At least we can count on one thing . The markets are fixed, rigged, gamed, manipulated AND propped up by the Banksters and their pet Government - what can possibly go wrong? Nothing if you know how to play the game (and, sorry bottom 90%, but this game can only be played by people with margin accounts to keep out the riff-raff) . That's why, last Thursday in our Live Member Chat Room, I was able to say : S&P better have support at 1,905 on /ES, which is 1,910 on the index, which is $110 on SSO and you can buy SSO Aug (next week) $109/111.50 bull call spreads for $1.45 with 72% upside potential on a very small recovery next week. A good upside play if you are too bearish or want to lock in bearish gains. For those of you not lucky enough to be a PSW Member ( and you can join here before the rate increase ), I even mentioned the trade in the next morning's post and SSO was still under $110 that morning. Today is August expiration day and that contract should pay the full $2.50 for a nice 72% gain in 8 days – nice work if you can get it. More importantly, we reviewed our Member Portfolios yesterday and our Short-Term Portfolio is still at $129,916 while our Long-Term Portfolio is at $598,115 for a total of $728,031, which is up $8,000 (1.1%) since last Friday and up a combined 21% for the year off our virtual $600,000 base for our main Member Portfolios. As I mentioned last week (and the week before and the week before) – it's all about BALANCE. Balance and following our strategy of BEING THE HOUSE – Not the Gambler . Selling premium and staying balanced allows us to grind out a steady profit in most market conditions. We don't HAVE to guess which way the markets are going – plays like SSO are just a bonus, nice though they may be. So sure, the stock market is …

At least we can count on one thing.

At least we can count on one thing.

The markets are fixed, rigged, gamed, manipulated AND propped up by the Banksters and their pet Government - what can possibly go wrong? Nothing if you know how to play the game (and, sorry bottom 90%, but this game can only be played by people with margin accounts to keep out the riff-raff). That's why, last Thursday in our Live Member Chat Room, I was able to say:

S&P better have support at 1,905 on /ES, which is 1,910 on the index, which is $110 on SSO and you can buy SSO Aug (next week) $109/111.50 bull call spreads for $1.45 with 72% upside potential on a very small recovery next week. A good upside play if you are too bearish or want to lock in bearish gains.

For those of you not lucky enough to be a PSW Member (and you can join here before the rate increase), I even mentioned the trade in the next morning's post and SSO was still under $110 that morning. Today is August expiration day and that contract should pay the full $2.50 for a nice 72% gain in 8 days – nice work if you can get it.

More importantly, we reviewed our Member Portfolios yesterday and our Short-Term Portfolio is still at $129,916 while our Long-Term Portfolio is at $598,115 for a total of $728,031, which is up $8,000 (1.1%) since last Friday and up a combined 21% for the year off our virtual $600,000 base for our main Member Portfolios.

More importantly, we reviewed our Member Portfolios yesterday and our Short-Term Portfolio is still at $129,916 while our Long-Term Portfolio is at $598,115 for a total of $728,031, which is up $8,000 (1.1%) since last Friday and up a combined 21% for the year off our virtual $600,000 base for our main Member Portfolios.

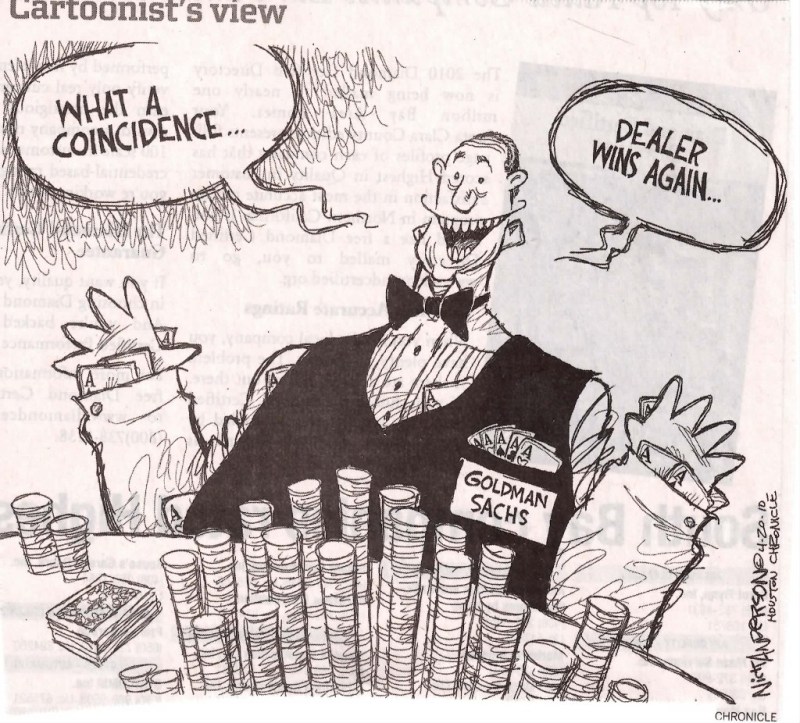

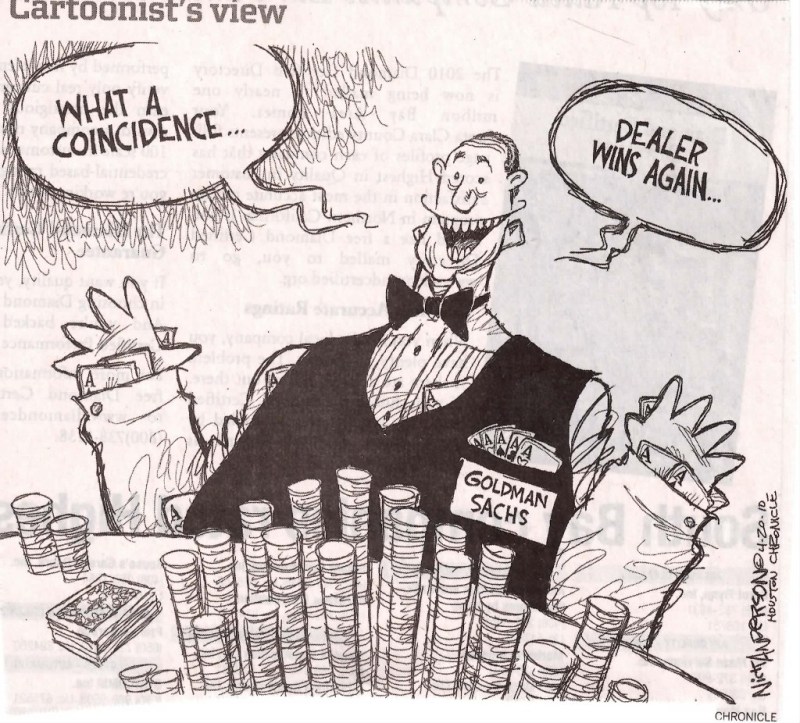

As I mentioned last week (and the week before and the week before) – it's all about BALANCE. Balance and following our strategy of BEING THE HOUSE – Not the Gambler. Selling premium and staying balanced allows us to grind out a steady profit in most market conditions. We don't HAVE to guess which way the markets are going – plays like SSO are just a bonus, nice though they may be.

So sure, the stock market is…

So sure, the stock market is…

At least we can count on one thing.

More importantly, we reviewed our Member Portfolios yesterday and our Short-Term Portfolio is still at $129,916 while our Long-Term Portfolio is at $598,115 for a total of $728,031, which is up $8,000 (1.1%) since last Friday and up a combined 21% for the year off our virtual $600,000 base for our main Member Portfolios.

More importantly, we reviewed our Member Portfolios yesterday and our Short-Term Portfolio is still at $129,916 while our Long-Term Portfolio is at $598,115 for a total of $728,031, which is up $8,000 (1.1%) since last Friday and up a combined 21% for the year off our virtual $600,000 base for our main Member Portfolios.