IBM spooked the markets this morning.

IBM spooked the markets this morning.

The Dow component missed on earnings and revenues by wide margins, reporting the worst quarter since Q1 of 2009, when the stock was under $100 so no surprise they dropped $14 (7.5%) from $182 to below $170. That gave us a great opportunity to short the Dow at 16,250 in our Live Member Chat Room and we caught a quick 50-point drop already (7:48) for a $250 per contract gain to start our week off right.

Fortunately, we followed through with our plan on Friday (see morning post) and flipped bearish again into Friday's close – the Futures trade was simply a way to take advantage of an obvious and immediate catalyst pre-market. We'll hear from two Fed doves this morning – Powell speaks at 10 but not much expected from him and Tarullo goes at noon and is bound to say something doveish if the market is read into lunch.

As to IBM – it's not as bad as it seems as IBM took a $4.7Bn one-time charge as they PAID GlobalFoundries $1.5Bn to take their money-losing semiconductor unit off their hands. I wish IBM had called me, I would have been happy to take their semiconductor unit for just $1.3Bn…

Still, we had IBM on our Buy List and were hoping they would come down so we could add them to one of our Porfolios but I don't like their "idea" of repositioning to more cloud computing, as I think that's really a commodity play with lower margins though I still believe in Watson and if you consider that IBM wrote off nearly $5 per share – the earnings weren't so terrible. So it's going to be watch and wait on IBM at $170 – hopefully they go lower and get irresistable but we're not going to run in and catch a falling knife on this one.

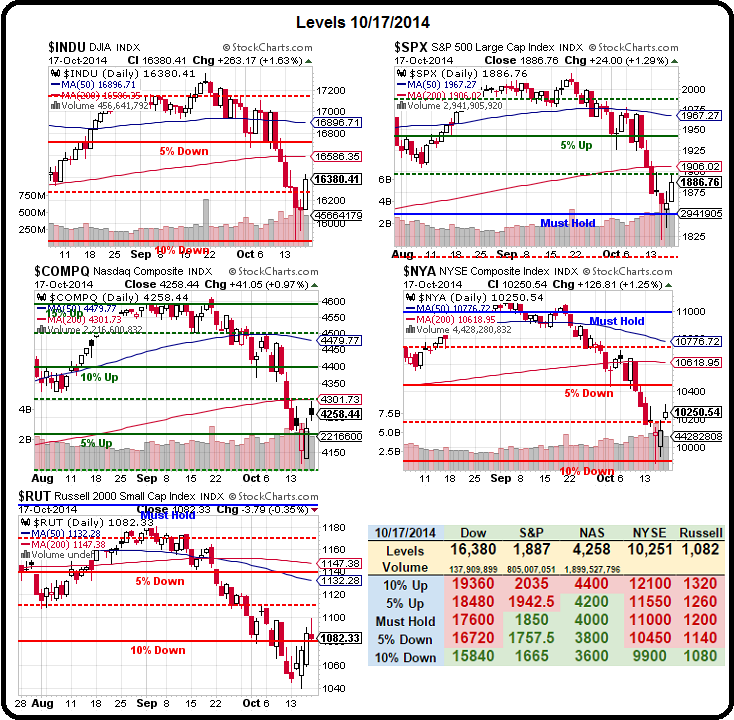

We'll also be keeping a very close eye on our levels this week and, as you can see from the Big Chart, we've

We'll also be keeping a very close eye on our levels this week and, as you can see from the Big Chart, we've

IN PROGRESS