Wow, what a recovery! And wow, what complete and utter BS it is. They NYSE is still below 11,000 (our Must Hold line) and the Russell is still below it's 50 dma and we up on less than 10% of the volume (total) that sold off for the last two weeks. But, who cares as long as it paints a pretty picture? We can thank the Wall Street Journal's Fed Whisperer, John Hilsenrath with yesterday's rally as he wrote not one but TWO articles that whipped traders into a frenzy on his " insider view " that the Fed " may keep the words "considerable time" in its policy statement. " Oh, be still my heart! More free money? Really? Will wonders never cease? Needless to say we took the opportunity to re-short the Dow Futures (/YM) at 17,050 and the S&P Futures (/ES) at 1,993 and the Nasdaq Futures (/NQ) at 4,060 and the Nikkei Futures (/NKD) at 15,950 – all of which we discussed in yesterday's Live Trading Webinar that was, sadly, a Members only affair ( but you can join us here ). We also got a chance to short oil at $95 again ( a level I published in yesterday's post ) and we're thrilled with that and already this morning, it's back at $94.50 for $500 per contract gains. For non-futures players we grabbed the SCO Sept $30s at .25 as a fun play that inventories at 10:30 won't support $95 oil in much the way Fed policies at 2pm won't support these market levels. In fact, here's CNBC's Art Cashin telling you yesterday evening what I told you yesterday morning – BRILLIANT! Art's actually one of the very few Wall Street analysts I respect, I've followed him since I was a kid – he's a fantastic guy. As you can see on the Big Chart, the Russell is the laggard and, if the indexes break higher – it's the index we'll go long on but our short bets (TZA) have already paid off very well. We like them long over 1,145 if the above levels are all over because there is very little upside resistance on TF, all the way back to 1,200. On the other hand, a break below 1,140 (-5% on the Big Chart) that sticks is likely to be tragic . IN PROGRESS

Wow, what a recovery!

Wow, what a recovery!

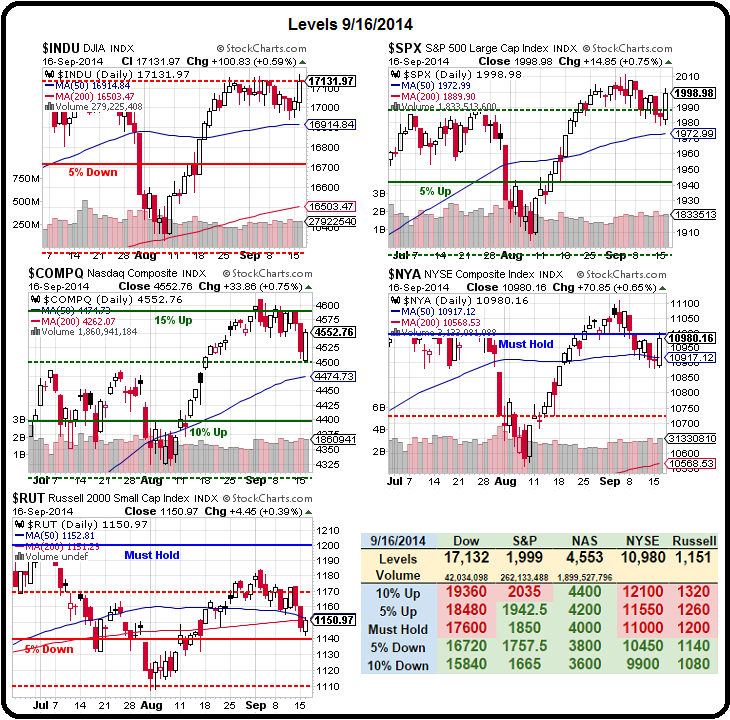

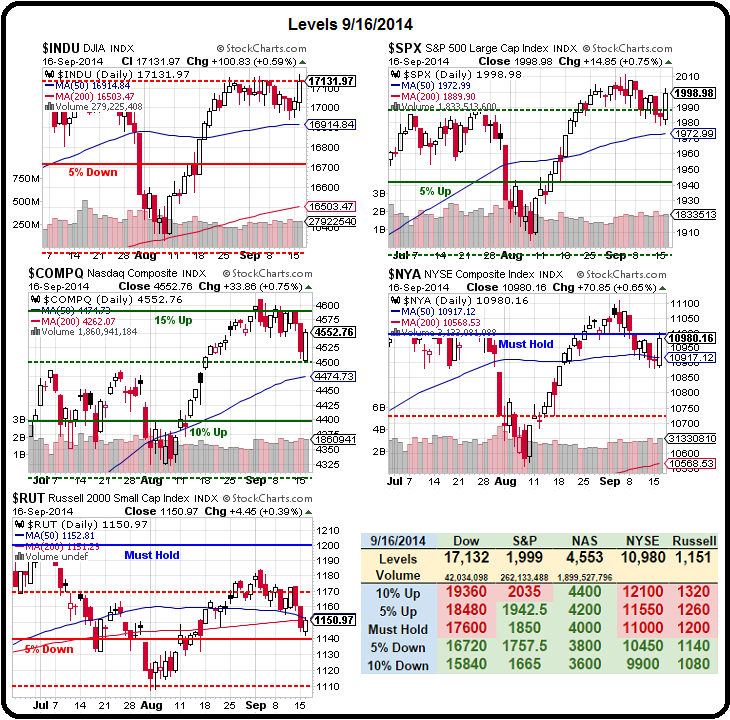

And wow, what complete and utter BS it is. They NYSE is still below 11,000 (our Must Hold line) and the Russell is still below it's 50 dma and we up on less than 10% of the volume (total) that sold off for the last two weeks. But, who cares as long as it paints a pretty picture?

We can thank the Wall Street Journal's Fed Whisperer, John Hilsenrath with yesterday's rally as he wrote not one but TWO articles that whipped traders into a frenzy on his "insider view" that the Fed "may keep the words "considerable time" in its policy statement." Oh, be still my heart! More free money? Really? Will wonders never cease?

Needless to say we took the opportunity to re-short the Dow Futures (/YM) at 17,050 and the S&P Futures (/ES) at 1,993 and the Nasdaq Futures (/NQ) at 4,060 and the Nikkei Futures (/NKD) at 15,950 – all of which we discussed in yesterday's Live Trading Webinar that was, sadly, a Members only affair (but you can join us here).

We also got a chance to short oil at $95 again (a level I published in yesterday's post) and we're thrilled with that and already this morning, it's back at $94.50 for $500 per contract gains. For non-futures players we grabbed the SCO Sept $30s at .25 as a fun play that inventories at 10:30 won't support $95 oil in much the way Fed policies at 2pm won't support these market levels. In fact, here's CNBC's Art Cashin telling you yesterday evening what I told you yesterday morning – BRILLIANT!

Art's actually one of the very few Wall Street analysts I respect, I've followed him since I was a kid – he's a fantastic guy. As you can see on the Big Chart, the Russell is the laggard and, if the indexes break higher – it's the index we'll go long on but our short bets (TZA) have already paid off very well. We like them long over 1,145 if the above levels are all over because there is very little upside resistance on TF, all the way back to 1,200. On the other hand, a break below 1,140 (-5% on the Big Chart) that sticks is likely to be tragic.

IN PROGRESS

Wow, what a recovery!

Wow, what a recovery!