Strap yourselves in – it's going to be a wild one!

Strap yourselves in – it's going to be a wild one!

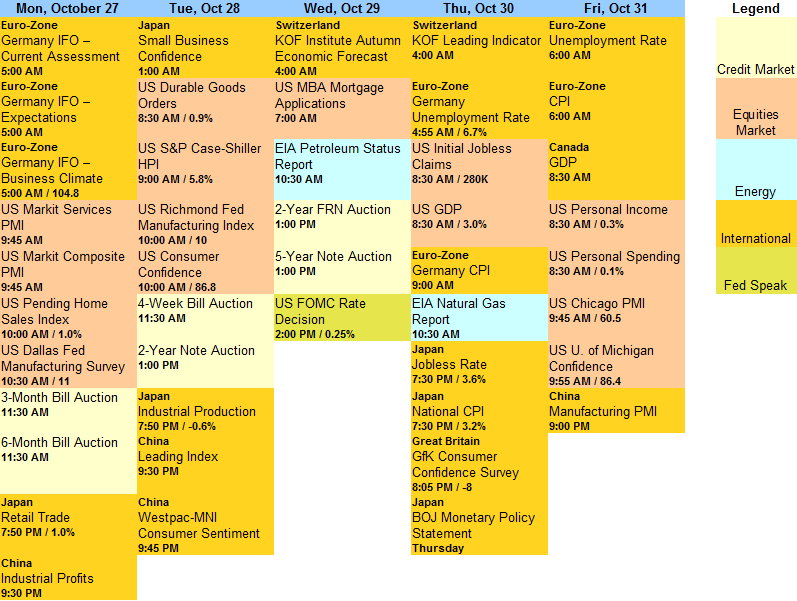

After closing out the best week in the market since 2012 (right after the worst week since 2011) it looks like we're in for more craziness as Draghi's happy talk fades into a distant memory (it was Friday afternoon) to be replaced by fear of the Fed on Wednesday (2pm) as well as an almost certain drop in our GDP from Q2s shocking 4.6% to probably 2.5% in Q3's first guesstimate.

Speaking of guesstimates – did you catch that downward revision to New Home Sales on Friday? On September 24th, the WSJ ran a headline proclaiming: "U.S. New-Home Sales Surge 18% in August - Highest Level Since 2008; Signals Higher Consumer Demand That Could Boost Housing Market" and the S&P popped 18 points (1%) and IYR began a 6% rally that day everyone was happy.

Only it was a lie. As it turns out, new home sales were actually only 466,000 and this month (Sept data) they are 467,000 yet, at the time, no one (except us) thought to question the validity of a sudden 18% jump in home sales when mortgages were still in decline.

Only it was a lie. As it turns out, new home sales were actually only 466,000 and this month (Sept data) they are 467,000 yet, at the time, no one (except us) thought to question the validity of a sudden 18% jump in home sales when mortgages were still in decline.

Even after the fact, people don't seem to think it's a big deal when major market-moving data has a fudge-factor of +/- 10%. It's bad enough that "THEY" control the markets – do they HAVE to fake the data as well? As Dave Fry notes regarding Friday's low-volume action:

So why did stocks rally?

In the midst of all this crummy data, CNBC rolled-out some commentary from one of the chief QE talking head proponents, the ECB’s Mario Draghi. His comments lit a fire under bulls and algos where terms like “more