What an "impressive" recovery we had last week.

What an "impressive" recovery we had last week.

After starting out down 750 Dow points we took 500 of them back overall, which gives us a still-constructive picture on the weekly chart – much better than the dreaded head and shoulders formation we would have had if we had finished around 17,500.

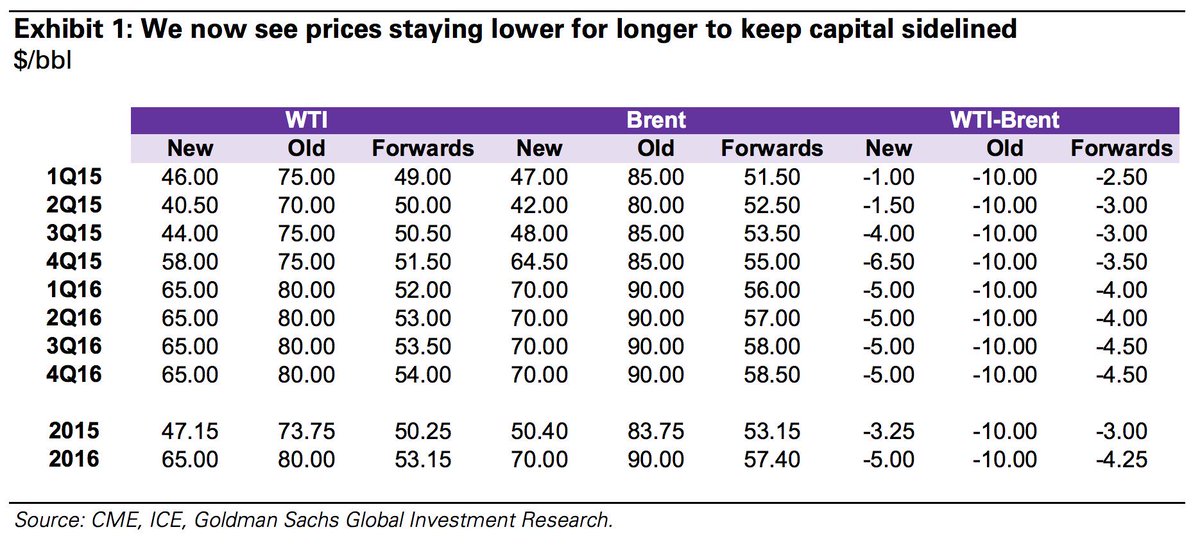

So that should make the chart people happy and this morning the Futures are up a bit, even though oil is down 2.5% as Goldman Sachs took advantage of a sleepy Monday Morning to come out with a MAJOR DOWNGRADE ON OIL that calls for $41 oil in 3 months, down from their previously totally wrong forecast of $70 (for WTIC).

Since GS was "only" off by 42% in their previous forecast, of course their current forecast is moving the markets as the beautiful sheeple stampede out of long positions. We're thrilled to see GS send oil to new lows as it makes it cheaper for us to buy longs. Last week alone 35 rigs were shut down at Bakken (61 overall) and, as we already calculated in our ongoing oil study, the average rig pumps 1,000 barrels a day, which means 61 rigs takes 427,000 barrels out of inventory starting next week.

GS knows this and they know the bottom is much closer than April – they just want to force the retail buyers (including their own clients) out of long positions so they and their preferred clients can load up on longs and make a fortune when oil does come back.

GS knows this and they know the bottom is much closer than April – they just want to force the retail buyers (including their own clients) out of long positions so they and their preferred clients can load up on longs and make a fortune when oil does come back.

You can see on their chart (left) that they are still projecting a $65 average for 2016 but GS knows (as do we) that the average investor has more like a 3-month time-frame, at most, and has no interest in what will happen a whole year from now – even if it could make them 50% if they simply make an investment now.

Fortunately, at PSW, we teach our Members not to be sheeple and, as I often say to our Members, "We don't care IF the game is rigged as long as we can understand HOW the…

Fortunately, at PSW, we teach our Members not to be sheeple and, as I often say to our Members, "We don't care IF the game is rigged as long as we can understand HOW the…