( click to enlarge )

( click to enlarge )Nuance Communications Inc. (NASDAQ:NUAN) is poised to break this triangle formation and could trade higher. On the upside, it may lead towards 14.60 levels and a breach of this area could force it up towards 15.01 levels. On the other hand, any dip below 14 levels could direct it towards 13.75 levels. The technical daily indicators are looking bullish. The MACD indicator is above the signal line and rising in positive territory. The RSI and slow stochastic are inside their bullish regions.

( click to enlarge )

( click to enlarge )King Digital Entertainment PLC (NYSE:KING) The potential inverted head and shoulders pattern is still valid on daily chart but we need a breach of the neckline near 16.45/51 area to confirm. The target of this bullish pattern is the $20.5/21 area, which coincides with the target of JPMorgan. While the RSI shows overbought conditions, current strong momentum likely to continue. Keep on watch for the break on volume and go long.

( click to enlarge )

( click to enlarge )Twitter Inc (NYSE:TWTR) has been consolidating after a mid-March surge from around 46 to 51.87 in 5 sessions. The stock is in a bullish flag/channel with price above all moving averages. MACD and RSI are both trending upward on the daily chart. Keep this one on your watch list, it could be setting up to break out of this flag.

( click to enlarge )

( click to enlarge )Arca Biopharma Inc (NASDAQ:ABIO) Another one that looks like a potential long opportunity. The stock pulled back on Thursday but did not attract many sellers, the volume was significantly low when compared to the rally seen the day before on Wednesday. From a technical stanpoint, the stock seems to be forming a Bullish inverted Head and Shoulders pattern with the neckline near the DT line. Additionally it has an up-trending MACD, indicating accumulation and the accumulation/distribution line also spiked higher on Wednesday. I believe the stock is on it's way to go break its 200-day EMA, which could accelerate the move up and the breakout. My stop loss on this will be the 0.70 level.

( click to enlarge )

( click to enlarge )Altisource Portfolio Solutions S.A. (NASDAQ:ASPS) had a remarkable rally Thursday on solid volume. Watch this downtrend line carefully here. A move above $15.35 (20-day EMA & DT) could spark a nice short-squeeze.

( click to enlarge )

( click to enlarge )JD (NASDAQ:JD) Technical daily chart looks pretty good. Accumulation continues to trend higher despite recent pullback. A break of this small bull flag would target a move to 31 on a continuation higher. Initial stop loss should be set below the 20-day EMA in 28.9 area.

( click to enlarge )

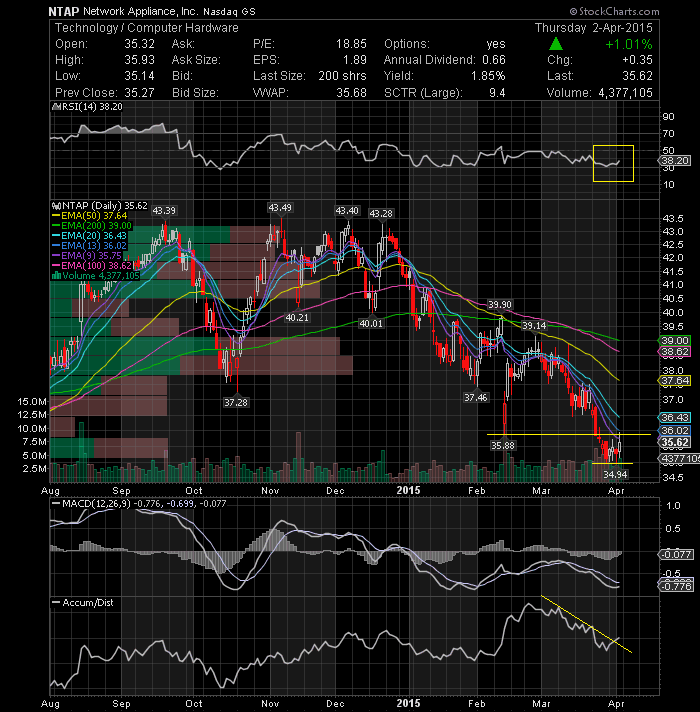

( click to enlarge )NetApp Inc. (NASDAQ:NTAP) After getting punished lower in the past four months, the price has been stabilizing and starting to build optimism along with the RSI giving positive signals. 35.88/36 zone is pretty much the pivot here. If it breaks and close above, we could see 37.50 quickly.

( click to enlarge )

( click to enlarge )On the daily time frame, I would like to point out some interesting signals on the long-term chart for Rambus Inc. (NASDAQ:RMBS). We have a potential "W" bottom here with the Accumulation/ Distribution line making new highs. This suggests that the stock has been accumulated for the last 3 months. Watch for a break this flag to enter longs for a 13.3/50 price target in the near term.

( click to enlarge )

( click to enlarge )VirnetX Holding Corporation (NYSEMKT:VHC) stock showed buying strength all day on Thursday and has regained the 100-day exponential moving average for the first time in over 3 weeks. If it breaks Thursday's high next week then expect $6.9-7 on upside as indicators showing signs of reversal. Stop loss 5.83

Nowadays, learning to trade stocks is not an easy task but by no means is it difficult either. Trading is all about determination, discipline and perseverance. The key point here is to understand who you are as a trader and trade to your strength. There are hundreds, if not thousands of stock trading strategies out there. As usually, I would like to share some good services that could help you. Take the Easter break to check this out:

- High Probability Swing Trading Alerts - Serge will send out notifications via real-time email and text message every time he enters a new trade. You will be able to see what percent of his portfolio he's investing and the exact amount of shares he's purchasing. Free 14-Day Trial

- Get Options Trading Alerts - Dr. Stoxx will send out notifications via real-time email and text message every time he enters a new trade. You will be able to see what percent of his portfolio he's investing and the exact amount of shares he's purchasing. Free 14-Day Trial

- Comprehensive research reports covering the top micro-cap trade pick with on-going updates and entry/exit targets. Recorded CEO interviews and continued analysis. Track trading portfolio and real-time trade alerts via email or text message. Tom Shaughnessy is a good friend and a humble person. Check out SecretCaps

- Benzinga Professional is my streaming platform. It is still available for you with a symbolic cost of just $ 1 for the first month. This is one of the best programs to use on a daily basis and that easily pays for itself. Check out $1 Special Offer

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC