The World Bank has downgraded the Global Economy. According to today's report , the Global Economy will slow to a 3% growth rate, down 10% from the previously projected 3.4% calculated in June. That's a pretty alarming rate of decline in the 2nd half of the year, don't you think? The report adds to signs of a growing disparity between the U.S. and other major economies while tempering any optimism that a plunge in oil prices will boost output. Risks to the global recovery are “ significant and tilted to the downside ,” with dangers including a spike in financial volatility, intensifying geopolitical tensions and prolonged stagnation in the euro region or Japan . “The global economy today is much larger than what it used to be, so it’s a case of a larger train being pulled by a single engine, the American one,” World Bank Chief Economist Kaushik Basu told reporters on a conference call. “This does not make for a rosy outlook for the world.” The bank sees average oil prices falling 32 percent this year, a decline that’s historically associated with a boost to global GDP of about 0.5 percent. Yet the impact on growth may be smaller in 2015 and 2016 because of other headwinds including weak confidence that encourages saving rather than spending, and a “ significant ” income shift from oil-producing countries to those that are net consumers, the World Bank said. In other words, all those things we have been telling you to worry about were actually things you should have been worried about. As I mentioned to you in Friday Morning's post, we added back $13,000 worth of TZA (ultra-short Russell) spreads in expectations of negative economic news this week. Those spreads have a $17,000 upside (130%) if the Russell fails to hold 1,170, which is right where we bounced off yesterday (the -2.5% line). We'll see if that line holds up today, as well as our two remaining Strong Bounce Lines ( see yesterday's post for predictions that came true ) of Dow 17,460 and Nasdaq 4,656. As we…

The World Bank has downgraded the Global Economy.

The World Bank has downgraded the Global Economy.

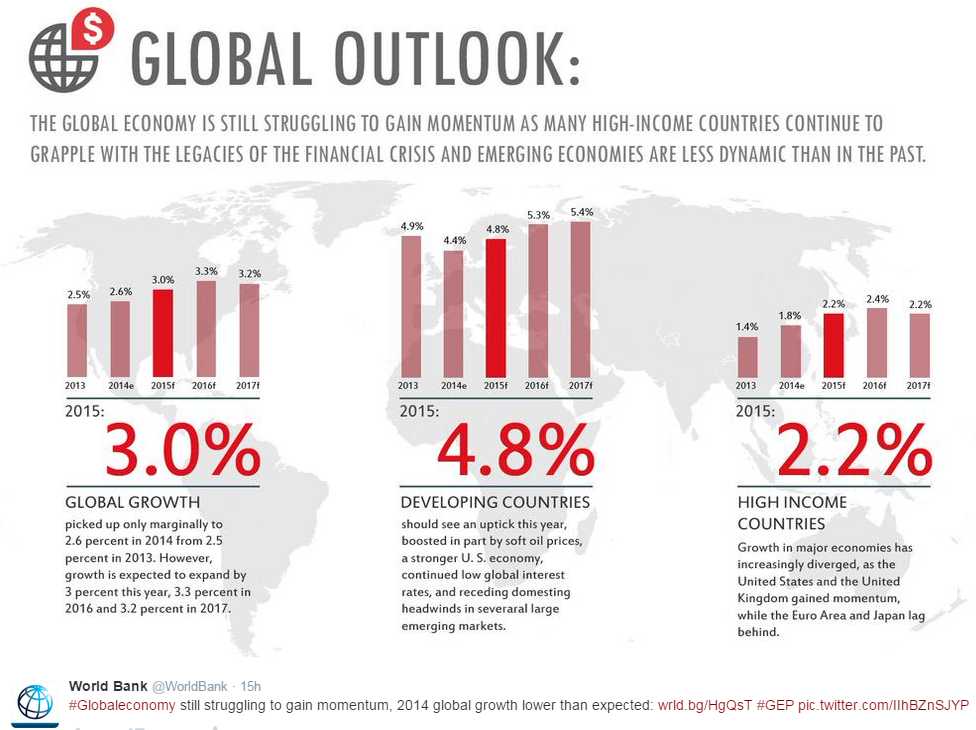

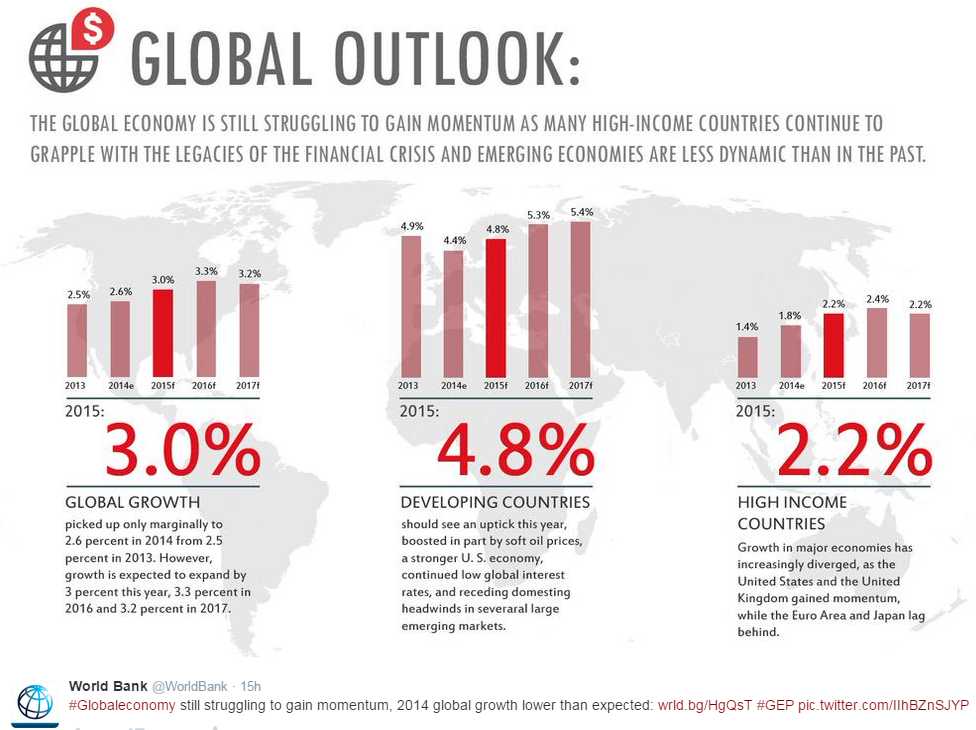

According to today's report, the Global Economy will slow to a 3% growth rate, down 10% from the previously projected 3.4% calculated in June. That's a pretty alarming rate of decline in the 2nd half of the year, don't you think? The report adds to signs of a growing disparity between the U.S. and other major economies while tempering any optimism that a plunge in oil prices will boost output. Risks to the global recovery are “significant and tilted to the downside,” with dangers including a spike in financial volatility, intensifying geopolitical tensions and prolonged stagnation in the euro region or Japan.

“The global economy today is much larger than what it used to be, so it’s a case of a larger train being pulled by a single engine, the American one,” World Bank Chief Economist Kaushik Basu told reporters on a conference call. “This does not make for a rosy outlook for the world.”

The bank sees average oil prices falling 32 percent this year, a decline that’s historically associated with a boost to global GDP of about 0.5 percent. Yet the impact on growth may be smaller in 2015 and 2016 because of other headwinds including weak confidence that encourages saving rather than spending, and a “significant” income shift from oil-producing countries to those that are net consumers, the World Bank said.

The bank sees average oil prices falling 32 percent this year, a decline that’s historically associated with a boost to global GDP of about 0.5 percent. Yet the impact on growth may be smaller in 2015 and 2016 because of other headwinds including weak confidence that encourages saving rather than spending, and a “significant” income shift from oil-producing countries to those that are net consumers, the World Bank said.

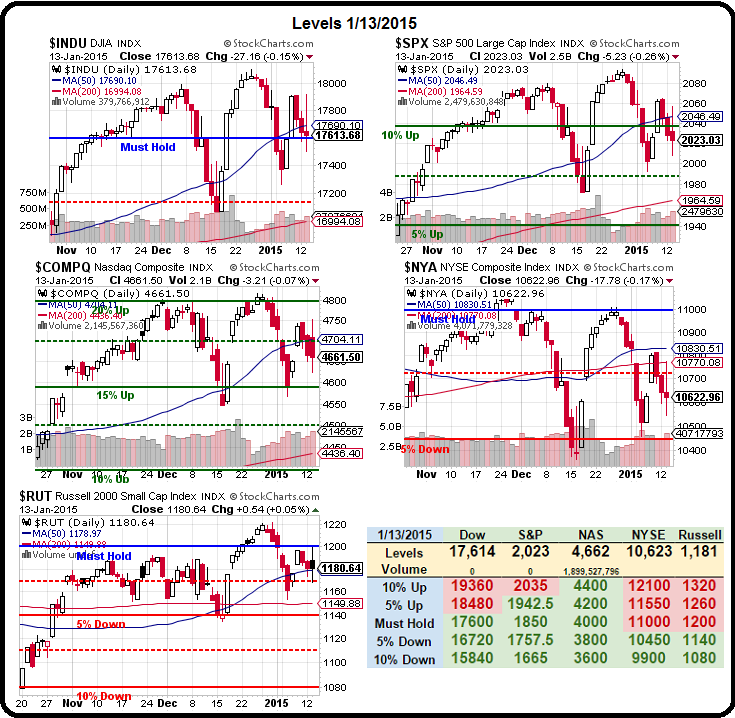

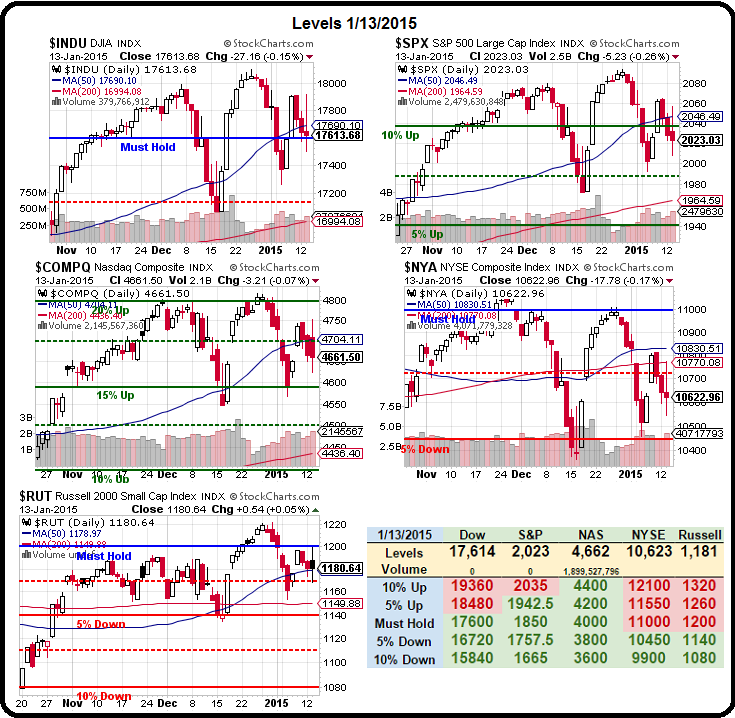

In other words, all those things we have been telling you to worry about were actually things you should have been worried about. As I mentioned to you in Friday Morning's post, we added back $13,000 worth of TZA (ultra-short Russell) spreads in expectations of negative economic news this week. Those spreads have a $17,000 upside (130%) if the Russell fails to hold 1,170, which is right where we bounced off yesterday (the -2.5% line).

We'll see if that line holds up today, as well as our two remaining Strong Bounce Lines (see yesterday's post for predictions that came true) of Dow 17,460 and Nasdaq 4,656. As we…

We'll see if that line holds up today, as well as our two remaining Strong Bounce Lines (see yesterday's post for predictions that came true) of Dow 17,460 and Nasdaq 4,656. As we…

The World Bank has downgraded the Global Economy.

The World Bank has downgraded the Global Economy. The bank sees average oil prices falling 32 percent this year, a decline that’s historically associated with a boost to global GDP of about 0.5 percent. Yet the impact on growth may be smaller in 2015 and 2016 because of other headwinds including weak confidence that encourages saving rather than spending, and a “significant” income shift from oil-producing countries to those that are net consumers, the World Bank said.

The bank sees average oil prices falling 32 percent this year, a decline that’s historically associated with a boost to global GDP of about 0.5 percent. Yet the impact on growth may be smaller in 2015 and 2016 because of other headwinds including weak confidence that encourages saving rather than spending, and a “significant” income shift from oil-producing countries to those that are net consumers, the World Bank said.

We'll see if that line holds up today, as well as our two remaining Strong Bounce Lines (see yesterday's post for predictions that came true) of Dow 17,460 and Nasdaq 4,656. As we…

We'll see if that line holds up today, as well as our two remaining Strong Bounce Lines (see yesterday's post for predictions that came true) of Dow 17,460 and Nasdaq 4,656. As we…