How are the markets treating you?

How are the markets treating you?

If you're having a rough ride, there's still time to head for the exits and join us in cash ahead of the Fed next Wednesday. I've already said the Fed will not raise rates but will indicate they will raise rates at the next meeting (10/28) barring "unforeseen circumstances," which will leave them room to put it of yet again without looking too indecisive.

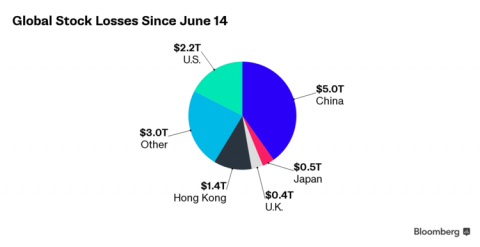

0.25% one way or the other is not going to make or break the markets. CHINA might break the markets, JAPAN might break the markets, BRAZIL might break the markets – 11 other Emerging Markets (the GS M-11 Fund) that have dropped 20%, into bear market territory, might break the makets – not the Fed hike.

As investor pessimism spreads to the smaller developing economies, capital outflows are deepening. Exchange-traded funds that invest in emerging markets recorded withdrawals of $1.65Bn in the week ended Sept 4th, the 10th week of outflows. Among the Next 11 Markets, funds focused on South Korea and Mexico had the biggest losses. The group also includes Indonesia, Nigeria, Bangladesh, Egypt, Pakistan and Vietnam. Iran is a member, but the Goldman Sachs fund doesn’t invest in the country because of international sanctions over its nuclear program.

“There’s just a lot of negative sentiment,” said Geoffrey Dennis, the head of global emerging-market strategy at UBS Group AG in Boston. “There are not many emerging markets that stand out against it, whether it’s Next-11 or BRIC. It sucks in every one.”

Per Bloomberg: The Next 11 countries’ shared vulnerabilities have been exposed by China’s slowdown and heightened anticipation of a Federal Reserve interest-rate increase as soon as this month. Weaker Chinese growth has hurt demand forKorean and Bangladeshi exports, along with the commodities produced by Mexico, Indonesia and Nigeria. Markets where foreign capital flows play an important role in driving investor sentiment — including Turkey and thePhilippines — have slumped on concern international money managers will gravitate toward dollar assets as the Fed boosts rates.

Per Bloomberg: The Next 11 countries’ shared vulnerabilities have been exposed by China’s slowdown and heightened anticipation of a Federal Reserve interest-rate increase as soon as this month. Weaker Chinese growth has hurt demand forKorean and Bangladeshi exports, along with the commodities produced by Mexico, Indonesia and Nigeria. Markets where foreign capital flows play an important role in driving investor sentiment — including Turkey and thePhilippines — have slumped on concern international money managers will gravitate toward dollar assets as the Fed boosts rates.

Chaos + uncertainty = CASH!!! That's the simple formula we like to follow at PSW. And that's not to say we can't find things…