What is the Fed so afraid of?

What is the Fed so afraid of?

Yesterday, at about 1:45, as the market was dipping, Fed President Kocherlakota decided it would be a good time to say it would be a MISTAKE for the Fed to raise rates any time in 2015:

“It would be inappropriate for the [Federal Open Market Committee] to raise the target range for the fed funds rate at any such meeting” occurring in 2015, Mr. Kocherlakota said.

As a voting member of the FOMC, Kocherlakota's words carry a lot of weight but he was already the dissenting opinion to the Fed's last vote, so this was not NEW information – but it was enough to re-energize the bulls, as there's nothing they love more than FREE MONEY!!!

Our Futures were dipping back down this morning until 3am, when it suddenly became urgent for NY Fed President Bill Dudley to say it was "still too early to raise rates." Noting there could be a significant benefit from letting the economy run "slightly hot." Speaking at the Central Bank of the United Arab Emirates in Abu Dhabi this morning, Dudley called for "patience" on an increase in the Fed funds rate as the risk of tightening prematurely is greater than the risk of tightening too late.

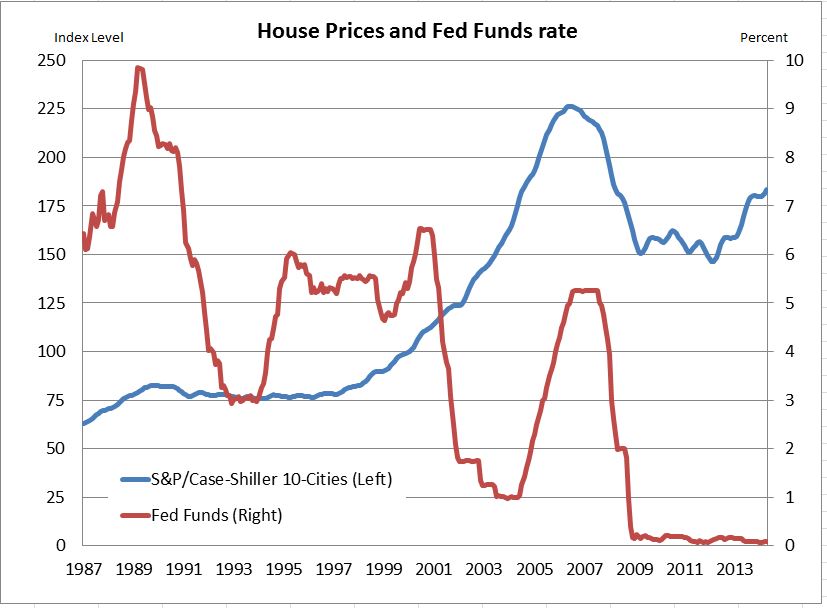

It's amazing to look at the chart above and consider that Greenspan "took away the punch bowl" when rates were 5%. THAT was a rate he considered far too accommodative but his VERY BRIEF attempts to raise rates to 7% were quickly reversed as the markets collapesed in 2000 and then, of course, 9/11 happened and rates were dropped to near zero to goose the economy – leading to our 2007 housing bubble that almost destroyed the Universe.

It's amazing to look at the chart above and consider that Greenspan "took away the punch bowl" when rates were 5%. THAT was a rate he considered far too accommodative but his VERY BRIEF attempts to raise rates to 7% were quickly reversed as the markets collapesed in 2000 and then, of course, 9/11 happened and rates were dropped to near zero to goose the economy – leading to our 2007 housing bubble that almost destroyed the Universe.

This time, of course, is different because – well because it is, right? Sure it could be argued that bubble #1 came during the dot com boom, when Clinton was in office and everyone had jobs and the deficit was low and the economy was booming and…