Wheeeeeee – a new record!

Wheeeeeee – a new record!

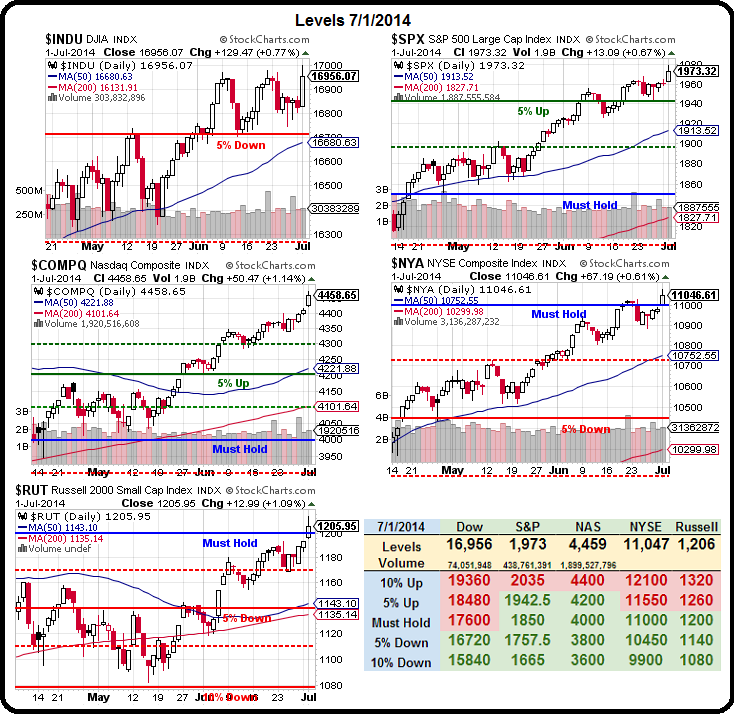

Actually, we shouldn't get too excited as it's a new record every day but it's still fun to celebrate while the all-time highs are lasting. The Dow fell just 2 points shy of 17,000 but ended up 44 points short – that's one we'll watch closely today, along with NYSE 11,000 – a level I have long stated will force us to turn more bullish if it holds.

Unfortunately, with the low-volume holiday trading, we won't be able to confirm these moves until next week but that doesn't bother TA people, who ignore everything but the squiggly lines on the charts and they say RALLY!!! I imagaine this weekend we'll see "Dow 20,000" on a magazine or two but that's still a far cry short of the 36,000 we were promised on the cover of the Atlantic back in January of 2000.

The Dow topped out that month at just under 12,000 so 17,000 is, in fact, good progress but still over 50% short of the level we were supposed to hit 10 years ago and let's not forget that we visited 6,600 first! So, maybe not the right time-frame and maybe not a smoothe ride – but we're heading in the right direction – now.

Not wanted to fight the mega-trends, we went wtih the flow and added Dow laggard IBM on Monday at noon in our Live Member Chat Room with the following trade idea:

IBM is on our Buy List but not in our Portfolio yet as I was hoping they'd have a weak Q2 and go down a bit but I'm nervous my theory on Watson will gain traction and send IBM back up so let's add 5 short 2016 $160 puts at $9.40 to the LTP and, if IBM goes lower, we'll be happy to sell 10 more and add a bull call spread.

As I noted in yesterday's Live Webinar and as you can see on the chart, our timing was perfect and IBM led the Dow higher in yesterday's rally and the short options we…