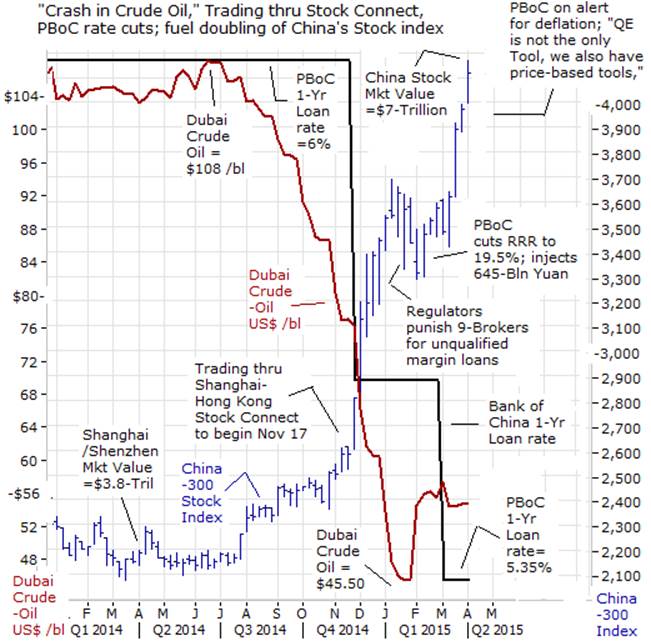

4,016! That's what the Shanghai blasted up to at the open, though we pulled back to 3,957 by the close as some people decided that a 100% run in 6 months called for a little profit-taking. Don't worry, it's all part of the " new normal " for equities and nothing bad can possibly happen – it's just that, 6 months ago, traders didn't know value when they saw it but NOW we are much smarter and these prices are here to stay, right? According to UBS : With no significant change in China's macro or corporate fundamentals, the visible rebound in China's A-share market since November appears to have been largely liquidity driven. We think this, in turn, may have been fuelled by a number of factors including: New funds flowing into the stock market from household saving, real estate, commodities and trust markets; Banks' bridge loans provided to investors who lost access to other high-yield shadow banking products as the result of tighter regulation; The PBC's easing of liquidity conditions via a variety of "targeted easing" tools (e.g. MSL, PSL, etc.); The official launch of Mutual Market Access (MMA) between the Hong Kong and Shanghai exchanges; Long-term expectations for SOE reform and A-shares entering the MSCI index next June; Increased use of leverage by retail investors via margin trading; and Market sentiment being boosted by expectations for further policy easing. This has been a " New Deal " for Chinese stocks as the Government attempts to paper over a slowing economy by giving the people record market highs to " prove " how well things are going. Now, BNP is out with a note calling China’s equity bubble “ a microcosm for the overall economy: unsustainable growth in leverage masking ever-deteriorating fundamentals and increasing future downside risks .” IN PROGRESS

4,016!

4,016!

That's what the Shanghai blasted up to at the open, though we pulled back to 3,957 by the close as some people decided that a 100% run in 6 months called for a little profit-taking. Don't worry, it's all part of the "new normal" for equities and nothing bad can possibly happen – it's just that, 6 months ago, traders didn't know value when they saw it but NOW we are much smarter and these prices are here to stay, right? According to UBS:

With no significant change in China's macro or corporate fundamentals, the visible rebound in China's A-share market since November appears to have been largely liquidity driven. We think this, in turn, may have been fuelled by a number of factors including:

- New funds flowing into the stock market from household saving, real estate, commodities and trust markets;

- Banks' bridge loans provided to investors who lost access to other high-yield shadow banking products as the result of tighter regulation;

- The PBC's easing of liquidity conditions via a variety of "targeted easing" tools (e.g. MSL, PSL, etc.);

- The official launch of Mutual Market Access (MMA) between the Hong Kong and Shanghai exchanges;

- Long-term expectations for SOE reform and A-shares entering the MSCI index next June;

- Increased use of leverage by retail investors via margin trading; and

- Market sentiment being boosted by expectations for further policy easing.

This has been a "New Deal" for Chinese stocks as the Government attempts to paper over a slowing economy by giving the people record market highs to "prove" how well things are going. Now, BNP is out with a note calling China’s equity bubble “a microcosm for the overall economy: unsustainable growth in leverage masking ever-deteriorating fundamentals and increasing future downside risks.”

This has been a "New Deal" for Chinese stocks as the Government attempts to paper over a slowing economy by giving the people record market highs to "prove" how well things are going. Now, BNP is out with a note calling China’s equity bubble “a microcosm for the overall economy: unsustainable growth in leverage masking ever-deteriorating fundamentals and increasing future downside risks.”

IN PROGRESS

4,016!

4,016!  This has been a "New Deal" for Chinese stocks as the Government attempts to paper over a slowing economy by giving the people record market highs to "prove" how well things are going. Now, BNP is out with a note calling China’s equity bubble “a microcosm for the overall economy: unsustainable growth in leverage masking ever-deteriorating fundamentals and increasing future downside risks.”

This has been a "New Deal" for Chinese stocks as the Government attempts to paper over a slowing economy by giving the people record market highs to "prove" how well things are going. Now, BNP is out with a note calling China’s equity bubble “a microcosm for the overall economy: unsustainable growth in leverage masking ever-deteriorating fundamentals and increasing future downside risks.”