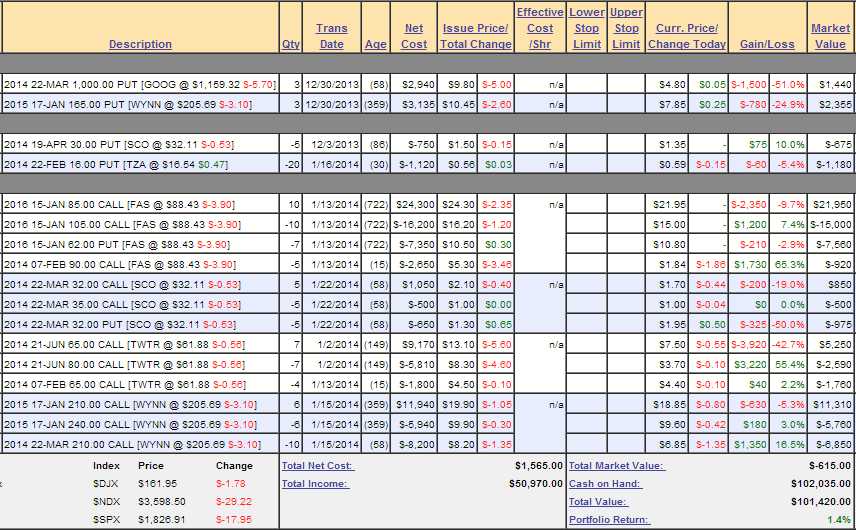

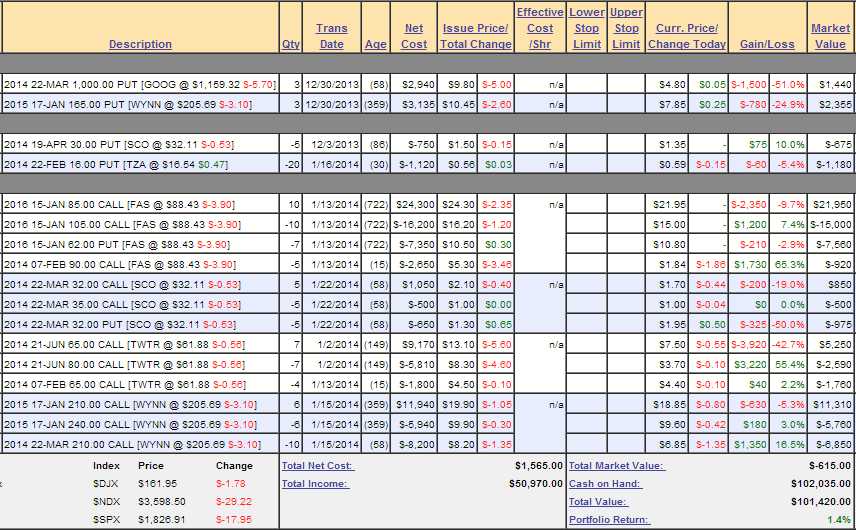

Short-Term Portfolio:

Our Short-term Portfolio spent no cash with put sales and credit spreads and currently has about a $2,035 net credit, of which $1,420 is profit (69.7% on cash). This portfolio is balanced bearish as we anticipated a market sell-off and now we're in the middle of one!

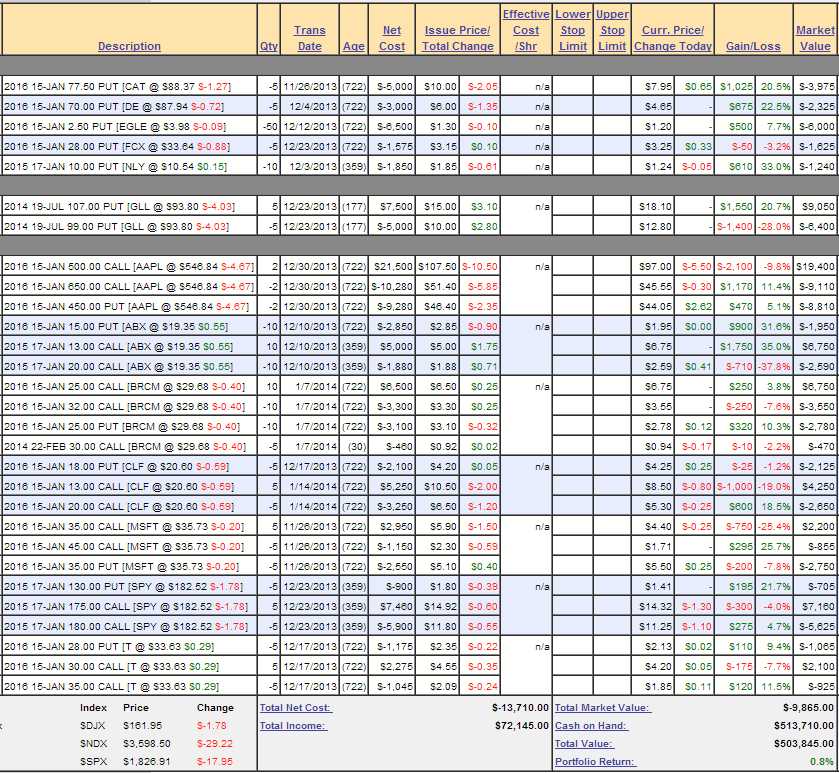

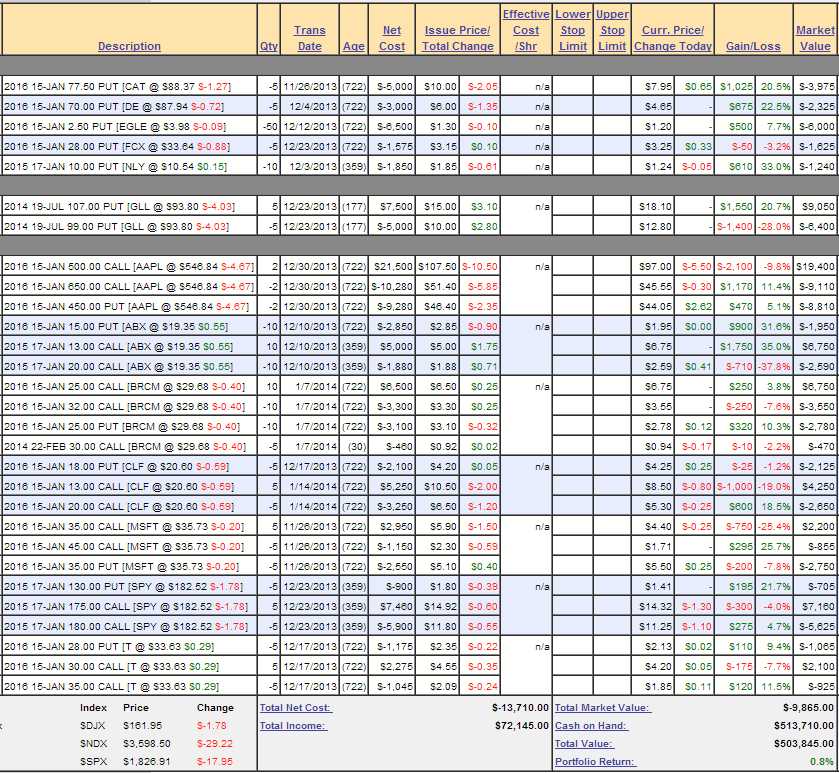

Long-Term Portfolio:

Our Long-Term Portfolio is, of course, much more conservative and we collected $13,710 more than we spent and, so far, our gain on cash is $3,845, a 28% return on those positions. We have only deployed about 20% of our margin BECAUSE we anticipated a sell-off and we PATIENTLY waited for a correction so we could do some bargain-hunting.

Now we will wait for the music to stop before we jump in for some bottom-fishing but, for the first time since October, we're actually excited about getting some buying opportunities!

Those are our two "Webcast Portfolios." Every Tuesday at 1pm we do a broadcast with the Darwin Investing Network in their Fundamental Profit Room and, of course, we have dozens of other trade ideas each week we discuss in our Daily Member Chat at www.philstockworld.com, where we teach you to BE THE HOUSE – Not the Gambler!

At PSW, we keep these 3 additional portfolios but, not having the pressure of HAVING to make weekly picks for the Webcast, we have generally elected to stay in Cash as we waited for the inevitable correction now in progress.

NOW comes the fun part as we get to deploy some of that sideline cash but PATIENCE is still the first major lesson of 2014!

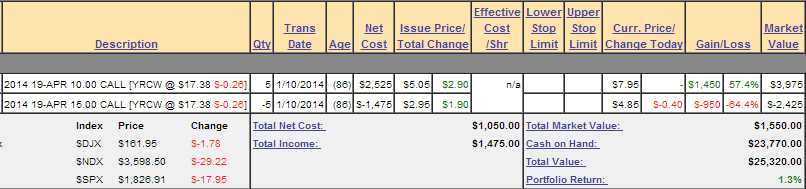

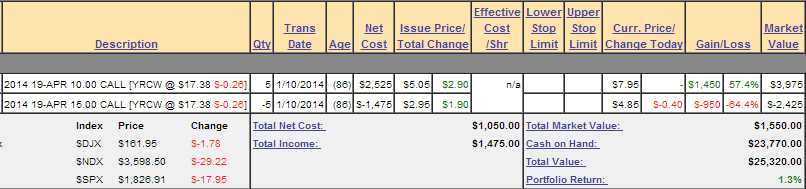

$25,000 Portfolio:

Just the one trade (we closed one unsuccessful put play on NFLX) so far. Still a very nice $320 gain on a net $1,575 spread is 20% in 2 weeks – we can live with those sort of returns!

Butterfly Portfolio:

This is…