Now that Yahoo! Inc. (Nasdaq: YHOO) has sold most of its Alibaba stake, and cash-rich BABA just completed the biggest IPO of all time, will a major tech deal go down - as in, will Alibaba buy Yahoo?

It could sure be a good deal for YHOO shareholders ...

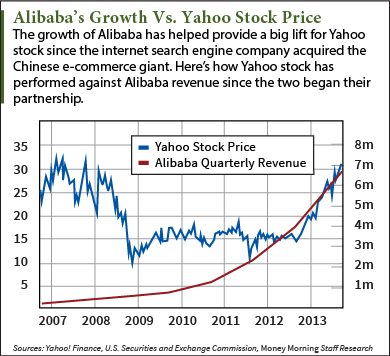

Over the last few years, shareholders have watched as YHOO has struggled to turn its core business around, while most of its value as an investment came from its lucrative overseas holdings. YHOO's once 40% stake (now 16.3%) in Alibaba Group Holding Ltd. (NYSE: BABA) and its 35% stake in Yahoo! Japan were effectively providing the bulk of YHOO's earnings, but income from its own operations continued to sink.

"Absent the Alibaba investment, Yahoo as a stand-alone business is just about worthless," said Money Morning Chief Investment Strategist Keith Fitz-Gerald. "But that doesn't mean the company is worthless. The value infused by the Alibaba deal is a huge windfall for Yahoo shareholders and Yahoo management."

Per a 2012 repurchasing agreement, YHOO sold half its stake in BABA back to the Chinese e-commerce giant and negotiated a "proposed staged exit" that would wind down YHOO's investment in the company over a number of years. This boosted YHOO's cash hoard by about $2.8 billion and delivered $3.31 earnings-per-share (EPS) on the year, compared to 2011's $0.91 EPS.

YHOO shed another 140 million shares after the Alibaba IPO on Sept. 19, and has promised to deliver half of those proceeds to shareholders as well.

YHOO's remaining stake in BABA is worth $36 billion, and the key to YHOO's value at the moment is based almost entirely on the potential for this to grow before it is sold off and put back into YHOO's cash coffers.

But if YHOO wants to capitalize on the windfall in the best way possible and reward shareholders, its best bet is a sale to Alibaba and its Chief Executive Officer Jack Ma, who in 2011 said he was "very interested" in buying the company when YHOO was considering a sell-off.

But first, here are the tough decisions YHOO is going to have to make.

How YHOO Can Help ShareholdersYahoo's at a point where if it wants to stay competitive, and it wants to turn around an ailing business that has failed to keep pace with the likes of Google and Facebook, it's going to have to reinvent itself in a new image more relevant to today's online consumers, according to Money Morning Executive Editor Bill Patalon.

This would require using the cash Yahoo already has by shedding its first round of Alibaba shares, as well as whatever other future cash it can make by selling the rest of its stake, to make big-ticket acquisitions, build economies of scale, and play off the success of other burgeoning players in this world of social media.

Just after selling about 140 million Alibaba shares, YHOO purchased an Indian startup, BookPad, which hosts cloud-based documents. While it only carried an $8.3 million price tag, it puts Yahoo's current challenges in perspective.

"You can't buy second-tier assets and bolt them all together and get a first-tier company," Patalon said.

Instead, the acquisitions that could make a splash for YHOO are names like Snapchat or Pinterest, Patalon said. But YHOO would be wise not to start a bidding war with the much more successful social media and tech companies who will likely be eyeing the same properties.

YHOO could run the risk of either not acquiring either, or acquiring an asset at such a high cost, that it can't continue to feed more money into that venture and the purchase becomes a lost cause.

Any move to reinvent itself, which Patalon said has a small chance of being successful, risks further disappointing patient shareholders, at a time when YHOO has the potential to generate cash and deliver well to them.

"Are these guys really going to be able to afford to buy the assets they need to transform their business and stay relevant?" Patalon said. "Or in doing so are they really going to fritter away this one opportunity to make sure their shareholders are well compensated?"

That's why an Alibaba purchase of Yahoo would be ideal.

Why Alibaba Would Buy YahooAlibaba doesn't want to stay confined to China.

"As ripe as the Chinese e-commerce market is, there's no way Alibaba is going to settle for being just a Chinese e-commerce company," Patalon said. "It wants to become a global power."

And what better way than to piggyback off the assets it already has here in the states?

As Patalon said, in Asian businesses relationships are everything. And while rocky at times, Alibaba and Yahoo have a well-established, 10-year marriage.

A purchase of YHOO would give Alibaba a good base of operations to launch its campaign for global Internet dominance.

And after selling off parts, or the whole company, YHOO would then be able to deliver big to its shareholders, something it hasn't been able to do for a number of quarters with its ailing core business.

YHOO would no longer be what it is now. Instead it would devolve into a holding company, flush with cash from its dealings with Alibaba. Though not a viable, sustainable business, it would become a boon to shareholders, who could see that cash come right back to them before YHOO would ultimately have to wind down its operations.

As it currently stands, YHOO is a valuable company not because its core business is robust and poised for a turnaround. It's valuable because of its potential to pay shareholders handsomely for having patience in a company that has been leveraging its floundering operations with its investments overseas.

And it's about time that those overseas investments are monetized and delivered to shareholders, instead of being used to finance the same flagging business model for years to come.

Now: Will Alibaba buy eBay too? There's a good case for the acquisition...

Tags: Alibaba IPO, Alibaba yahoo partnership, Alibaba's value to Yahoo, Will Alibaba Buy Yahoo, yahoo stock, YHOO StockThe post Will Alibaba Buy Yahoo? Here's What YHOO Needs to Consider appeared first on Money Morning - Only the News You Can Profit From.