.jpg) And we're OUT!!!

And we're OUT!!!

That's right, we've had enough of these idiotic market moves and, after discussing the idea with our Members all week, I sent out Alerts this morning that we will be cashing out our main Virtual Tracking Portfolios ahead of what we consider market conditions that are simply too unsafe to hold large, bullish positions in.

We use our Short-Term Portfolio mainly to hedge the much larger, bullish positions in our Long-Term Portfolio, which is "only" up 35% but we also use the STP to make opportunistic calls, like our short calls on SCO and NLFX (click to enlarge).

Since going to CASH!!! means we'll have lots of money for opportunity trades, which are up 214.5%, I don't see it as a big negative that we're taking down our Long-Term Trades, which have relatively slogged along since we last went (mainly) to cash in May.

"The tree of liberty must be refreshed from time to time with the blood of patriots and tyrants" is what Jefferson once said (and we are LONG overdue for a revolution in this country) and Phil says the tree of your portfolio must be refreshed from time to time by cashing out winners and losers alike and taking a nice, fresh look at the market.

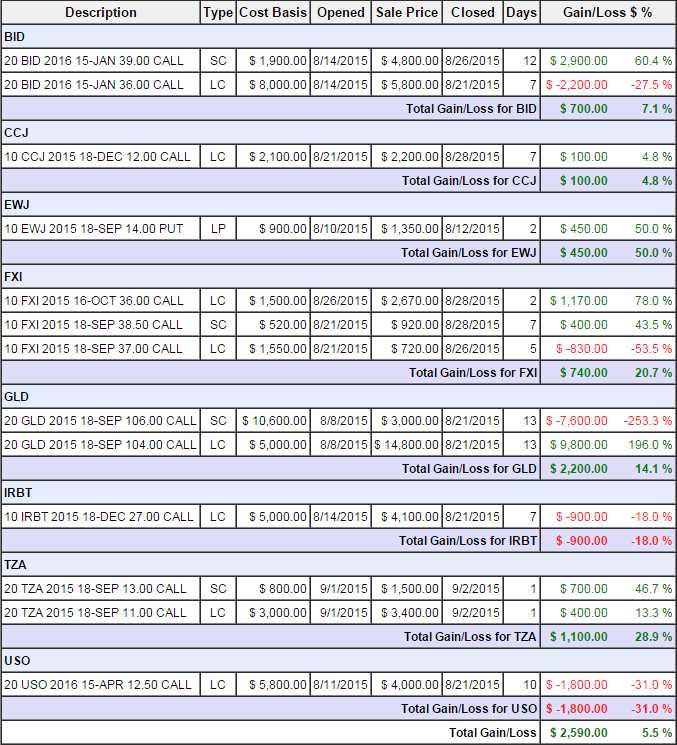

It's not like we can't find anything to make money on. Over at Seeking Alpha we've been running a 5% (Monthly) Portfolio, with the goal of making 5% per month using various option strategies. We began trading it on August 8th (Saturday with an introduction) and it hasn't been a month but, already, our closed positions are indeed up net 5.5%:

It's not like we can't find anything to make money on. Over at Seeking Alpha we've been running a 5% (Monthly) Portfolio, with the goal of making 5% per month using various option strategies. We began trading it on August 8th (Saturday with an introduction) and it hasn't been a month but, already, our closed positions are indeed up net 5.5%:

If we can find 8 trades in less than 30 days that make a quick 5.5% (66% annualized), why fear going to cash? Cash is what keeps us flexible. Cash is, by far, the best possible thing to have in a crisis and it doesn't suck in a bull market either – especially when the Dollar is rallying anyway.

If I were going to keep anything, I'd be keeping our Material Stocks, as those are both beaten down a bit too far and they make a nice hedge against…