MORE FREE MONEY!!!

MORE FREE MONEY!!!

Mario Draghi (a Goldman employee) will discuss his $75Bn/month QE program for the ECB this morning and the BOE (another Goldman employee) has already announced they will continue their $35Bn/month QE program while Japan contines their $80Bn/month QE program and our own Fed is still at $80Bn/month with China probably around the same. That's $350Bn PER MONTH or $4.2Tn per year being pumped into the Global Economy by Central Banksters. AND IT'S NOT REALLY HELPING!!!

Well, it is helping the Top 1% as they get richer and richer and richer. It's easy to get richer when we can borrow money at 0.25% and then lend it to poor people (and we're justified because their credit simply isn't as good as ours) for 5%. That's a 20x return on our borrowing cost – don't you just love the Central Bansters?!?

Well, it is helping the Top 1% as they get richer and richer and richer. It's easy to get richer when we can borrow money at 0.25% and then lend it to poor people (and we're justified because their credit simply isn't as good as ours) for 5%. That's a 20x return on our borrowing cost – don't you just love the Central Bansters?!?

Now, I know that there are those of you in America who are confused by these numbers because you think your economy is improving – and it is – but that's because you're not thinking the math through. 300M Americans, with an average income of $55,000 per family, are already in the top 10% of the Worlds 7Bn people. So the whole top 10% of America is already in the Global Top 1%, which is what is giving our economy such a boost – but it's at the expense of Billions of others.

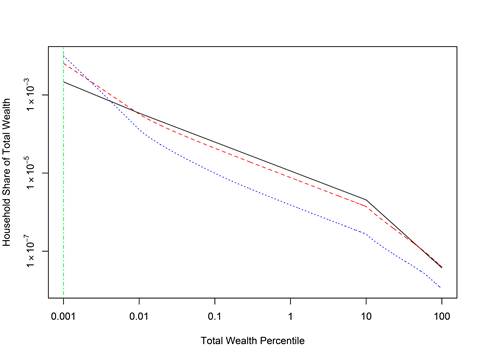

A study by Fernholz in Econobrowser shows the very direct correlation between the gains of wealth held by the top 0.01% and 0.01-0.1% of households are increasing by 3% and 1% per year, respectively, while the share of wealth held by the bottom 90% of households is decreasing by 1.5% per year. 1.5% PER YEAR. When you graph it, it looks like this over time:

A study by Fernholz in Econobrowser shows the very direct correlation between the gains of wealth held by the top 0.01% and 0.01-0.1% of households are increasing by 3% and 1% per year, respectively, while the share of wealth held by the bottom 90% of households is decreasing by 1.5% per year. 1.5% PER YEAR. When you graph it, it looks like this over time:

Not only is wealth being taken from the poor and given to the rich but the process is accellerating through QE policies. One of the ways the top 0.1% is reaping these rewards is through share buybacks – $2Tn worth of them since 2009, which is 6 times more money than the amount contributed by actual investors (apx $300Bn of inflows) during the…