The Dollar is down so the markets are up this morning.

The Dollar is down so the markets are up this morning.

This isn't complicated, folks, we've seen this dance before. The S&P almost hit our goaaaalllllll!!! of 2,035 at 2,039 yesterday and was saved by the bell and this morning we have a bit of a recover – but only because the Dollar has fallen almost 1% to prop up the markets.

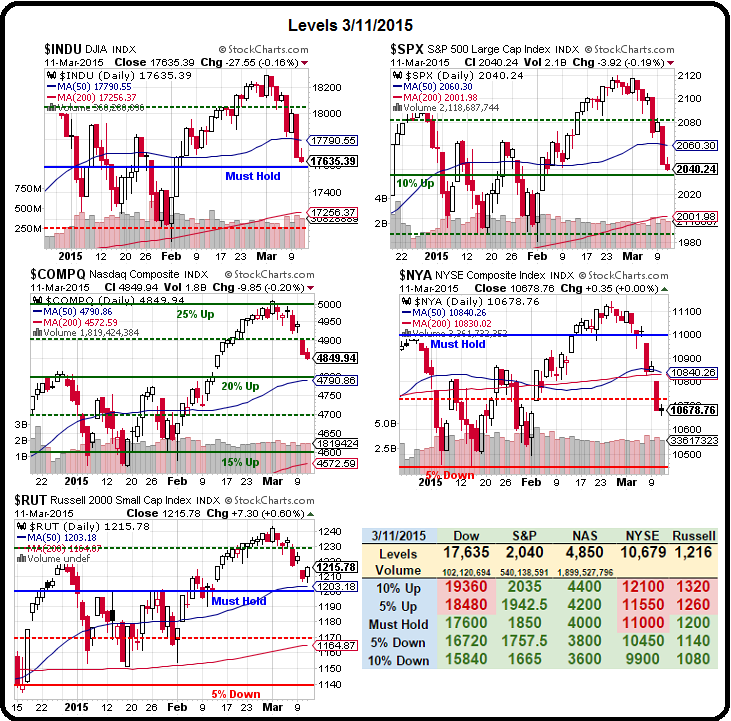

Whether Dollar-driven or not, our 5% Rule™ dictates we still need to see strong bounces before letting ourselves get more bullish. So far, we have just the Russell making a turn off their 50 dma line at 1,203 – if that WASN'T bouncy, things would be very bad indeed. Keep in mind that domestic small caps are least affected by the strong Dolllar while big-cap exporters and commodity producers are most affected.

Likewise, as you can see from Dave Fry's SPY chart, we're testing the 200 dma on the S&P and that had better be bouncy or look out below. The bounces we'll be looking for are:

Likewise, as you can see from Dave Fry's SPY chart, we're testing the 200 dma on the S&P and that had better be bouncy or look out below. The bounces we'll be looking for are:

Dow 18,200 to 17,600 is 600 points (3.3%) and we look for 120-point bounces to 17,720 (weak) and 17,840 (strong).

S&P 2,120 to 2,040 is 80 points (3.7%) and we look for 16-point bounces to 2,056 (weak) and 2,071 (strong).

Nasdaq 5,000 to 4,850 is 150 points (3%) and we look for 30-point bounces to 4,880 (weak) and 4,910 (strong)

NYSE

IN PROGRESS