Prestidigitation.

Prestidigitation.

It's a skill or cleverness in deceiving others, usually by hand and who know what invisible hand is playing cups and balls with Global Economies these days? We are simply lurching from crisis to crisis this summer in a state of constant distraction when the answer to your investing problems is really quite simple – DON'T PLAY!!!

It's a rigged game and they keep changing the rules but you don't even have access to real information – not when the Mainstream Media you rely upon for your information tells you that the Greek vote will be "close" or favors remaining in the Euro when it ends up going 60% against – that's not even within the margin of polling error – therefore, the polls are either faulty or simply lying to you to get you to invest contrary to the true facts.

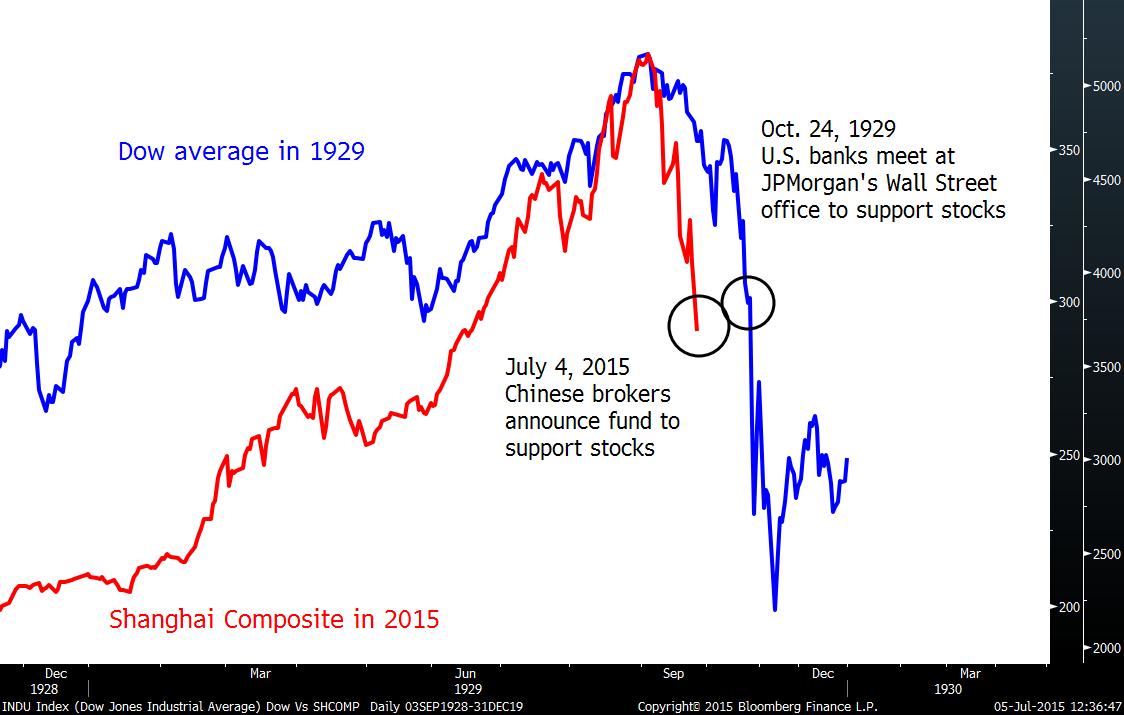

The same thing is going on in China, where EXTREME measures are being taken to prop up the market. This weekend, IPOs have been halted in China and the PBOC announced it will provide liquidity to China Securities Finance Corp, who manage the nation's short-selling and margin trading and Central Huijin Investments (a unit of China's Sovereign Wealth Fund) began buying China ETFs to stem the outflows from their market.

That was just today's action! Last week we already had: A PBOC rate cut, cut in reserve requirements, state pension funds investing in more stocks, lowering brokers fees, relaxation of margin rules allowing clients with "insufficient collateral" to hold onto their positions, bond issuances by brokers, more reduced tradijng fees, even lower margin requirements, regulators threatening to "punish" short-sellers, a meeting to discuss halting all trading in large-cap companies on ChiNext, raising the cost of Futures trading (to stop shorting), more short-selling suspensions, $19.3Bn from brokers to prop up the market and, on Saturday, 25 mutual funds jointly stated they will "actively buy stock funds and hold them for a year."

That was just today's action! Last week we already had: A PBOC rate cut, cut in reserve requirements, state pension funds investing in more stocks, lowering brokers fees, relaxation of margin rules allowing clients with "insufficient collateral" to hold onto their positions, bond issuances by brokers, more reduced tradijng fees, even lower margin requirements, regulators threatening to "punish" short-sellers, a meeting to discuss halting all trading in large-cap companies on ChiNext, raising the cost of Futures trading (to stop shorting), more short-selling suspensions, $19.3Bn from brokers to prop up the market and, on Saturday, 25 mutual funds jointly stated they will "actively buy stock funds and hold them for a year."

This is EXACTLY what they mean when they say "rearranging deck chairs on the Titanic" and what stikes me about my recent conversations with investors is that they keep asking me how they should play this catatrophe which ranges, to me, from "what part of the ship do…