And down we go again!

And down we go again!

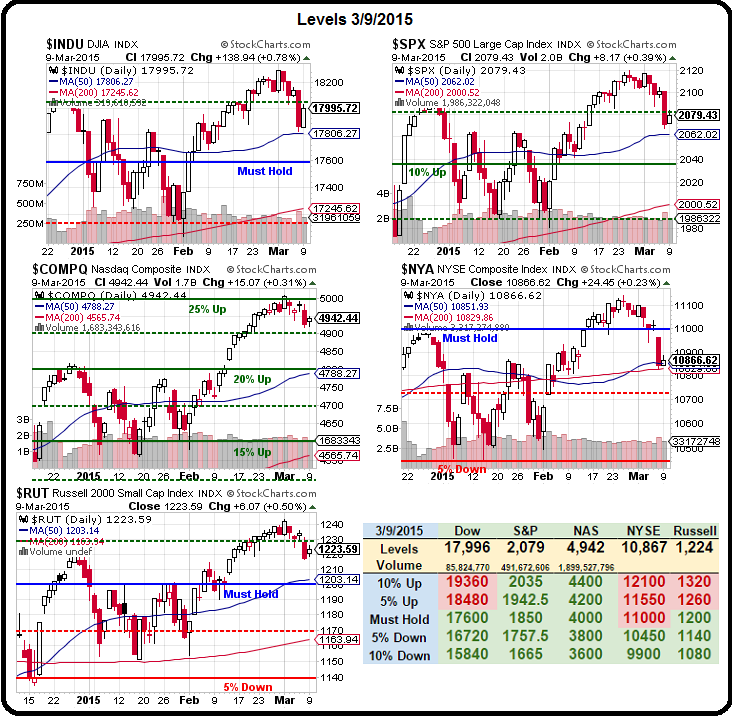

Futures have already given up all of yesterday's ill-gotten, low-volume, gains and now we will be testing the 50-day moving average on the Dow at 17,800 and the S&P at 2,060 while the NYSE has already failed 10,850 but it never got back over our Must Hold line at 11,000, so we never thought it was strong in the first place.

As I noted for our Members in our Live Chat Room yesterday morning, the weak bounce for the NYSE was 10,900 and failing that kept us bearish, despite the "rally" we had for the day. The Dow finished between weak (17,950) and strong (18,050) but S&P failed weak (2,080) while the Nasdaq and Russell were both looking strong. Still, 3 of 5 fails and we stay bearish – that's sensible, right?

We stayed bearish on the Nikkei (see yesterday's post for why) and this morning we got a huge drop back to our goal at 18,500. As I said way back on Feb 26th (as well as in our Live Webinars since then) our bet on /NKD was that 19,000 would fail and it's happened several times since but this is the first day we got the full drop from 19,000 to our goal (close enough and still falling) all in one session.

We stayed bearish on the Nikkei (see yesterday's post for why) and this morning we got a huge drop back to our goal at 18,500. As I said way back on Feb 26th (as well as in our Live Webinars since then) our bet on /NKD was that 19,000 would fail and it's happened several times since but this is the first day we got the full drop from 19,000 to our goal (close enough and still falling) all in one session.

That's a good sign that 18,500 is not the bottom and is likely to fail, which is fabulous for the EWJ puts we have in both our Short-Term Portfolio and our $25,000 Portfolio (see this weekend's Portfolio Review). Even worse for the Nikkei is that this drop is coming DESPITE the Yen weakening to 122 to the Dollar overnight – that's the lowest it's been in 13 years and USUALLY that makes the Japanese exporters very happy. Maybe they read my post yesterday and got worried it will all end in tears?

Speaking of collapsing currencies, the Euro is down to $1.0746 this morning as ECB bond-buying (see Thursday's post) runs right into hawkish commentary by the Fed's Fisher, who says the Fed should "promptly" end it's…

Speaking of collapsing currencies, the Euro is down to $1.0746 this morning as ECB bond-buying (see Thursday's post) runs right into hawkish commentary by the Fed's Fisher, who says the Fed should "promptly" end it's…