What an amazing recovery!

What an amazing recovery!

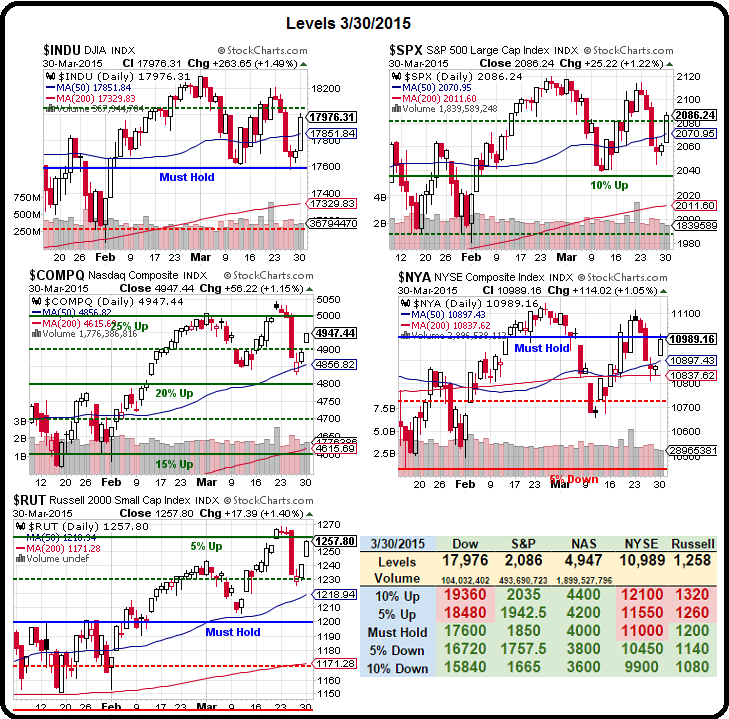

Sure there was no volume and sure almost all the gains came at the open and sure there was a high-volume wave of last minute selling but – WOW!!! – what a rally! With the month ending today we're not expecting much of a sell-off and we'll be looking to see if our strong bounce lines hold intra-day (they should) at:

Dow 17,850, S&P 2,060, Nasdaq 4,905, NYSE 10,910 and Russell 1,245

After barely making our weak bounce lines on Thursday (see Friday's post for details) we were still short of strong bounces on 4 of our 5 indexes at Friday's close (3 of 5 over is a bullish signal) but yesterday, as you can see from Dave Fry's SPY chart, we just popped right over at the open and never looked back.

We'd really like to see the NYSE confirm a bullish move by finally getting over the Must Hold line at 11,000 – that's been a constant sign of weakness that has kept us cautious all year (and last year as well). We had a move all the way to 11,100 in late Feb, but it quickly reversed and we fell 300 points to start March off on a sour note but now, as you can see – we've had 5 up days this month that have accounted for all of the gains to take us back to the promised land.

Nothing really matters until we see the Non-Farm Payroll Report on Friday but we have an interesting situation where the US Markets (and many EU Markets) are closed for Good Friday so, whatever the number is – there won't be a reaction to it until next Monday, when many EU markets are still closed.

Nothing really matters until we see the Non-Farm Payroll Report on Friday but we have an interesting situation where the US Markets (and many EU Markets) are closed for Good Friday so, whatever the number is – there won't be a reaction to it until next Monday, when many EU markets are still closed.

So we're very happy to be mainly in CASH!!! in our largest portfolio and, even so, yesterday's rally brought us up $4,000 as our mainly Materials stocks gained a little ground. That did not make up for the $15,000 LOSS experience in our Short-Term Portfolio which, as I had said…

So we're very happy to be mainly in CASH!!! in our largest portfolio and, even so, yesterday's rally brought us up $4,000 as our mainly Materials stocks gained a little ground. That did not make up for the $15,000 LOSS experience in our Short-Term Portfolio which, as I had said…