Iraq, Ukraine, Ebola…

Iraq, Ukraine, Ebola…

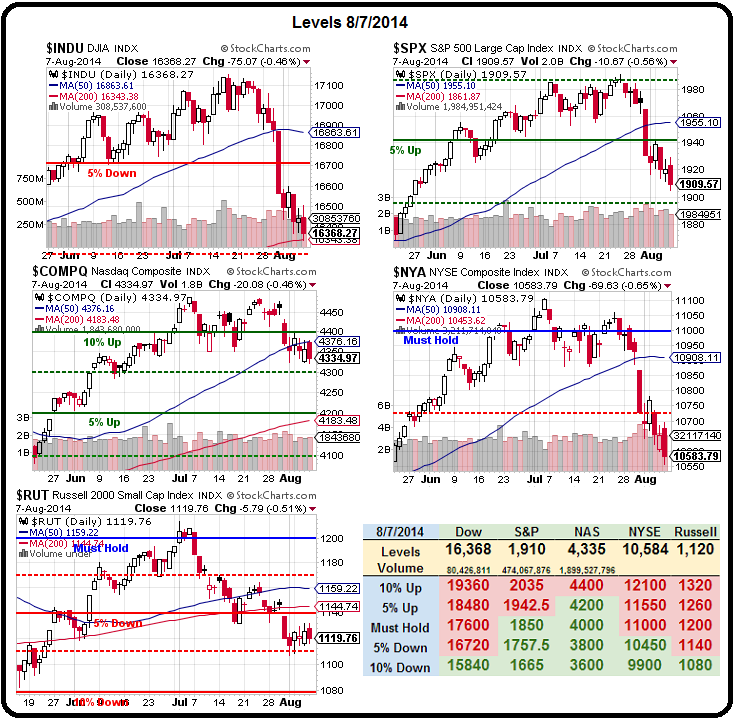

PLENTY of things to worry about and we've ONLY corrected 10 points (7.5%) on the Russell – exactly what we prediced under our fabulous 5% Rule™! None of the other major indexes have fallen as far, so we continue to watch that line very closely for support.

This morning we played the S&P (/ES Futures) bullish in our Live Member Chat Room (you can join us here) off the 1,900 line and were rewarded with a quick 10-point gain already (7:45) as our assessment of the Global situation (that it's not all that bad) seems to be playing out with Russia making a few conciliatory noises over in Ukraine though, of course, any good game of brinksmanship involves a bit of give and take – so it ain't over until it's over.

As you can see from our Big Chart, we're still down 3 of 5 Must Hold lines and, when the Must Hold lines don't hold – we stay bearish! Not too bearish, mind you, we've pretty much shifted to neutral in our Member Portfolios and our Long-Term Portfolio closed the day at $587,490 (up 17.5% for the year) while our Short-Term Porfolio finished at $132,314 (up 32.3% for the year) for a combined $720K up $1,000 for the week and down $4K on the day as we added more BULLISH positions (bottom fishing) into the weekend.

We'll quickly abandon our hopes for a bounce if the Dow fails to hold it's 200 dma at 16,343 and we're keeping an eye on the Transports, where IYT is testing it's 100 dma at 142, which Scott Murray's chart shows us has held firm for two years now. Having well-balanced portfolios let's us quickly pivot to take advantage of changing conditions and this is an inflection point, so we have bullish and bearish trades ready to trigger – depending on how these lines play out.

We'll quickly abandon our hopes for a bounce if the Dow fails to hold it's 200 dma at 16,343 and we're keeping an eye on the Transports, where IYT is testing it's 100 dma at 142, which Scott Murray's chart shows us has held firm for two years now. Having well-balanced portfolios let's us quickly pivot to take advantage of changing conditions and this is an inflection point, so we have bullish and bearish trades ready to trigger – depending on how these lines play out.

IN PROGRESS