Not the same as last Tuesday.

Not the same as last Tuesday.

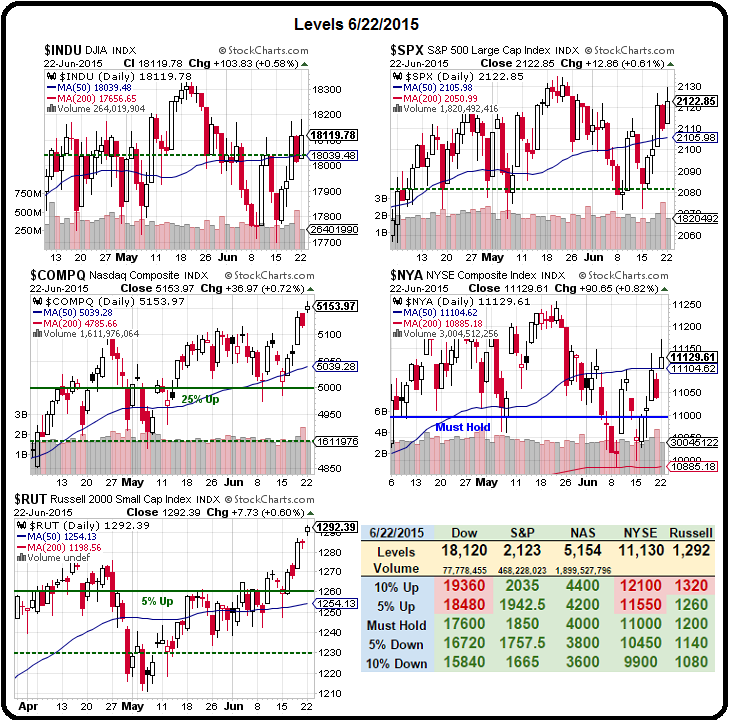

Last Tuesday we were testing our lows and we were looking to see if the indexes could bounce back and bounce back they did, past all of our Strong Bounce Lines at Dow 18,000, S&P 2,100, Nasdaq 5,050, NYSE 11,050 and Russell 1,260. We were also very concerned about Germany's DAX retaking its 11,500 line and yesterday we finished at 11,460 and today we are back over – all the way to 11,600 as Greece remains fixed for the 2nd consecutive day!

None of our underlying concerns have changed – only the immediate potential downside catalyst of a Greek default has (seemingly) been removed for the moment. We're not going to race back into the market but, on the other hand, we did plenty of bottom-fishing last week and added plenty of long trades to our portfolios (see our June Trade Review for a look at our free picks). Now we're headed back into earnings season with plenty of cash in our wallets, looking for more stocks to go on sale.

The whole market doesn't have to down for there to be bargain stocks. While the Nasdaq made a new all-time high yesterday, 40 of it's component stocks made 52-week lows. 57 new lows were made on the NYSE as well, where 1/3 of the index is within 5% of their year's lows, despite the recent round of exuberance.

For an up 1% day, yesterday was a pathetically low-volume affair – as you can see from Dave Fry's S&P ETF (SPY) chart. The index fell from 213.34 on Thursday to 210.36 on Thursday on 195M shares but all the way back to just under 212 on 65M shares. Hey, it's more than a quarter (but less than a third) – so let's not quibble over whether it's meaningless or manipulated and just sit back and enjoy the show.

For an up 1% day, yesterday was a pathetically low-volume affair – as you can see from Dave Fry's S&P ETF (SPY) chart. The index fell from 213.34 on Thursday to 210.36 on Thursday on 195M shares but all the way back to just under 212 on 65M shares. Hey, it's more than a quarter (but less than a third) – so let's not quibble over whether it's meaningless or manipulated and just sit back and enjoy the show.

You need the same sort of suspension of disbelief watching the markets as you do watching Jurassic World. Not so much that people are living with dinosaurs but that Ingen is still in business after 3 previous park disasters and this time their idea is to put much bigger dinosaurs in a new…