It can be very easy to be down on silver at the moment, as the silver futures market activity gives a firm advantage to the white metal's bears.

It can be very easy to be down on silver at the moment, as the silver futures market activity gives a firm advantage to the white metal's bears.

But what silver futures also indicate is an unsustainable downward spiral for silver prices that is more than ready to reverse itself as silver trades at its 2014 lows.

That current silver bear slump has been aggravated by speculators.

These speculators buy and sell contracts that promise the delivery of silver at a set price. However, these traders will almost never demand the actually delivery, instead, they'll hold the contracts until prices move in their favor and make their contracts more valuable.

Silver speculators going long will buy contracts or physical silver at a set price with the hope that prices will go up and they will be able to pocket the difference between the price paid, and the increased market price they will be able to sell it at.

When silver speculators go short, they are essentially selling borrowed silver with an obligation to buy it back later. If all goes as planned for a silver short, prices will decline and when they buy it back, they can pocket the difference between what they pay and the price they initially sold it at.

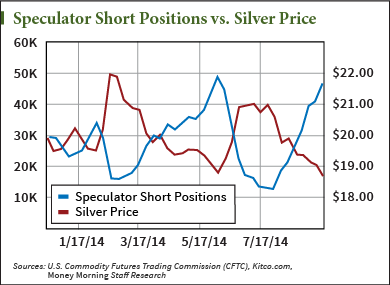

As of the most recent data, speculators currently hold 235.5 million ounces of silver in short positions underlying 47,093 contracts. This is an increase of 5,426 contracts from the week before. It's also only 1,891 contracts away from an historic record that was reached earlier this year, according to the U.S. Commodity Futures Trading Commission (CFTC).

This is significant because the current session of short covering began on July 29, when shorts stood at a 2014 low of 12,603 contracts. It explains why since then, prices have fallen $2.77 an ounce to $17.79 as of Friday's close, good for a 13.6% drop.

But it also represents a pattern seen earlier this year, when massive short covering inevitably led to a six-week bull session.

And silver is ready for it again...

How Silver Short Positions Move PricesOn June 2 this year, silver was trading at $18.76 an ounce, then a low on the year.

Short contracts totaled 48,984 representing 244.9 million ounces.

Because silver was trading so low at this time, speculators fear that silver bulls eyeing these cheap prices would buy up the white metal while it was still inexpensive.

This led to a massive short-covering spree, where speculators shed 36,381 contracts over a number of weeks.

The flood of short sellers looking to cover their position provided a pop in the silver market, and helped propel silver prices up more than 14% at one point.

TD Securities thinks we're gearing up for another one of these sessions, according to Kitco.com.

"Both [gold and silver] have seen two-way flow in New York trading and while the bears are firmly in control, we can't help but think we are setting ourselves up for a mighty short-covering rally," TDS said.

As Jeffrey Christian, managing partner at CPM Group wrote in an email to Money Morning, speculators can help put upward or downward pressure on silver prices depending on which side of the trade they are on and in what volumes.

"When there are few shorts, that leaves the price vulnerable to renewed short selling," Jeffrey Christian wrote. "So, too, when there are a lot of longs, that leaves the price vulnerable to profit-taking selling by the longs."

And as it stands, there is not a lot of profit to be realized through long selling, and the ceiling for shorts is shrinking ever lower with this latest round of numbers from the CTFC.

More on What Could Affect Silver: Inflation will be a big determinant in silver prices, as a weakening dollar will cause investors to flock to precious metals as a safe haven asset. But there's one counter-inflationary policy that the Fed might be too afraid to consider, given what's at stake...

Tags: short silver, silver 2014, silver futures, Silver Prices, Silver Prices 2014, silver prices this week, silver prices this year, silver speculation, silver speculators, why is silver going downThe post What the Silvers Futures Market Can Tell Us About Silver's Current Slump appeared first on Money Morning - Only the News You Can Profit From.