Over $4,300 in one day.

Over $4,300 in one day.

Not bad for sitting at a computer, right? Yesterday morning, at 9:37, we sent out a Top Trade Alert to our Members (which comes via Text and Email as well as in our Live Member Chat Room) to take advantatage of the morning plunge in oil to $44 a barrel on the May contracts.

We had, of course, been discussing oil trades all week but it's always special when we make something a Top Trade Idea and this was the moment we had been waiting to take advantage of, when the rollover of the April contracts caused a panic sell-off at the NYMEX ahead of an inventory report that was expected to be disappointing – a perfect storm!

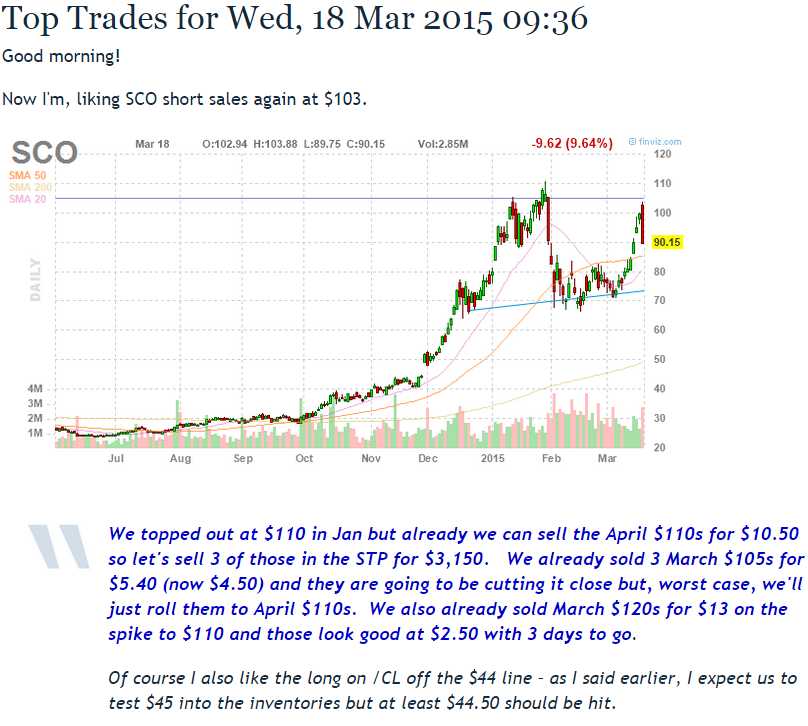

That caused us to send out this Top Trade Alert for SCO, where we sold 3 of the April $110 puts for $10.50 (chart above) as well as a long entry on /CL (oil Futures) at $44. After the Fed announcement, we had oil at $47 for a $3,000 per contract gain and the 3 short SCO contracts that paid us $3,150 in the morning were available to buy back in the afternoon at just $1,800 (+42% on the day), for another $1,350 gain.

That caused us to send out this Top Trade Alert for SCO, where we sold 3 of the April $110 puts for $10.50 (chart above) as well as a long entry on /CL (oil Futures) at $44. After the Fed announcement, we had oil at $47 for a $3,000 per contract gain and the 3 short SCO contracts that paid us $3,150 in the morning were available to buy back in the afternoon at just $1,800 (+42% on the day), for another $1,350 gain.

That's $4,350 of that single Alert in a single day – not bad! Of course we have no reason to buy back the short SCO calls and we expect to make another $1,800 on the trade between now and April 15th (contract expiration) but we took the money and ran on the volatile Futures trade.

Unfortunately, not everyone can trade the Futures so, at 10:14, we sent out a second Top Trade Alert to allow our Members to take advantage of the oil lows with the following trade ideas:

I like UCO July $5/9 bull call spread at $1.35, selling the Jan $5 puts for $1 for net 0.35 on the $4 spread.

USO has less decay so safer