Now China has lowered their lending rates – again!

Now China has lowered their lending rates – again!

That's right, first thing this morning, the PBOC announced another 0.25% rate cut at 7:30 this morning along with a 50 basis point reduction in reserve requirements AND completely removed the bank deposit rate ceiling. That, of course, sent our Futures flying and, as I noted yesterday, is surely more proof that China's 6.9% GDP growth numbers are legitimate – Central Banks always panic with massive quantitative easing when their economy is growing 6.9% per year, right?

Fortunately, we had flipped long on the Russell (/TF) futures into yesterday's close at 1,155 and those punched up $1,000 per contract gains but, unfortunately, we were short on the S&P (/ES) futures at 2,050 and those are down $1,000 per contract at 2,070. So, what do we do? We take the profits from /TF and buy more /ES shorts at 2,070, of course! By the way, the replay of Tuesday's Live Futures Trading Webinar is HERE.

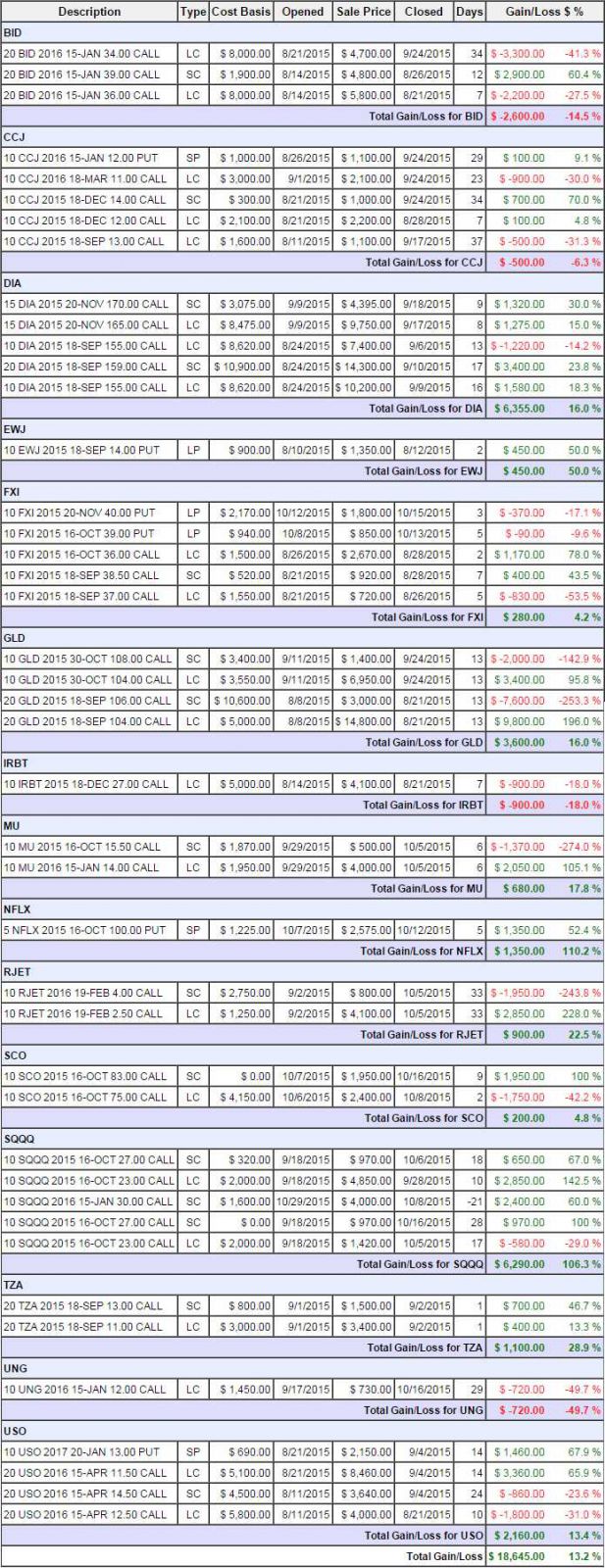

Our weekly live trading webinars are occasionally fee (Tuesday's was) but are part of the service provided to followers of our Options Opportunity Portfolio over at Seeking Alpha. Even though we got this week "wrong" by working our way into neutral (down $300 since last weekend's review) it's because we are protecting what are now $18,645 in gains on closed positions since our August 8th inception date:

Many of these may seem familiar to readers of our morning posts, as we often discuss similar position in our morning reports but it's inside the Member Site where we mark the actual trades, live, while the markets are open and then track them in virtual portfolios like this one. Oddly enough, the ultra-short Nasdaq ETF (SQQQ) has been one of our biggest winners but it's also our biggest current loser on the open side. We'll be repositioning those this morning on the super-spike back to 5,000 (about 4,625 on /NQ).

As you can see, our other big winner was Dow ETF (DIA) longs. We're just as happy to make money on the long side as the short. Today we just feel a lot more comfortable being short –…

As you can see, our other big winner was Dow ETF (DIA) longs. We're just as happy to make money on the long side as the short. Today we just feel a lot more comfortable being short –…