I was going to say something nice about yesterday's gains – but they are GONE already . That's right, the Futures have reversed all of yesterday's BS low-volume gains so fast, I didn't even have a chance to say that I don't trust the gains because they were based on low-volume BS BUT the long-term technicals were starting to shape up. But they're now gone . Have I mentioned how happy we are to be in CASH!!! lately? Still, I hear a lot of you silly people are still playing this ridiculous game so let's pretend it's not all just manipulated BS aimed at tricking you out of your money and talk about earnings and the economy as if they matter – OK? Oil shot up 5% yesterday, from $54 (/CLK5) to $56.70 on the nose which made the weak retrace line $56.16 and the strong retrace line $55.62 per our 5% Rule™, which works best when a market is being entirely traded by machines that are programmed to take your money. I'll let you be the judge of whether or not that's happening: While it's possible to have healthy consolidation at the strong retrace line ($55.62) a failure they can quicly lead to a 50% pullback ($55.35) but a failure there means the whole move was BS and you can expect to see $54 tested again before you'll get another run-up. We got off on the wrong side of oil, shorting into the NYMEX rollover next week but those of us caught with open contracts scaled into a break-even at $55.50, so now we're just watching that line to see what happens . Those are the technicals but FUNDAMENTALLY, OPEC is reporting a huge surge in production , further feeding the glut with a predicted surplus of 1.5M barrels per day projected for 2015 despite optimistic projections of " steady " demand (or lack thereof). The bullish case for oil rests entirely on the HOPE that US production will be cut back in the second half of 2015 (but it's only April 16th). Last November, when OPEC also announced it was keeping its production…

I was going to say something nice about yesterday's gains – but they are GONE already.

I was going to say something nice about yesterday's gains – but they are GONE already.

That's right, the Futures have reversed all of yesterday's BS low-volume gains so fast, I didn't even have a chance to say that I don't trust the gains because they were based on low-volume BS BUT the long-term technicals were starting to shape up. But they're now gone.

Have I mentioned how happy we are to be in CASH!!! lately?

Still, I hear a lot of you silly people are still playing this ridiculous game so let's pretend it's not all just manipulated BS aimed at tricking you out of your money and talk about earnings and the economy as if they matter – OK?

Oil shot up 5% yesterday, from $54 (/CLK5) to $56.70 on the nose which made the weak retrace line $56.16 and the strong retrace line $55.62 per our 5% Rule™, which works best when a market is being entirely traded by machines that are programmed to take your money. I'll let you be the judge of whether or not that's happening:

While it's possible to have healthy consolidation at the strong retrace line ($55.62) a failure they can quicly lead to a 50% pullback ($55.35) but a failure there means the whole move was BS and you can expect to see $54 tested again before you'll get another run-up. We got off on the wrong side of oil, shorting into the NYMEX rollover next week but those of us caught with open contracts scaled into a break-even at $55.50, so now we're just watching that line to see what happens.

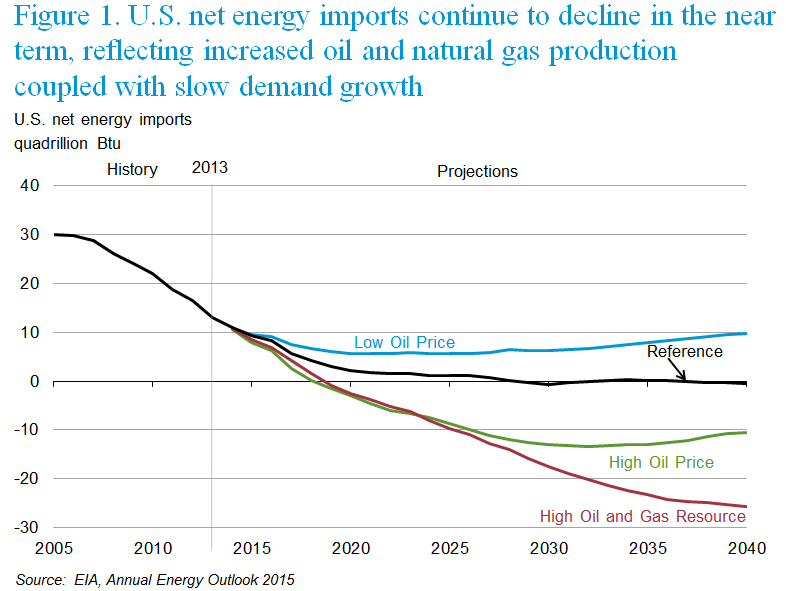

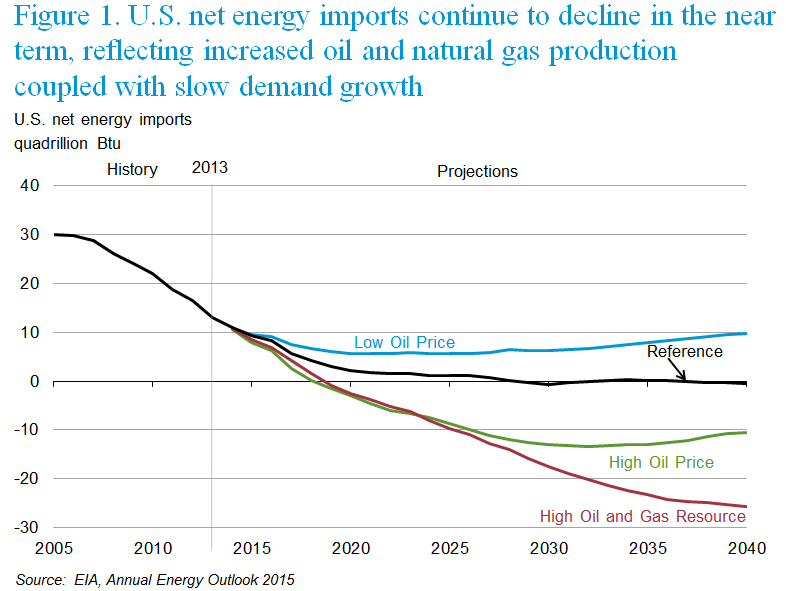

Those are the technicals but FUNDAMENTALLY, OPEC is reporting a huge surge in production, further feeding the glut with a predicted surplus of 1.5M barrels per day projected for 2015 despite optimistic projections of "steady" demand (or lack thereof). The bullish case for oil rests entirely on the HOPE that US production will be cut back in the second half of 2015 (but it's only April 16th).

Last November, when OPEC also announced it was keeping its production…

Last November, when OPEC also announced it was keeping its production…

I was going to say something nice about yesterday's gains – but they are GONE already.

I was going to say something nice about yesterday's gains – but they are GONE already.  Last November, when OPEC also announced it was keeping its production…

Last November, when OPEC also announced it was keeping its production…