Wheeeee, what a ride! So far, the markets are doing exactly what we expected them to do all month ( see previous posts ) ever since, in fact, that I wrote my post on May 15th (the tippy top on these charts) titled: " All-Time Highs Prove Investors Must be Stoned ." The best part of looking back on these posts is to read all the comments of people telling me how wrong I was to doubt the might of the markets at the time . We did our mid-May Portfolio Review that day and our Short-Term Portfolio was up 119.5% at the time and fortunately, since we did call it correctly, we finished the day yesterday at +137.4%, gaining 18% as the S&P fell 2.5%. 2.5% is very significant to our 5% Rule™ so we'll be looking for a 0.5% " weak " bounce today and a 1% " strong " bounce by the end of the week. Last Monday (" Bouncing or Bust "), we were focused on Germany's Dax Index as a leading index to the downside and on Weak Bounce Wednesday (10th) before the market opened we were already calling for a move back up. As I said at the time: Speaking of gravity, we're looking for some weak bounces today, especially in Germany, where the DAX is completing a 10% correction (12,250 to 11,000) which is still above the 200-day moving average at 10,469, which would be another 5% drop from here. This is all perfectly normal after a 30% run from 9,500 in January, which is kind of a lot for a major market to move in 6 months . As you can see from how well it obeys the lines Fibonacci Lines ( see our primer here ), the bots are firmly in control of the trading in Europe so this 50% retracement will be a huge test of sentiment over there. Of course we're going to have a "bullish" bounce off the 11,000 line – it's major support – the question is whether the bounce will be strong (40% retrace of the drop) or weak (20% retrace) and the drop was from 12,250 so 1,250 points means we're looking for a 250-point weak bounce to 11,250 this Friday and 11,500 by …

Wheeeee, what a ride!

Wheeeee, what a ride!

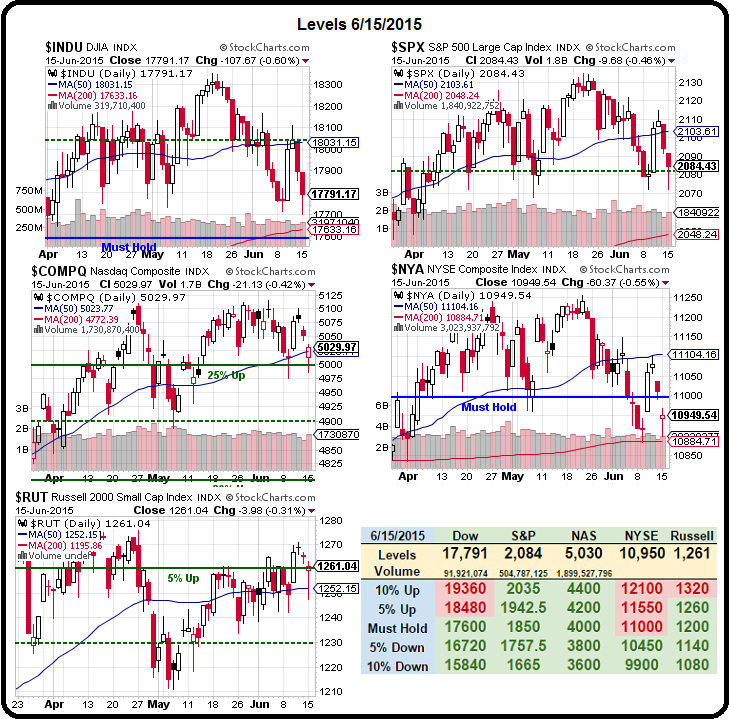

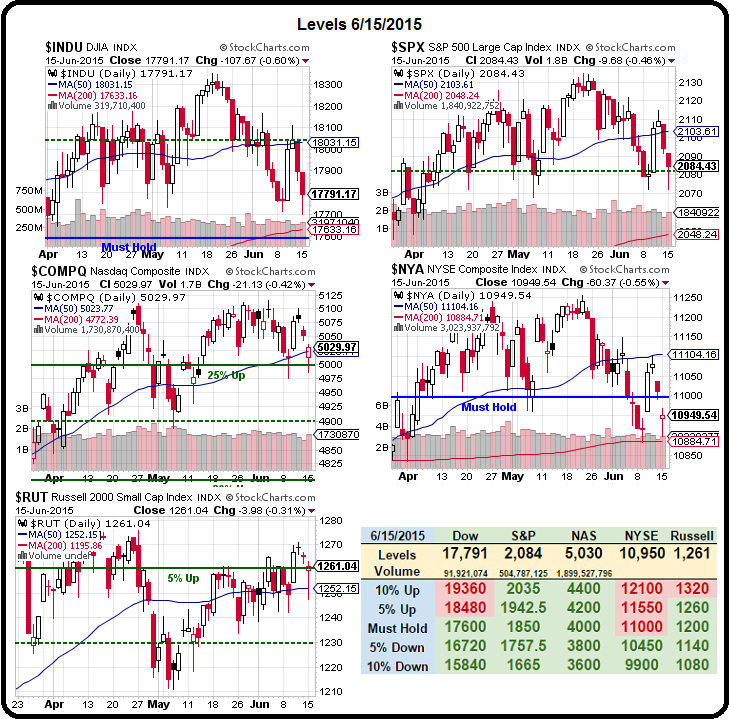

So far, the markets are doing exactly what we expected them to do all month (see previous posts) ever since, in fact, that I wrote my post on May 15th (the tippy top on these charts) titled: "All-Time Highs Prove Investors Must be Stoned." The best part of looking back on these posts is to read all the comments of people telling me how wrong I was to doubt the might of the markets at the time.

We did our mid-May Portfolio Review that day and our Short-Term Portfolio was up 119.5% at the time and fortunately, since we did call it correctly, we finished the day yesterday at +137.4%, gaining 18% as the S&P fell 2.5%. 2.5% is very significant to our 5% Rule™ so we'll be looking for a 0.5% "weak" bounce today and a 1% "strong" bounce by the end of the week.

Last Monday ("Bouncing or Bust"), we were focused on Germany's Dax Index as a leading index to the downside and on Weak Bounce Wednesday (10th) before the market opened we were already calling for a move back up. As I said at the time:

Speaking of gravity, we're looking for some weak bounces today, especially in Germany, where the DAX is completing a 10% correction (12,250 to 11,000) which is still above the 200-day moving average at 10,469, which would be another 5% drop from here. This is all perfectly normal after a 30% run from 9,500 in January, which is kind of a lot for a major market to move in 6 months.

As you can see from how well it obeys the lines Fibonacci Lines (see our primer here), the bots are firmly in control of the trading in Europe so this 50% retracement will be a huge test of sentiment over there. Of course we're going to have a "bullish" bounce off the 11,000 line – it's major support – the question is whether the bounce will be strong (40% retrace of the drop) or weak (20% retrace) and the drop was from 12,250 so 1,250 points means we're looking for a 250-point weak bounce to 11,250 this Friday and 11,500 by

…

Wheeeee, what a ride!

Wheeeee, what a ride!